Attorney-Verified Promissory Note Document for New York State

Common mistakes

-

Incorrect Date: Many individuals forget to enter the correct date when signing the note. This can lead to confusion about when the loan agreement becomes effective.

-

Missing Signatures: Failing to sign the document is a common oversight. Both the borrower and lender must provide their signatures for the note to be valid.

-

Ambiguous Terms: Some people use vague language when describing the loan terms. Clear and specific terms help avoid misunderstandings later on.

-

Improper Amount: Entering the wrong loan amount is a frequent error. Double-checking the figures can prevent disputes over the amount owed.

-

Missing Payment Schedule: Not including a payment schedule can lead to confusion. Specify when payments are due and the amount of each installment.

-

Ignoring Interest Rate: Some people neglect to state the interest rate. Including this information is crucial for clarity on the total repayment amount.

-

Omitting Late Fees: Failing to outline late fees can lead to complications if payments are missed. Clearly define any penalties for late payments.

-

Not Including Collateral: If the loan is secured, it's important to specify the collateral. This protects the lender's interests in case of default.

-

Failure to Review: Skipping a thorough review of the completed form can lead to overlooked mistakes. Taking the time to review can save future headaches.

-

Not Keeping Copies: Many forget to keep a copy of the signed note. Retaining a copy is essential for both parties to reference the agreement later.

Learn More on This Form

-

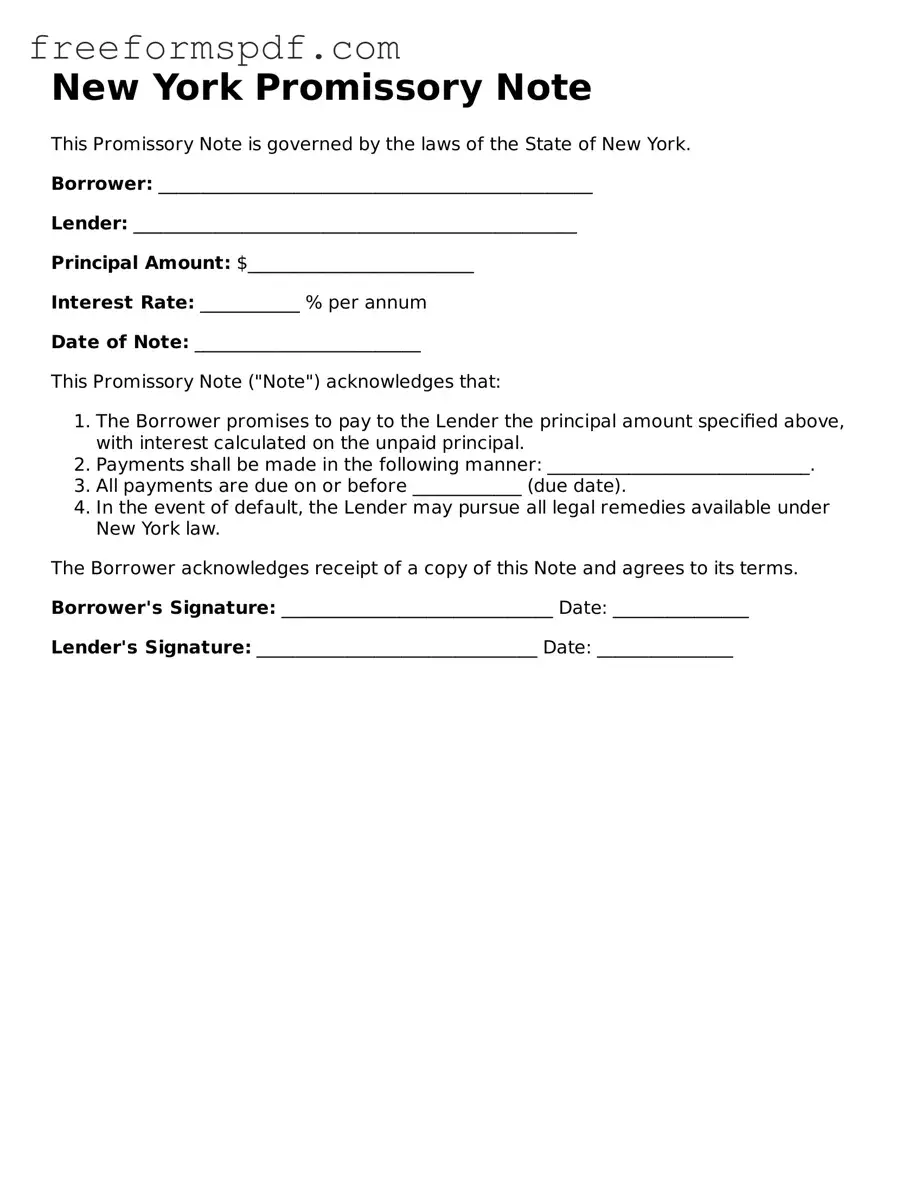

What is a New York Promissory Note?

A New York Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. This note specifies the amount borrowed, the interest rate, repayment schedule, and any consequences for failing to repay. It serves as a formal agreement between the parties involved.

-

Who typically uses a Promissory Note?

Individuals and businesses often use Promissory Notes in various situations. For example, a person might use it when lending money to a friend or family member. Businesses may utilize it for loans between partners or to finance operations. Essentially, anyone who needs to document a loan agreement can benefit from a Promissory Note.

-

What are the key components of a New York Promissory Note?

A well-drafted Promissory Note should include:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties, indicating agreement to the terms.

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed by both parties, it creates an obligation for the borrower to repay the loan according to the specified terms. If the borrower fails to repay, the lender can take legal action to recover the owed amount.

-

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A legal professional can ensure that the document meets all legal requirements and adequately protects your interests. If the loan amount is significant or if the terms are complex, seeking legal advice is recommended.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement. This helps prevent misunderstandings and provides a clear record of the new terms.

Misconceptions

Understanding the New York Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, each note can be tailored to the specific agreement between the parties involved, including terms like interest rates and repayment schedules.

- A Promissory Note Must Be Notarized: Some assume that notarization is a requirement for all promissory notes. While notarization can add an extra layer of authenticity, it is not legally required for a promissory note to be valid in New York.

- Only Written Promissory Notes are Valid: There is a belief that only written notes hold legal weight. However, verbal agreements can also be considered promissory notes, though they are much harder to enforce in court.

- Interest Rates Are Always Fixed: A common misconception is that interest rates on promissory notes must be fixed. In fact, they can be variable or fixed, depending on what the parties agree upon.

- Promissory Notes Are Only for Large Loans: Many think that promissory notes are only necessary for significant amounts of money. In truth, they can be used for any loan amount, no matter how small.

- Once Signed, a Promissory Note Cannot Be Changed: Some believe that once a promissory note is signed, it is set in stone. However, the terms can be amended if both parties agree to the changes in writing.

Being aware of these misconceptions can help individuals navigate the complexities of financial agreements more effectively. It is always wise to seek clarity and understanding when dealing with legal documents.

Some Other Promissory Note State Templates

How to Create a Promissory Note - This form can help ensure clarity and prevent misunderstandings regarding loan repayment.

For those seeking guidance on how to properly fill out the NYC Payroll Form, resources such as NY Templates can offer valuable templates and insights, ensuring contractors and subcontractors maintain compliance with labor regulations while accurately reporting payroll information for their employees.

Promissory Note Template Oregon - In the event of disputes, this document serves as critical evidence of the agreement.