Attorney-Verified Operating Agreement Document for Oregon State

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required information. This can include missing names, addresses, or signatures. Ensure every section is filled out completely to avoid delays.

-

Incorrect Member Designations: Some people mistakenly designate members as managers or vice versa. Clearly define roles to prevent confusion and ensure proper governance.

-

Omitting Capital Contributions: A common oversight is not detailing the capital contributions of each member. Clearly outline what each member is contributing to the business to establish ownership percentages.

-

Ignoring State Requirements: Each state has specific requirements for operating agreements. Failing to adhere to Oregon’s regulations can lead to complications. Review state guidelines thoroughly.

-

Not Including an Amendment Clause: Some individuals neglect to include a clause for amendments. This can make it difficult to modify the agreement in the future. Always plan for potential changes.

-

Forgetting to Date the Document: A simple yet critical mistake is forgetting to date the agreement. Without a date, it may be challenging to determine the agreement’s validity. Always include the date of signing.

Learn More on This Form

-

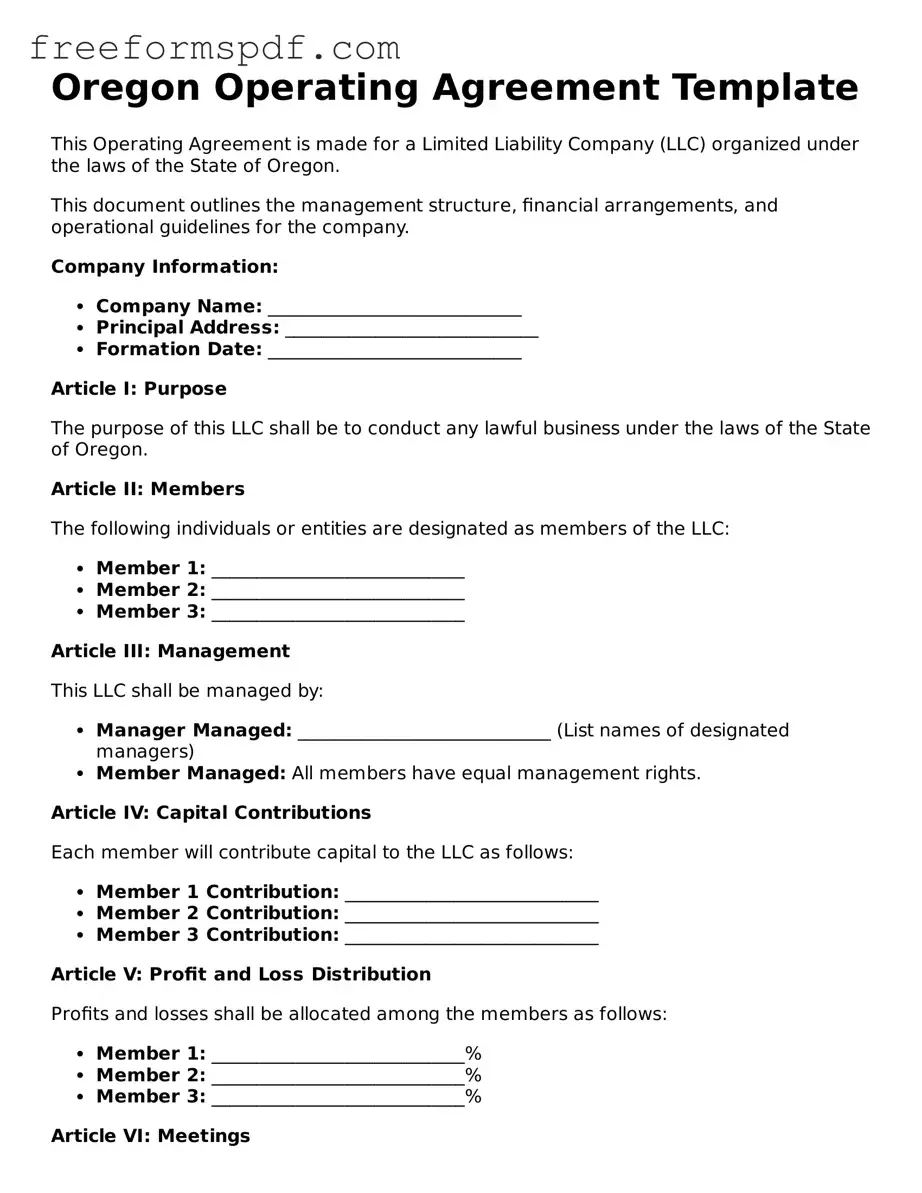

What is an Oregon Operating Agreement?

An Oregon Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in the state of Oregon. This agreement serves as a foundational document that defines the rights and responsibilities of the members, as well as the rules for running the business.

-

Is an Operating Agreement required in Oregon?

While Oregon law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provides a clear framework for decision-making and dispute resolution.

-

What should be included in an Operating Agreement?

An Operating Agreement typically includes the following elements:

- The name and purpose of the LLC

- The names and addresses of the members

- The management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

-

How is an Operating Agreement created?

Creating an Operating Agreement involves drafting the document with the necessary provisions that reflect the members' intentions. Members can either use templates available online or consult with legal professionals to ensure compliance with state laws and individual business needs.

-

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. The process for making amendments should be outlined within the agreement itself. Typically, amendments require the consent of a majority or all members, depending on the terms established in the original document.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, the default rules set forth by Oregon state law will apply. This can lead to complications, as the default provisions may not align with the members' intentions or business practices, potentially resulting in disputes.

-

How does an Operating Agreement affect liability protection?

An Operating Agreement does not directly affect liability protection; however, it reinforces the separation between the LLC and its members. By clearly outlining the structure and operations of the business, it helps maintain the LLC's status as a separate legal entity, which is crucial for protecting personal assets from business liabilities.

-

Where should the Operating Agreement be kept?

The Operating Agreement should be kept in a safe place, such as a secure file or a digital storage system. All members should have access to the document, and it is advisable to keep copies both in physical and electronic formats for ease of reference.

Misconceptions

Understanding the Oregon Operating Agreement form can be challenging. Here are some common misconceptions that may lead to confusion:

- It's only for large businesses. Many people think that only big companies need an Operating Agreement. In reality, even small businesses and startups benefit from having one.

- It's a legal requirement in Oregon. While having an Operating Agreement is highly recommended, it is not legally required for all business types in Oregon.

- It must be filed with the state. Some believe that the Operating Agreement needs to be submitted to the state. However, it is an internal document and does not need to be filed.

- It cannot be changed once created. Many think that once the Operating Agreement is established, it cannot be modified. In fact, it can be amended as needed to reflect changes in the business.

- All members must agree on every detail. While it's important for members to be on the same page, not every detail requires unanimous agreement. The Operating Agreement can outline decision-making processes.

- It's only for LLCs. Some assume that only Limited Liability Companies need an Operating Agreement. However, other business structures can also benefit from having one.

- It doesn't need to be detailed. A common misconception is that a simple document will suffice. A comprehensive Operating Agreement can help prevent disputes and clarify roles.

- It's a one-time task. Many people think that creating the Operating Agreement is a one-and-done situation. In reality, it should be reviewed and updated regularly.

- Legal help is unnecessary. Some believe they can draft an Operating Agreement without assistance. While it’s possible, consulting a legal expert can ensure that it meets all necessary requirements.

- It's only for members with equal ownership. There is a belief that Operating Agreements are only useful for businesses with equal ownership. In truth, they can clarify roles and responsibilities for any ownership structure.

Being aware of these misconceptions can help you make informed decisions about your business's Operating Agreement. It's an important tool for clarity and protection.

Some Other Operating Agreement State Templates

How to Create an Operating Agreement - This form allows for customization based on business needs.

To ensure informed healthcare choices are made, understanding the role of a Medical Power of Attorney designation is vital, as it empowers someone to act in your best interest when you are unable to communicate your wishes.

Create an Operating Agreement - This document can help define the lifespan of the business.

Operating Agreement Llc Texas Template - It specifies how major decisions are to be made.

Nyc Llc - An Operating Agreement can facilitate smoother operations during transitions.