Attorney-Verified Transfer-on-Death Deed Document for New York State

Common mistakes

-

Not including all required information: When filling out the Transfer-on-Death Deed, it is essential to provide complete details about the property and the beneficiaries. Missing even one piece of information can lead to complications later on.

-

Failing to sign the deed: The deed must be signed by the property owner. Without a signature, the document is invalid, and the intended transfer may not occur.

-

Not having the deed notarized: In New York, the Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can result in the deed being challenged.

-

Incorrectly identifying beneficiaries: It’s crucial to accurately list the names and relationships of beneficiaries. Mistakes can lead to disputes or unintended consequences.

-

Not recording the deed: After completing the form, it must be filed with the appropriate county clerk’s office. Failing to do so means the deed may not be recognized, and the transfer may not take effect.

-

Ignoring state-specific requirements: Each state has its own rules regarding Transfer-on-Death Deeds. Be sure to familiarize yourself with New York's specific laws to avoid pitfalls.

-

Using outdated forms: Always ensure you are using the most current version of the Transfer-on-Death Deed form. Using an outdated form can lead to errors and complications.

-

Not considering tax implications: It's important to understand the potential tax consequences of transferring property through a Transfer-on-Death Deed. Consulting a tax professional can provide clarity.

-

Failing to communicate with beneficiaries: Open communication with beneficiaries about the deed and its implications is vital. This can prevent misunderstandings and disputes after the property owner’s passing.

Learn More on This Form

-

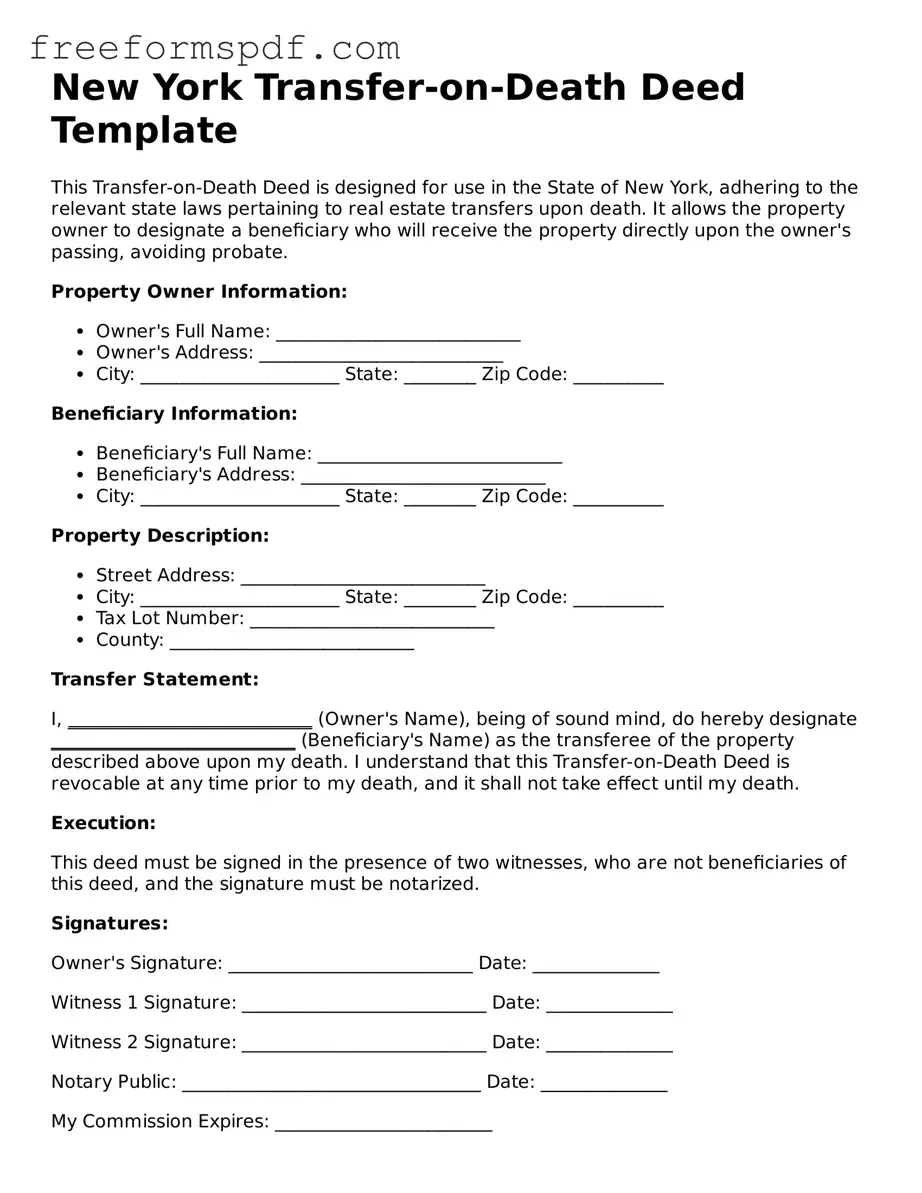

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners in New York to designate a beneficiary who will automatically receive their real estate upon their death. This process helps avoid probate, making the transfer of property simpler and more efficient for the beneficiaries.

-

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in New York and is of sound mind can create a TOD deed. It’s important to ensure that the property is solely owned by the individual or held in a way that allows for a transfer to a beneficiary.

-

How do I create a Transfer-on-Death Deed?

To create a TOD deed, you must fill out the appropriate form, which includes details about the property and the designated beneficiary. Once completed, the deed must be signed in front of a notary public and then recorded with the county clerk's office where the property is located. Recording the deed is crucial for it to be valid.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD deed at any time while you are alive. To do this, you would need to create a new TOD deed or file a revocation form with the county clerk. It’s wise to inform the beneficiary about any changes to avoid confusion later.

-

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the TOD deed will not be effective. In this case, you may want to update the deed to name a new beneficiary or consider other estate planning options to ensure your property is transferred according to your wishes.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. However, it’s essential to consider potential estate taxes or capital gains taxes that might arise upon the transfer of property to the beneficiary. Consulting a tax professional can provide clarity on your specific situation.

-

Is a Transfer-on-Death Deed the best option for everyone?

A TOD deed can be a great tool for many individuals, but it may not be suitable for everyone. Factors such as family dynamics, the nature of the property, and overall estate planning goals should be considered. It’s often beneficial to seek advice from an estate planning attorney to determine the best approach for your unique circumstances.

Misconceptions

Understanding the New York Transfer-on-Death Deed (TODD) can be challenging. Here are seven common misconceptions that people often have about this legal tool:

- It automatically transfers property upon death. Many believe that a TODD instantly transfers ownership when the property owner dies. In reality, the transfer occurs only after the death of the owner and when the deed is properly recorded.

- It eliminates the need for a will. Some think that using a TODD means they do not need a will. However, a TODD only addresses the transfer of specific property. A will is still important for other assets and to outline final wishes.

- All properties are eligible for a TODD. Not every type of property can be transferred using a TODD. For instance, properties held in a trust or those subject to a mortgage may have different requirements.

- It is irrevocable once signed. A common belief is that a TODD cannot be changed after it is signed. In fact, the owner can revoke or change the deed at any time before their death, as long as they follow the proper procedures.

- Beneficiaries have immediate rights to the property. Some assume that beneficiaries can access the property immediately after the owner's death. However, beneficiaries must wait until the deed is recorded and any potential claims against the estate are resolved.

- There are no tax implications. Many people think that using a TODD avoids all tax implications. However, estate taxes may still apply, and it’s essential to consider the tax consequences when planning.

- It is a one-size-fits-all solution. Lastly, some believe that a TODD is the best solution for everyone. Each individual’s situation is unique, and it is crucial to evaluate personal circumstances and consult with a professional before proceeding.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers in New York.

Some Other Transfer-on-Death Deed State Templates

Transfer on Death Deed Washington - It can serve as a tool for caregivers or family members wanting to ensure homeownership for loved ones.

Oregon Transfer on Death Deed - This deed type allows for flexibility in adjusting beneficiaries as family dynamics change.

In addition to filing the necessary documents, entrepreneurs should consider utilizing resources like NY Templates to ease the process of preparing the New York Certificate form, ensuring that all required information is accurately presented and compliant with state regulations.

Virginia Transfer on Death Deed - A Transfer-on-Death Deed can only be applied to real estate and not personal property or financial accounts.

Transfer on Death Deed Pennsylvania - This legal document must be properly completed and recorded to be effective.