Operating Agreement Document

Operating Agreement - Customized for Each State

Operating Agreement Document Subtypes

Common mistakes

-

Inaccurate Member Information: Failing to provide correct names, addresses, or ownership percentages of the members can lead to confusion and disputes later on.

-

Omitting Key Provisions: Important sections, such as management structure, voting rights, and profit distribution, may be overlooked. This can create ambiguity about how the business will operate.

-

Not Defining Roles Clearly: Each member's responsibilities should be clearly outlined. Ambiguities can result in misunderstandings and conflicts among members.

-

Ignoring State Requirements: Each state has specific laws governing Operating Agreements. Failing to comply with these regulations can render the agreement ineffective.

-

Neglecting to Update the Agreement: As the business evolves, the Operating Agreement should be updated. Not doing so can lead to outdated practices that no longer reflect the current structure.

-

Rushing the Review Process: Taking the time to carefully review the agreement is essential. Rushing can lead to mistakes that might have serious repercussions for the business.

Learn More on This Form

-

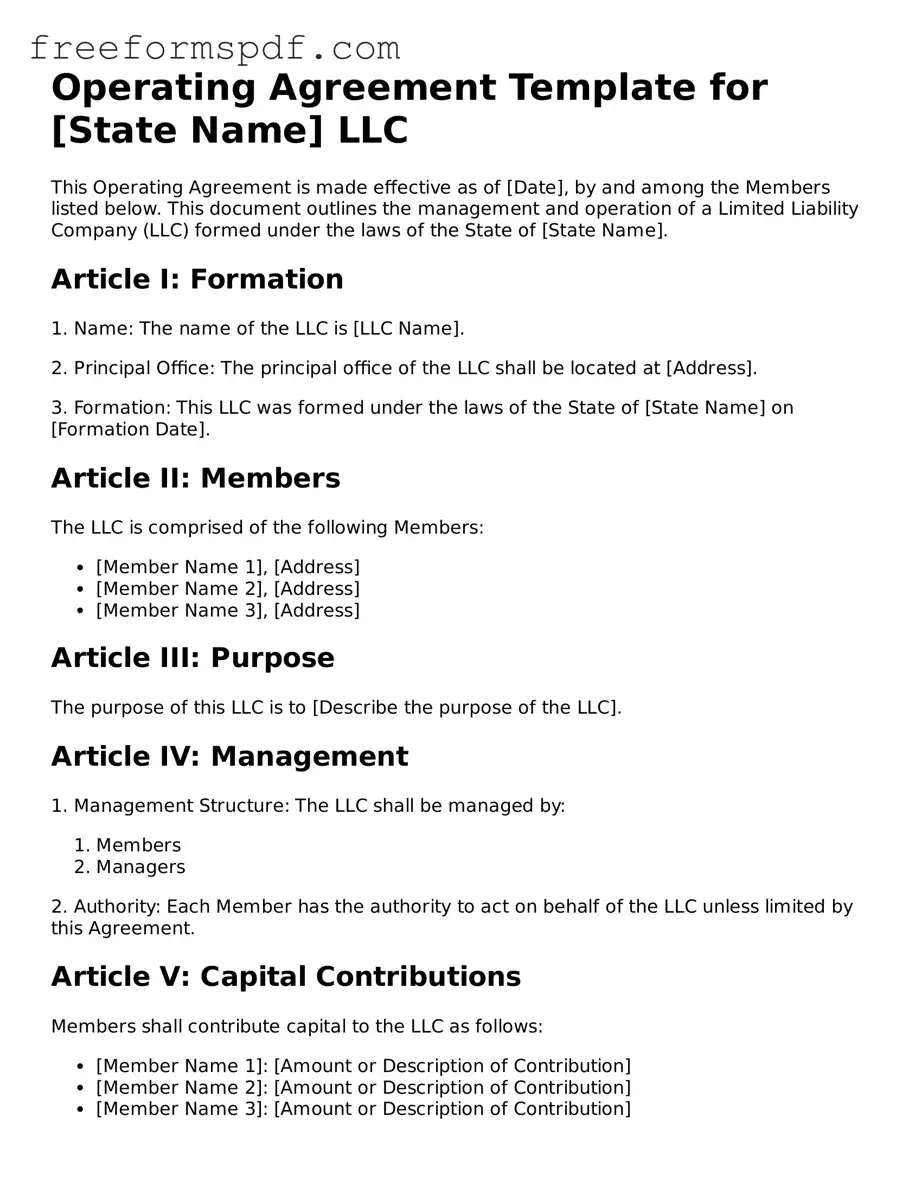

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC). It details the roles and responsibilities of the members, how profits and losses are distributed, and the process for making decisions. This agreement serves as a roadmap for the LLC's operations and helps prevent disputes among members.

-

Why is an Operating Agreement important?

An Operating Agreement is crucial because it provides clarity and structure for the LLC. It helps define the relationship between members, reducing the risk of misunderstandings. Additionally, having an Operating Agreement can strengthen the LLC's legal standing and protect personal assets in case of legal issues.

-

Who should create the Operating Agreement?

All members of the LLC should participate in creating the Operating Agreement. Each member's input is valuable to ensure that everyone's interests and concerns are addressed. It is advisable to consult with a legal professional to ensure that the document complies with state laws and accurately reflects the members' intentions.

-

How often should the Operating Agreement be updated?

The Operating Agreement should be reviewed and updated regularly, especially when there are significant changes in the business, such as adding new members, changing ownership percentages, or altering management structures. Keeping the document current helps maintain clarity and prevents potential disputes.

-

Is an Operating Agreement legally required?

While not all states require LLCs to have an Operating Agreement, it is highly recommended. Some states may mandate it for certain types of LLCs. Even if not required, having an Operating Agreement can provide legal protection and clarity for the members.

-

Can the Operating Agreement be modified?

Yes, the Operating Agreement can be modified. Members can agree to changes through a formal amendment process, which should be documented in writing. It is important to follow the procedures outlined in the original agreement for making amendments to ensure that all members are in agreement.

Misconceptions

When it comes to the Operating Agreement, many people hold misconceptions that can lead to confusion or mismanagement of their business. Understanding the truth behind these misconceptions can help ensure that you’re making informed decisions. Here are nine common misconceptions:

- Only LLCs need an Operating Agreement. While it is essential for Limited Liability Companies (LLCs) to have an Operating Agreement, other business structures, like partnerships and corporations, can also benefit from having one. It clarifies roles and responsibilities among owners.

- An Operating Agreement is not legally required. In many states, an Operating Agreement is not legally required for LLCs, but having one is highly recommended. It provides a framework for how the business operates and can help prevent disputes.

- All Operating Agreements are the same. This is a misconception. Each Operating Agreement should be tailored to the specific needs and goals of the business. Different businesses have unique structures and operational needs.

- Once created, an Operating Agreement cannot be changed. In reality, Operating Agreements can be amended as needed. As the business evolves, so too can the terms of the agreement to reflect new realities.

- An Operating Agreement is only for large businesses. Small businesses and startups also benefit from having an Operating Agreement. It helps to establish clear guidelines and can prevent misunderstandings among owners.

- It’s only about ownership percentages. While ownership percentages are a crucial part of an Operating Agreement, it also covers many other important aspects, such as decision-making processes, profit distribution, and procedures for adding new members.

- You don’t need an Operating Agreement if you have a verbal agreement. Verbal agreements can lead to misunderstandings and disputes. An Operating Agreement provides a written record that can clarify expectations and responsibilities.

- Having an Operating Agreement is a one-time task. This is not true. An Operating Agreement should be reviewed and updated regularly to reflect any changes in the business or its members.

- Operating Agreements are only for multi-member LLCs. Even single-member LLCs can benefit from having an Operating Agreement. It helps to separate personal and business liabilities and provides a clear structure for the business.

By addressing these misconceptions, business owners can better understand the importance of an Operating Agreement and how it can serve their interests effectively.

Popular Forms:

Geico Partners - The submission process is vital for the repair facility's reimbursement.

Roof Guarantee - The warranty does not cover structural movements or failures that affect the roof's integrity.

The California Employment Verification form is a document used to confirm an employee’s job status and details with their current or past employer. This form is an essential tool for various purposes, including loan applications, background checks, and other employment-related processes. For additional resources and information, you can visit PDF Documents Hub to get started.

Wedding Venue Contract - Specify the timeline for finalizing guest counts and meal selections.