Attorney-Verified Durable Power of Attorney Document for Oregon State

Common mistakes

-

Not Naming Alternate Agents: Many people forget to name alternate agents. If the primary agent cannot act for any reason, having a backup is crucial.

-

Failing to Specify Powers: Some individuals leave the powers too vague. Clearly outlining what the agent can and cannot do helps prevent misunderstandings.

-

Ignoring State Requirements: Each state has specific rules. Not adhering to Oregon’s requirements can render the document invalid.

-

Not Signing in Front of Witnesses: The Oregon Durable Power of Attorney requires signatures in front of witnesses. Skipping this step can lead to complications.

-

Overlooking Date and Location: Failing to include the date and location of signing may cause issues later. This information helps establish the validity of the document.

-

Using Outdated Forms: Laws change, and so do forms. Using an outdated version of the Durable Power of Attorney can create legal challenges.

-

Not Discussing with the Agent: Some people fill out the form without discussing it with the chosen agent. This can lead to surprises and potential conflicts.

-

Neglecting to Review Regularly: Life circumstances change. Failing to review and update the document can result in it no longer reflecting one’s wishes.

-

Assuming It’s Only for Elderly: Many believe that a Durable Power of Attorney is only for older adults. In reality, anyone can benefit from having one in place.

Learn More on This Form

-

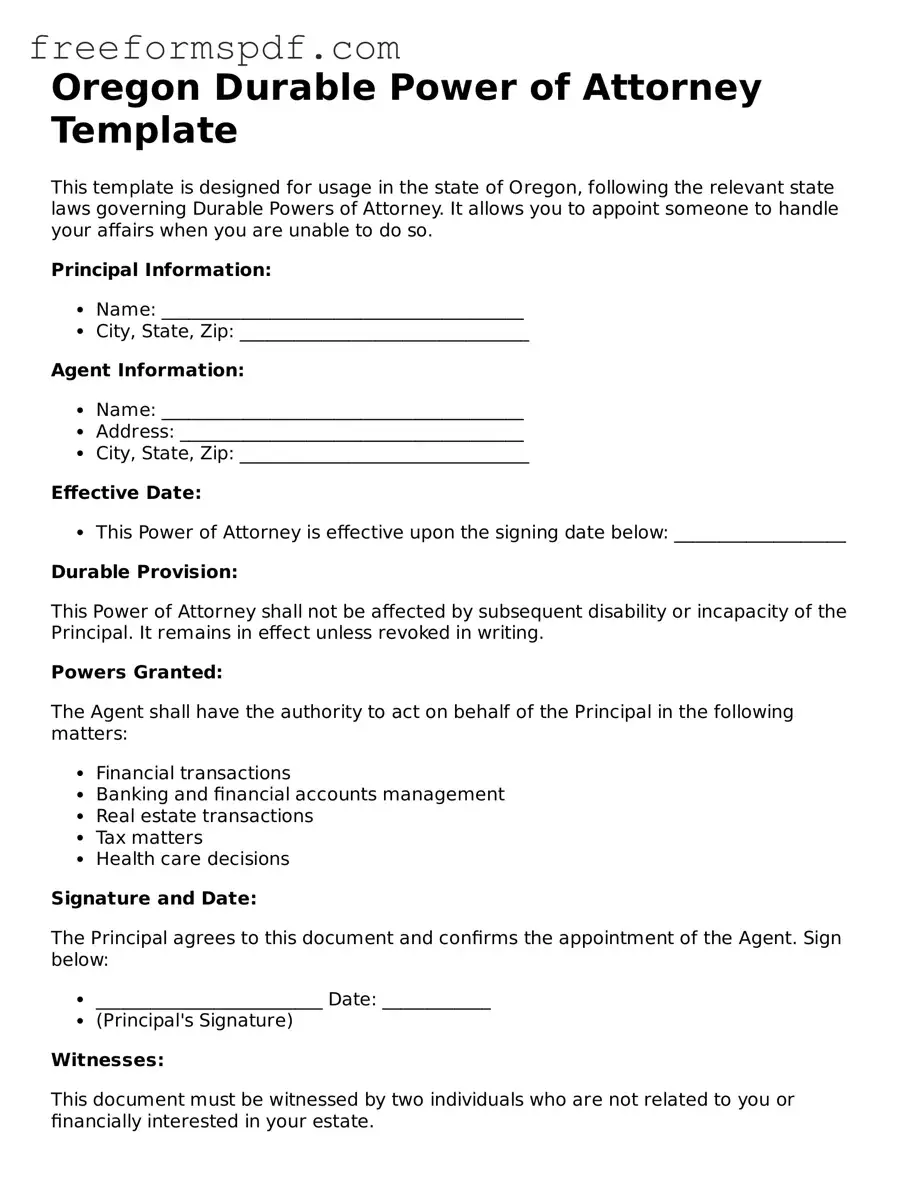

What is a Durable Power of Attorney in Oregon?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make decisions on your behalf if you become incapacitated. Unlike a regular Power of Attorney, a Durable Power of Attorney remains effective even if you are unable to make decisions for yourself.

-

Who can be appointed as an agent?

You can appoint any competent adult as your agent. This could be a family member, friend, or a trusted advisor. It is important to choose someone who understands your values and wishes, as they will be responsible for making significant decisions about your health and finances.

-

What types of decisions can my agent make?

Your agent can make a variety of decisions, including:

- Managing your financial affairs, such as paying bills and managing investments.

- Making healthcare decisions, including medical treatments and end-of-life care.

- Handling legal matters on your behalf.

You can specify the scope of authority in the document, allowing you to limit or expand your agent's powers as you see fit.

-

How do I create a Durable Power of Attorney in Oregon?

To create a Durable Power of Attorney, you must complete a form that complies with Oregon state laws. You can find templates online or consult with a legal professional to ensure that your document meets all requirements. After completing the form, you must sign it in the presence of a notary public or two witnesses.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation notice and inform your agent and any relevant institutions, such as banks or healthcare providers.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, the court may appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy and may not align with your personal wishes, making it essential to have a Durable Power of Attorney in place.

-

Is a Durable Power of Attorney only for financial matters?

No, a Durable Power of Attorney can encompass both financial and healthcare decisions. You can include provisions for managing your finances and making medical choices, ensuring that your agent has comprehensive authority to act in your best interest.

-

Can I include specific instructions in my Durable Power of Attorney?

Absolutely. You can include specific instructions regarding your preferences for medical treatment, financial management, and any other matters that are important to you. Clear instructions can help guide your agent in making decisions that reflect your wishes.

Misconceptions

Understanding the Oregon Durable Power of Attorney (DPOA) form is crucial for ensuring your wishes are honored when you can no longer communicate them. However, several misconceptions often cloud people's understanding of this important document. Here are eight common misconceptions:

- 1. A Durable Power of Attorney is the same as a regular Power of Attorney. While both documents allow someone to make decisions on your behalf, a DPOA remains effective even if you become incapacitated. A regular Power of Attorney becomes invalid in such situations.

- 2. A DPOA can only be used for financial matters. This is not true. A Durable Power of Attorney can cover a wide range of areas, including healthcare decisions, depending on how it is drafted.

- 3. Once I sign a DPOA, I lose all control over my affairs. This is a common fear, but you can still manage your affairs as long as you are capable. The DPOA only activates under specific conditions, typically when you become incapacitated.

- 4. I can’t change my DPOA once it’s signed. You can change or revoke a Durable Power of Attorney at any time, as long as you are mentally competent. Just ensure that the new document is properly executed.

- 5. A DPOA is only necessary for older adults. Many people think this document is only for seniors, but anyone can benefit from having a DPOA, especially if they have health concerns or are planning for the future.

- 6. My spouse automatically has the authority to make decisions for me. While spouses often have rights to make decisions, a DPOA specifically designates someone to act on your behalf. Without a DPOA, there may be legal complications.

- 7. A DPOA is a one-size-fits-all document. Each DPOA can be customized to fit your needs. You can specify what powers you want to grant and under what circumstances they should be activated.

- 8. A DPOA is only valid in Oregon. While the DPOA is specific to Oregon law, many states recognize a properly executed DPOA from another state. However, it’s wise to check local laws if you move.

By clearing up these misconceptions, individuals can better understand the importance of the Oregon Durable Power of Attorney and make informed decisions about their future.

Some Other Durable Power of Attorney State Templates

Virginia Power of Attorney - The Durable Power of Attorney is recognized in all states, ensuring your choices are respected nationwide.

To facilitate the process of payroll reporting, contractors can utilize resources such as the NY Templates, which provide easy-to-use formats for completing the NYC Payroll Form accurately and efficiently, ensuring adherence to the necessary compliance standards.

Free Durable Power of Attorney Form Pdf - Legal advice can enhance the process of choosing an agent and drafting the document correctly.

Power of Attorney Washington State - You can create a Durable Power of Attorney for a limited time or a specific situation.

Durable Power of Attorney Form Texas - Crafting a Durable Power of Attorney enables you to maintain control over your affairs even when you can’t.