Attorney-Verified Articles of Incorporation Document for Oregon State

Common mistakes

-

Failing to include the correct name of the corporation. The name must be unique and not similar to existing businesses.

-

Not designating a registered agent. Every corporation needs a registered agent to receive legal documents.

-

Incorrectly stating the purpose of the corporation. The purpose must be clear and specific.

-

Omitting the duration of the corporation. If not specified, it may default to perpetual existence.

-

Providing inaccurate information about the incorporators. All incorporators must be listed with correct details.

-

Neglecting to include the number of shares the corporation is authorized to issue. This is a crucial detail for stock corporations.

-

Using an improper format for signatures. All required signatures must be present and correctly formatted.

-

Forgetting to check the filing fee. The correct fee must accompany the Articles of Incorporation.

-

Not reviewing the form for errors before submission. Mistakes can delay the incorporation process.

-

Failing to keep a copy of the submitted Articles of Incorporation. It's important to retain a copy for your records.

Learn More on This Form

-

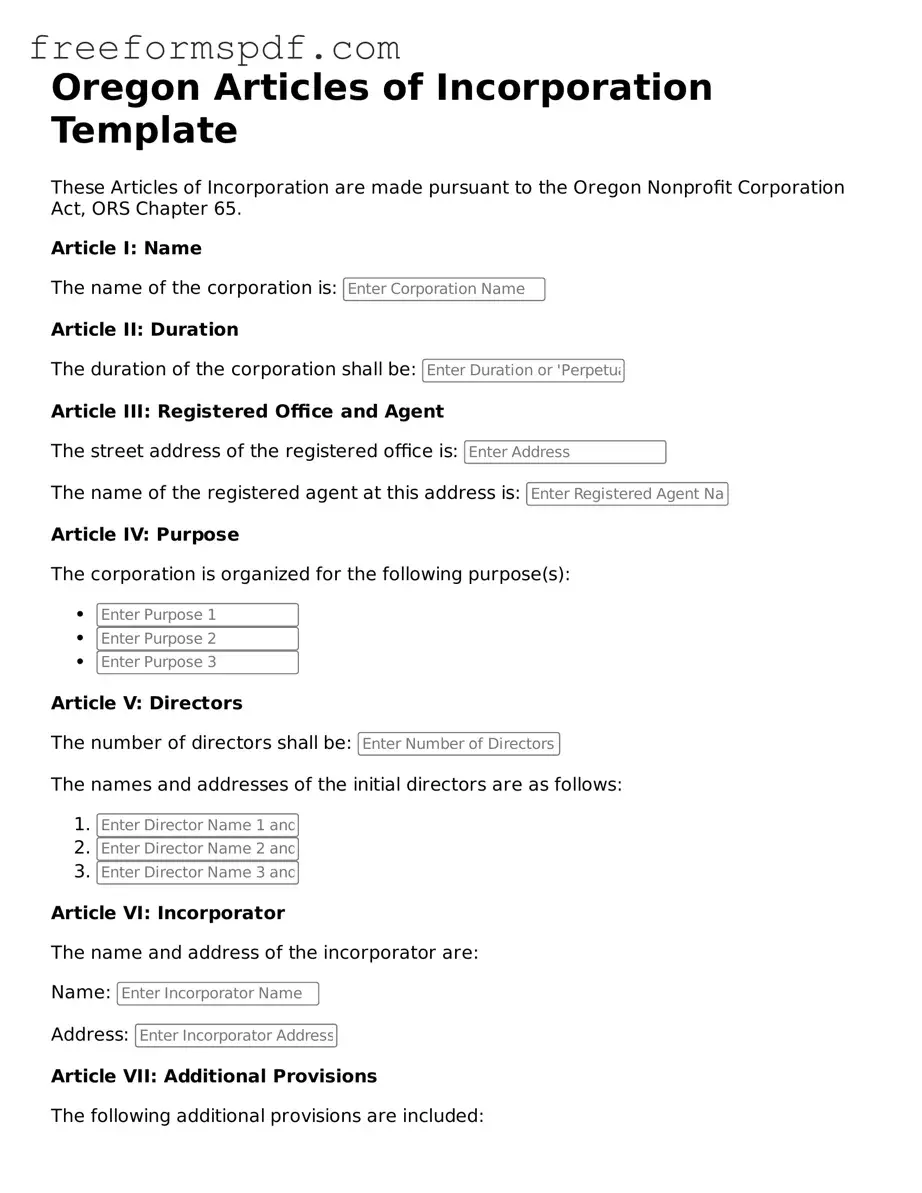

What is the purpose of the Oregon Articles of Incorporation form?

The Articles of Incorporation form is a legal document that establishes a corporation in the state of Oregon. It outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares authorized for issuance.

-

Who needs to file the Articles of Incorporation?

Any individual or group wishing to create a corporation in Oregon must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises.

-

What information is required to complete the form?

- The name of the corporation.

- The purpose of the corporation.

- The name and address of the registered agent.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the incorporators.

Providing accurate and complete information is crucial for the approval of the filing.

-

How do I submit the Articles of Incorporation?

The Articles of Incorporation can be submitted online through the Oregon Secretary of State’s website, or you can mail a paper form to the appropriate office. Ensure that the submission includes the required filing fee.

-

What is the filing fee for the Articles of Incorporation?

The filing fee varies depending on the type of corporation being formed. As of October 2023, the fee for a standard corporation is typically around $100. It is advisable to check the Oregon Secretary of State’s website for the most current fee information.

-

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, online submissions are processed more quickly than paper submissions. Expect processing to take anywhere from a few business days to several weeks, depending on the volume of filings and the method of submission.

-

What happens after the Articles of Incorporation are approved?

Once approved, the corporation officially exists as a legal entity. The corporation can then begin operations, open bank accounts, and conduct business under its registered name. Additionally, it is important to comply with ongoing requirements such as annual reports and taxes.

Misconceptions

Understanding the Oregon Articles of Incorporation form is crucial for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- Misconception 1: Filing Articles of Incorporation is optional.

- Misconception 2: The Articles of Incorporation are the only requirement for starting a business.

- Misconception 3: All corporations must have a board of directors listed in the Articles.

- Misconception 4: You can only file Articles of Incorporation online.

- Misconception 5: The Articles of Incorporation must be filed in person.

- Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 7: The Articles of Incorporation are the same as the corporate bylaws.

- Misconception 8: All businesses must incorporate in Oregon to operate there.

In Oregon, filing Articles of Incorporation is a mandatory step for forming a corporation. Without this document, your business cannot operate as a legal entity.

While the Articles are essential, they are just one part of the process. Additional steps include obtaining necessary licenses, permits, and possibly filing for an Employer Identification Number (EIN).

Oregon does not require the names of directors to be included in the Articles of Incorporation. However, corporations must have a board of directors to manage the business.

While online filing is convenient, Oregon allows for paper submissions as well. You can choose the method that works best for you.

Filing can be done by mail or online, making it accessible regardless of your location. In-person filing is not a requirement.

Changes can be made to the Articles after filing. Amendments can be submitted to update the information as needed.

The Articles of Incorporation establish the corporation's existence, while bylaws outline the internal governance of the corporation. They serve different purposes.

Not all businesses are required to incorporate. Sole proprietorships and partnerships can operate without filing Articles of Incorporation. However, incorporation offers liability protection.

Some Other Articles of Incorporation State Templates

Washington Sos Business Search - Your business becomes a separate legal entity upon filing these articles.

Articles of Incorporation Texas - States the purpose for business operation specifics.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. For those interested in drafting this document, resources such as NY Templates can offer valuable templates and guidance. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets.

Nys Division of Corporations - Establishes the official name of your corporation.