Fill in a Valid Notarized Odometer Statement Template

Common mistakes

-

Incomplete Vehicle Information: Many people forget to fill in all the required details about the vehicle, such as the make, model, and VIN. Omitting any of this information can lead to delays or complications in the registration process.

-

Incorrect Mileage Reporting: It's crucial to accurately report the mileage on the odometer. Errors in this section can raise suspicions and may even lead to legal consequences if the information is found to be misleading.

-

Notary Signature Issues: Some individuals overlook the importance of having the notary public sign and date the form correctly. Without the proper notarization, the document may not be considered valid.

-

Failure to Provide Personal Identification: When appearing before a notary, individuals must provide satisfactory evidence of their identity. Forgetting to bring a valid ID can result in the inability to complete the notarization process.

Learn More on This Form

-

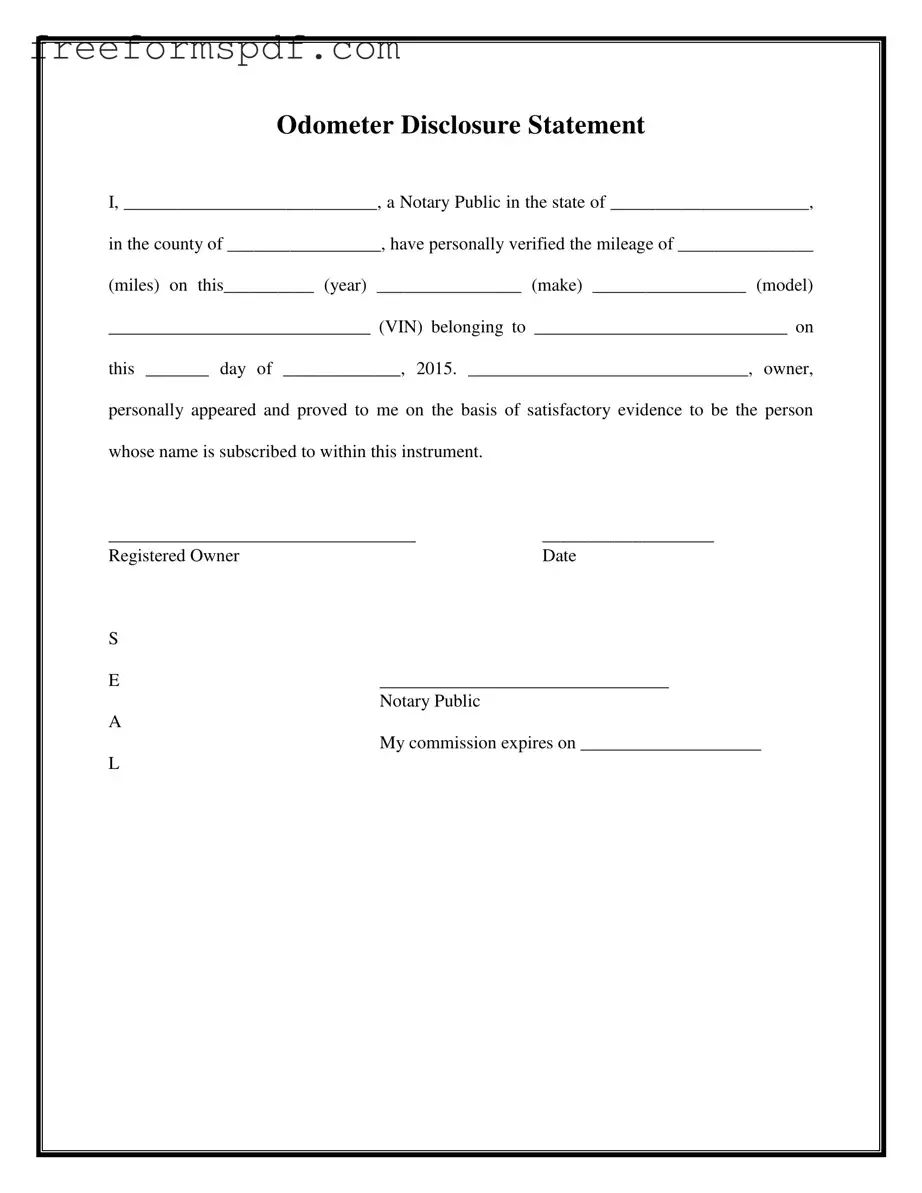

What is a Notarized Odometer Statement?

A Notarized Odometer Statement is a legal document that verifies the mileage of a vehicle at the time of sale or transfer. It is signed by the vehicle owner and notarized by a licensed notary public.

-

Why is a Notarized Odometer Statement necessary?

This statement is important for preventing fraud. It ensures that the mileage reported during a vehicle sale is accurate, helping to protect both the buyer and seller from potential disputes.

-

Who needs to complete a Notarized Odometer Statement?

Typically, the seller of the vehicle must complete this statement. If the vehicle is being sold or transferred, the seller must provide an accurate odometer reading to the buyer.

-

What information is required on the form?

The form requires several key details, including:

- The name of the notary public

- The state and county where notarization takes place

- The current mileage of the vehicle

- The year, make, model, and VIN of the vehicle

- The name of the vehicle owner

- The date of the notarization

-

How does the notarization process work?

The vehicle owner must appear before a notary public and provide satisfactory evidence of their identity. The notary will then verify the mileage and sign the document, confirming its authenticity.

-

Is there a fee for notarizing the statement?

Yes, notaries typically charge a fee for their services. The fee can vary based on state regulations and the notary's discretion.

-

Can I complete the form online?

While some aspects of the process may be completed online, the notarization itself must occur in person. This ensures that the notary can verify the identity of the signer.

-

What happens if the odometer reading is inaccurate?

If the odometer reading is found to be inaccurate, it can lead to legal issues. Both the buyer and seller may face penalties. Therefore, it is crucial to provide an accurate reading.

-

How long is a Notarized Odometer Statement valid?

The statement remains valid as long as it accurately reflects the vehicle's mileage at the time of notarization. However, it is best to complete this statement close to the time of sale to avoid discrepancies.

Misconceptions

Here are four common misconceptions about the Notarized Odometer Statement form:

- Notarization is optional. Many people believe that notarizing the odometer statement is not necessary. In reality, notarization adds a layer of authenticity and helps prevent fraud during vehicle sales.

- Anyone can notarize the document. Some think that any person can serve as a notary. However, only individuals who have been officially commissioned and trained can perform notarizations. This ensures that the process is handled correctly.

- The form is only needed for used vehicles. There is a belief that the odometer statement is only required when selling used cars. In fact, it may also be necessary for certain new vehicle sales, depending on state regulations.

- The mileage must be exact. Some assume that the mileage recorded on the form has to be precise to the last digit. While accuracy is important, minor discrepancies may be acceptable as long as they are disclosed and documented properly.

Browse More Forms

Melaleuca Cancellation Form Pdf - Your cancellation helps us understand customer needs and trends.

For those seeking clarity in legal agreements, the importance of a "Hold Harmless Agreement" cannot be overstated, as it outlines the terms under which parties agree not to hold each other liable for specified risks in various scenarios. You can learn more by visiting the necessary Hold Harmless Agreement guidelines.

Form 1099 Nec - The 1099-NEC supports fair and transparent tax practices for freelance work and independent income.

Stock Transfer Form Template - Promotes transparency in stock ownership and transfer activities.