Attorney-Verified Operating Agreement Document for New York State

Common mistakes

-

Inaccurate Member Information: Failing to provide correct names, addresses, and ownership percentages for all members can lead to legal disputes. Each member’s details must be precise and up-to-date.

-

Neglecting to Define Management Structure: Not specifying whether the LLC will be member-managed or manager-managed can create confusion. Clear definitions help in decision-making processes.

-

Omitting Profit and Loss Distribution: Leaving out how profits and losses will be shared among members can result in disagreements. Clearly outline the distribution method to avoid future conflicts.

-

Ignoring Member Voting Rights: Failing to address how voting will occur can lead to power struggles. Specify voting rights and procedures to ensure smooth governance.

-

Not Including an Indemnification Clause: Excluding protections for members against certain liabilities can expose them to unnecessary risks. An indemnification clause can safeguard members from personal liability.

-

Forgetting to Update the Agreement: Once the agreement is signed, neglecting to revise it as the business evolves can lead to outdated practices. Regular reviews and updates are essential for compliance and relevance.

Learn More on This Form

-

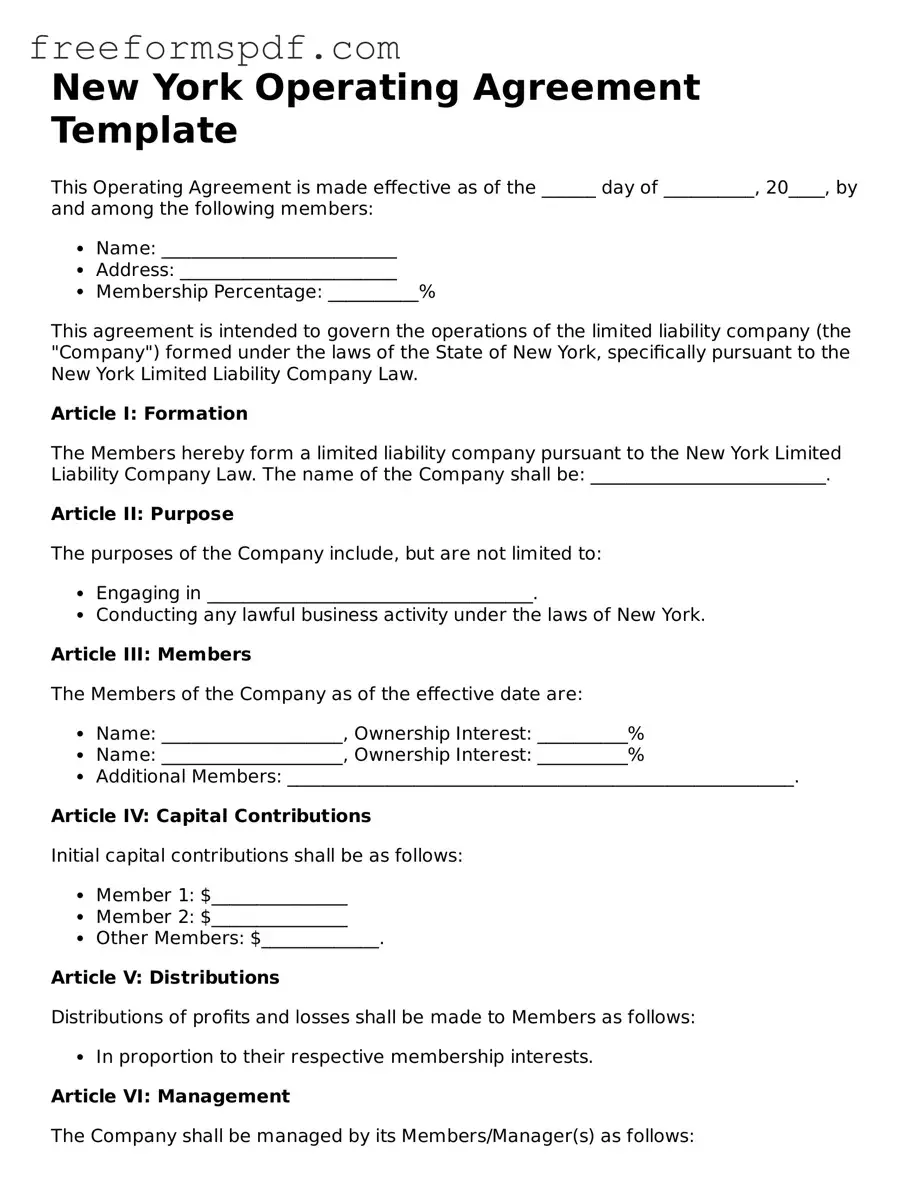

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in New York. It serves as an internal guideline for the members of the LLC, detailing how the business will be managed and the rights and responsibilities of each member.

-

Is an Operating Agreement required in New York?

No, New York does not legally require LLCs to have an Operating Agreement. However, having one is highly recommended. It helps prevent misunderstandings among members and provides a clear framework for operations, which can be crucial in case of disputes.

-

What should be included in an Operating Agreement?

An Operating Agreement should include:

- The name of the LLC

- The purpose of the business

- The names and addresses of the members

- Each member’s ownership percentage

- The management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- How the agreement can be amended

-

Can I change my Operating Agreement later?

Yes, you can amend your Operating Agreement at any time. To do this, all members must agree to the changes. It’s best to document any amendments in writing to maintain clarity and avoid future disputes.

-

How does an Operating Agreement help in a dispute?

In the event of a dispute among members, an Operating Agreement serves as a reference point. It outlines the agreed-upon procedures and responsibilities, making it easier to resolve conflicts. Courts may also refer to the Operating Agreement when making decisions regarding disputes.

-

Where can I get a New York Operating Agreement form?

You can find templates for a New York Operating Agreement online. Many legal websites offer customizable forms. Alternatively, consider consulting with a legal professional to ensure that your Operating Agreement meets your specific needs and complies with New York laws.

Misconceptions

When it comes to the New York Operating Agreement form, several misconceptions can lead to confusion. Here are five common misunderstandings:

- It's only for large businesses. Many believe that operating agreements are only necessary for big corporations. In reality, even small businesses and LLCs benefit from having one. It helps outline management structure and operational procedures.

- It's a one-size-fits-all document. Some think that a standard template will work for every business. However, each business has unique needs and circumstances. Customizing the agreement ensures it reflects the specific goals and structure of the company.

- It's not legally required. While New York law does not mandate an operating agreement for LLCs, not having one can lead to disputes among members. It's a good practice to have one in place to clarify roles and responsibilities.

- Once it's created, it can't be changed. Some people feel that an operating agreement is set in stone. In fact, it can be amended as the business evolves or as members agree on changes. Flexibility is key.

- It only covers financial matters. Many assume that the operating agreement is solely about money. While financial aspects are important, it also addresses management roles, decision-making processes, and dispute resolution.

Understanding these misconceptions can help business owners make informed decisions about their operating agreements and ensure their businesses run smoothly.

Some Other Operating Agreement State Templates

Operating Agreement Llc Texas Template - An Operating Agreement can set voting rights for members.

Operating Agreement Llc Oregon - This agreement encourages transparency within the organization by detailing member rights.

Pa Llc Operating Agreement - The agreement sets the groundwork for future business operations and strategies.

The Employment Verification process is vital for assuring prospective employers or lenders about an individual's job history. For accurate documentation, you can access our range of templates, including an efficient Employment Verification form tailored for various needs.

Create an Operating Agreement - The document allows members to define their unique business structure.