Attorney-Verified Transfer-on-Death Deed Document for Oregon State

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Missing details can lead to delays or rejection of the deed. Ensure that all sections are completed accurately.

-

Incorrect Property Description: A common mistake is providing an inaccurate or vague description of the property. It is crucial to include the correct address and legal description to avoid confusion.

-

Not Signing the Form: Some people overlook the need for signatures. The deed must be signed by the owner(s) to be valid. Remember, without a signature, the document cannot be processed.

-

Failure to Notarize: The Transfer-on-Death Deed requires notarization. Neglecting this step can invalidate the deed. Always have the document notarized before submission.

-

Improper Filing: After completing the form, individuals may not file it correctly with the appropriate county office. Ensure you understand the filing process and submit the deed to the right location.

Learn More on This Form

-

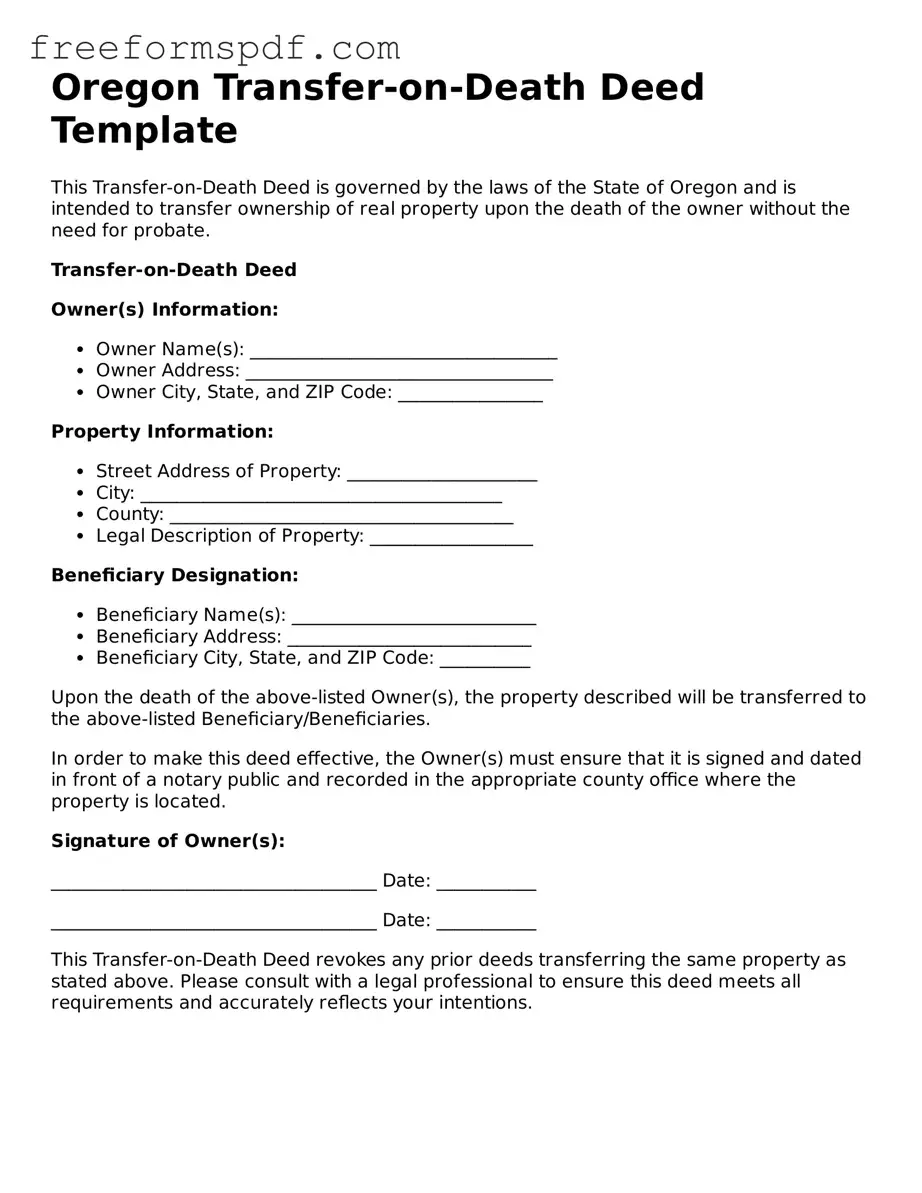

What is a Transfer-on-Death Deed in Oregon?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real property to a designated beneficiary upon their death. This deed ensures that the property bypasses the probate process, allowing for a smoother and quicker transition of ownership. In Oregon, this form can be particularly beneficial for individuals looking to simplify the transfer of their property after they pass away.

-

Who can use a Transfer-on-Death Deed?

Any property owner in Oregon can utilize a Transfer-on-Death Deed. This includes individuals who own residential, commercial, or vacant land. However, the property must be held in the owner’s name alone or as a joint tenant with the right of survivorship. It’s important to note that married couples may also choose to designate a beneficiary for their property.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Oregon, you must fill out the appropriate form, which is available through the Oregon Secretary of State's website or local county offices. The form requires you to provide details about the property, the owner, and the designated beneficiary. After completing the form, it must be signed in front of a notary public and then recorded with the county recorder’s office where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that either designates a different beneficiary or explicitly states that the previous deed is revoked. It is crucial to record the new deed with the county recorder’s office to ensure that it is legally recognized.

-

What happens if the beneficiary predeceases me?

If the designated beneficiary passes away before you, the Transfer-on-Death Deed will not automatically transfer the property to that individual’s heirs. Instead, the deed will become void unless you have named an alternate beneficiary. It’s advisable to review your beneficiary designations periodically to ensure they reflect your current wishes.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner or the beneficiary. The property will receive a step-up in basis for tax purposes upon the owner's death, which can be beneficial for the beneficiary. However, it is wise to consult with a tax professional to understand any potential implications specific to your situation.

Misconceptions

Understanding the Oregon Transfer-on-Death Deed can be challenging, and several misconceptions often arise. Here are seven common misunderstandings about this legal tool.

-

It automatically transfers property upon death. Many people believe that the Transfer-on-Death Deed automatically transfers the property to the beneficiary as soon as the owner passes away. In reality, the deed only facilitates the transfer after the owner's death, but the beneficiary must still take steps to claim the property.

-

It replaces a will. Some individuals think that a Transfer-on-Death Deed can serve as a substitute for a will. However, this deed only applies to specific real estate and does not cover other assets. A comprehensive estate plan typically includes both a will and potentially a Transfer-on-Death Deed.

-

All properties can be transferred using this deed. There is a misconception that any type of property can be transferred using a Transfer-on-Death Deed. In Oregon, this deed only applies to real property, not personal property or other assets.

-

Beneficiaries have immediate rights to the property. Some believe that beneficiaries gain immediate rights to the property after the owner's death. In truth, the property must go through the necessary legal processes, including any debts or claims against the estate, before beneficiaries can take possession.

-

The deed can be revoked at any time. While it is true that a Transfer-on-Death Deed can be revoked, some people think it can be done without any formalities. To revoke the deed, the owner must follow specific legal procedures to ensure the revocation is valid.

-

It avoids all taxes. A common belief is that using a Transfer-on-Death Deed allows beneficiaries to avoid all taxes associated with the property. However, beneficiaries may still be responsible for property taxes and, depending on the estate's value, estate taxes may also apply.

-

Only one beneficiary can be named. Some individuals think that a Transfer-on-Death Deed allows for only one beneficiary. In fact, multiple beneficiaries can be designated, making it a flexible option for estate planning.

By clarifying these misconceptions, individuals can better understand how the Oregon Transfer-on-Death Deed works and how it may fit into their estate planning needs.

Some Other Transfer-on-Death Deed State Templates

Transfer on Death Deed Pennsylvania - Beneficiaries do not have any rights to the property until the owner dies.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. For those interested in creating an NDA, resources like NY Templates can provide valuable templates and guidance. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets.

Virginia Transfer on Death Deed - Individuals might prefer this option if they want to retain flexibility over their assets while alive.

Transfer on Death Deed Washington - This deed can be particularly beneficial in avoiding family disputes over property ownership after the owner's death.