Attorney-Verified Promissory Note Document for Oregon State

Common mistakes

-

Incorrect Borrower Information: Failing to provide the correct name and contact details of the borrower can lead to confusion and complications down the line.

-

Missing Lender Details: Just like the borrower, the lender's name and address must be clearly stated. Omitting this information can render the note unenforceable.

-

Unclear Loan Amount: Writing the loan amount incorrectly or ambiguously can create disputes. Always double-check the figures.

-

Failure to Specify Interest Rate: If the interest rate is not included, it may default to a state-imposed rate, which may not be favorable for the lender.

-

Omitting Payment Schedule: Not detailing when payments are due can lead to misunderstandings. Clearly outline the payment dates and amounts.

-

Not Including Late Fees: If late fees are applicable, they should be explicitly stated. Otherwise, the lender may not be able to enforce them.

-

Neglecting Signatures: Both parties must sign the document. A missing signature can invalidate the entire agreement.

-

Ignoring Witness or Notary Requirements: Depending on the situation, having a witness or notarization may be necessary. Skipping this step can lead to issues in enforcement.

-

Not Keeping Copies: Failing to make copies of the signed note for all parties involved can create problems later if disputes arise.

-

Using Outdated Forms: Always ensure that you are using the most current version of the Oregon Promissory Note form. Outdated forms may not comply with current laws.

Learn More on This Form

-

What is a Promissory Note?

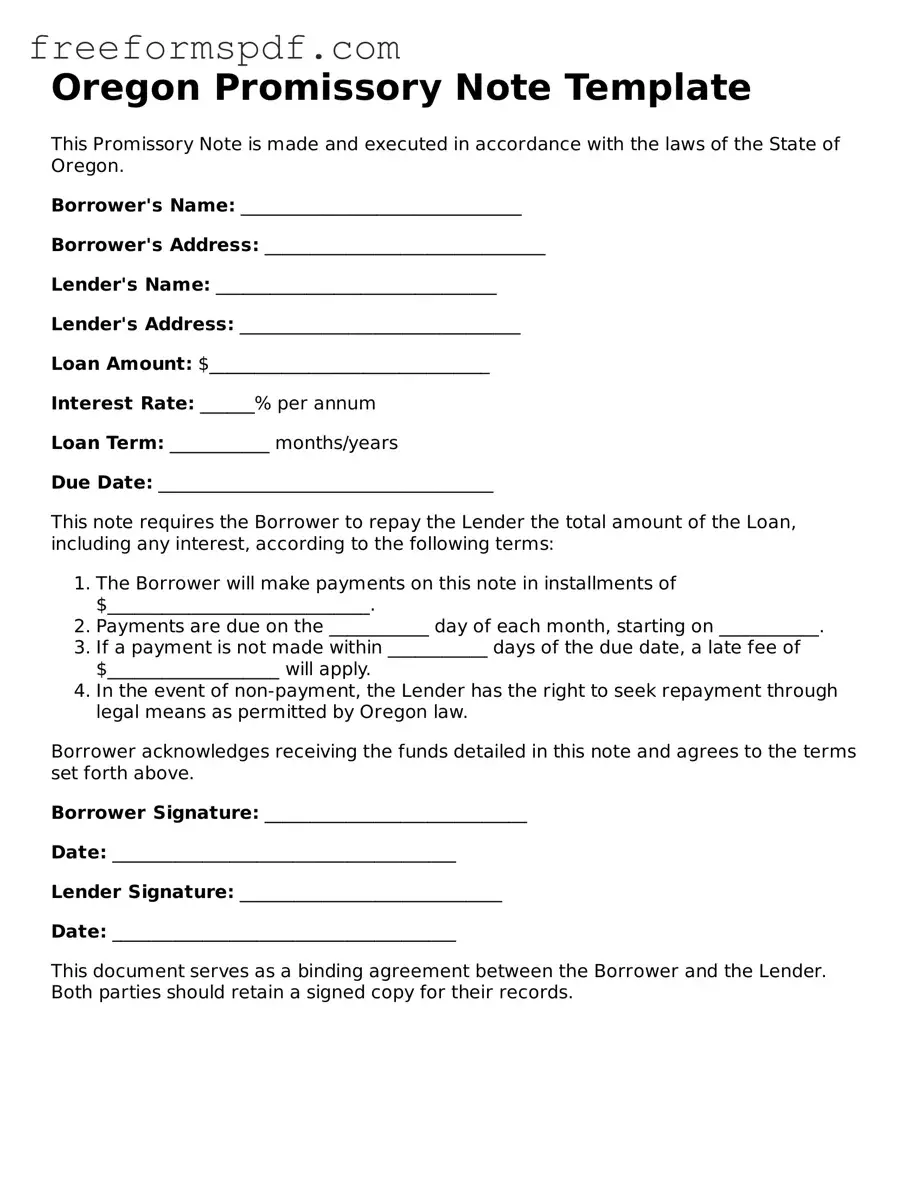

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a future date or on demand. In Oregon, this document serves as a legal agreement between the borrower and the lender, outlining the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

-

Why is an Oregon Promissory Note important?

This document provides clarity and protection for both parties involved in a loan. It establishes the borrower's obligation to repay the loan and the lender's right to receive payment. In case of disputes, the promissory note can serve as evidence in court, making it essential to have a well-drafted agreement.

-

What should be included in an Oregon Promissory Note?

Key elements of the note should include:

- The names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties, along with the date.

-

Can I modify an Oregon Promissory Note after it is signed?

Yes, modifications can be made, but both parties must agree to the changes. It is advisable to create a written amendment that outlines the specific changes made to the original agreement. Both parties should sign this amendment to ensure it is legally binding.

-

Is a Promissory Note legally binding in Oregon?

Yes, a properly executed promissory note is legally binding in Oregon. As long as it meets the necessary legal requirements, it can be enforced in a court of law. This means that if the borrower fails to repay the loan, the lender has the right to take legal action to recover the owed amount.

-

Do I need a lawyer to create an Oregon Promissory Note?

While it is not legally required to have a lawyer draft a promissory note, consulting with one can be beneficial. A lawyer can help ensure that the document complies with Oregon laws and meets the specific needs of both parties. This can prevent potential issues in the future and provide peace of mind.

Misconceptions

Understanding the Oregon Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- It is a legally binding document only if notarized. While notarization can add an extra layer of authenticity, a promissory note can still be legally binding without it, as long as it meets the necessary requirements.

- All promissory notes are the same. This is not true. Promissory notes can vary significantly in terms of terms, conditions, and legal requirements depending on the state and the specifics of the agreement.

- Only banks can issue promissory notes. Individuals can also create promissory notes. Any person or entity can issue one as long as they follow the necessary legal guidelines.

- Verbal agreements are sufficient. While verbal agreements may hold some weight, a written promissory note provides clear evidence of the terms and can be crucial in case of disputes.

- Once signed, a promissory note cannot be modified. In fact, parties can agree to modify the terms of a promissory note. This should be done in writing and signed by all parties involved.

- Promissory notes are only for large loans. Promissory notes can be used for any amount, big or small. They are a flexible tool for personal loans, business transactions, and more.

- Defaulting on a promissory note has no consequences. Defaulting can lead to serious repercussions, including legal action, damage to credit scores, and potential loss of collateral.

By clarifying these misconceptions, individuals can better navigate the complexities of promissory notes and make informed decisions in their financial dealings.

Some Other Promissory Note State Templates

New York Promissory Note - This form acts as a safeguard for both parties in financial transactions.

For businesses seeking to take advantage of tax benefits in New York, the New York DTF-84 form serves as a vital resource. Understanding the requirements and filling out the form accurately is essential to avoid delays in processing. For those looking for further guidance and resources related to this form, NY Templates can be a valuable tool in navigating this process.

Promissory Note Template Washington State - Overall, a Promissory Note promotes trust and clarity in financial arrangements.

Create a Promissory Note - This document often serves as a vital record for accounting purposes.