Attorney-Verified Quitclaim Deed Document for New York State

Common mistakes

-

Incorrect Grantee Information: Many people mistakenly enter the wrong name or misspell the name of the person receiving the property. This can lead to complications later on.

-

Failure to Include a Legal Description: Some individuals forget to provide a complete legal description of the property. A vague description can create confusion and make the deed invalid.

-

Not Notarizing the Document: A common oversight is neglecting to have the deed notarized. Without a notary's signature, the deed may not be recognized by the county clerk.

-

Omitting the Date: Forgetting to date the document is another frequent error. A date is essential for establishing when the transfer of property takes effect.

-

Ignoring State-Specific Requirements: Each state has unique requirements for quitclaim deeds. Failing to adhere to New York's specific guidelines can render the deed ineffective.

Learn More on This Form

-

What is a Quitclaim Deed?

A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the property is free of liens or claims. Instead, it simply conveys whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

Quitclaim deeds are often used in situations where the transfer of property is between family members, such as during a divorce or inheritance. They are also suitable for clearing up title issues or when the grantor is unsure of the property’s status.

-

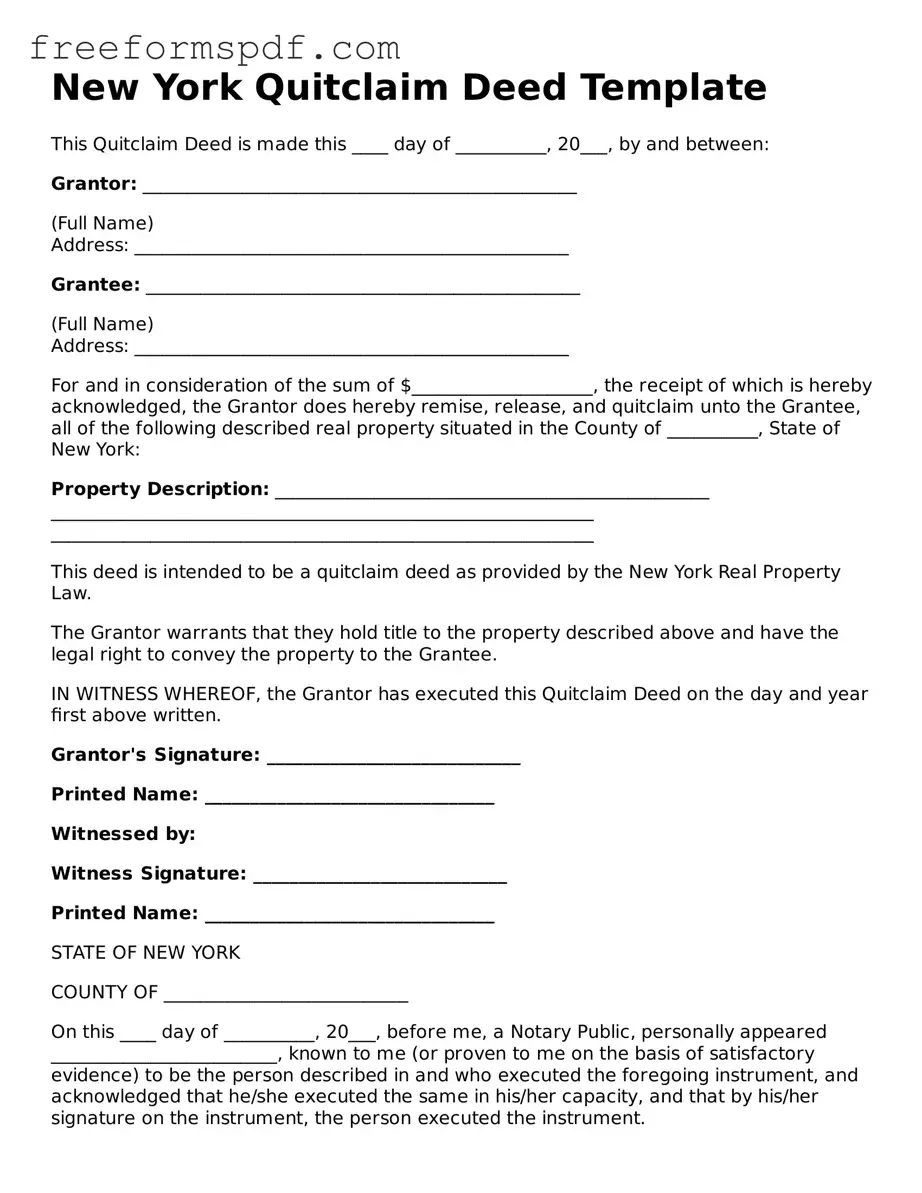

How do I complete a Quitclaim Deed in New York?

To complete a quitclaim deed in New York, you need to fill out the form with the names of the grantor and grantee, a description of the property, and the date of transfer. It must be signed by the grantor in the presence of a notary public. After signing, the deed should be filed with the county clerk’s office where the property is located.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a quitclaim deed is not the same as a warranty deed. A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a quitclaim deed does not provide such assurances, making it a riskier option for the grantee.

-

Are there any tax implications when using a Quitclaim Deed?

In New York, transferring property via a quitclaim deed may trigger certain tax implications. While the transfer itself may not incur a tax, it could affect property taxes or capital gains taxes in the future. It is advisable to consult a tax professional to understand the potential consequences.

-

Can a Quitclaim Deed be revoked?

Once a quitclaim deed is executed and recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed to transfer the property back or to another party. This process would require the same formalities as the original deed.

-

What happens if the grantor has no ownership interest in the property?

If the grantor has no ownership interest in the property, the quitclaim deed will still transfer whatever interest they may have, which could be nothing. This means the grantee receives no rights or claims to the property, highlighting the importance of ensuring the grantor holds valid title before proceeding.

-

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a quitclaim deed, it is highly recommended. An attorney can ensure that the deed is filled out correctly and complies with all state laws, helping to avoid potential issues down the road.

-

How much does it cost to file a Quitclaim Deed in New York?

The cost to file a quitclaim deed in New York varies by county. Generally, there are filing fees that can range from $20 to $100. Additional costs may include notary fees and any necessary tax forms. Always check with your local county clerk’s office for specific fee information.

-

Can a Quitclaim Deed be used for property that has a mortgage?

Yes, a quitclaim deed can be used for property that has a mortgage. However, the mortgage does not disappear with the transfer. The grantee may assume the mortgage responsibility unless otherwise stated in the deed or mortgage agreement. It is essential to consult with the lender to understand any implications.

Misconceptions

Understanding the New York Quitclaim Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are seven common misconceptions explained.

-

A Quitclaim Deed transfers ownership completely.

This is misleading. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has any ownership interest at all.

-

A Quitclaim Deed is only for family members.

This is not true. While Quitclaim Deeds are often used among family members, they can be used in any situation where the parties agree to the transfer of interest.

-

A Quitclaim Deed eliminates all liens on the property.

This is incorrect. Liens remain attached to the property, even if ownership changes hands. The new owner may still be responsible for those debts.

-

You don’t need to record a Quitclaim Deed.

This is a misconception. While it is not legally required, recording the deed protects the new owner's interest and provides public notice of the ownership change.

-

A Quitclaim Deed is the same as a Warranty Deed.

This is false. A Warranty Deed offers guarantees about the property’s title, while a Quitclaim Deed does not provide any warranties or assurances.

-

A Quitclaim Deed can be used to transfer property without a sale.

This is true, but it’s important to note that even without a sale, the transfer must still comply with legal requirements and tax implications.

-

You can use a Quitclaim Deed to fix title issues.

This is misleading. While a Quitclaim Deed can transfer interest, it does not resolve underlying title problems. Legal advice may be necessary to address those issues.

Being aware of these misconceptions can help you navigate the complexities of real estate transactions more effectively.

Some Other Quitclaim Deed State Templates

Quitclaim Deed Form Pennsylvania - The document is not recommended for purchasing property from strangers.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect confidential information shared between parties. This agreement ensures that sensitive data remains private and is not disclosed to unauthorized individuals. By signing an NDA, individuals and businesses can foster trust and collaboration while safeguarding their proprietary information. For those looking to formalize this process, a useful resource is the Non-disclosure Agreement form.

How to File a Quitclaim Deed in Virginia - This type of deed is often used in real estate transactions involving trusts.

Texas Quitclaim Deed Form - A Quitclaim Deed is a useful option for quick title changes.

Quit Claim Deed Oregon - Be sure to check state-specific requirements when drafting this document.