Attorney-Verified Loan Agreement Document for New York State

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This can include missing names, addresses, or financial information. Each section must be filled out completely to avoid delays.

-

Incorrect Loan Amount: Some applicants mistakenly enter the wrong loan amount. Double-checking the figures is essential to ensure that you are requesting the correct sum.

-

Neglecting to Sign: A common oversight is forgetting to sign the form. Without a signature, the agreement is not valid. Always ensure that you sign and date the document before submission.

-

Ignoring Terms and Conditions: Some individuals skip reading the terms and conditions. Understanding these details is crucial, as they outline your responsibilities and rights under the agreement.

Learn More on This Form

-

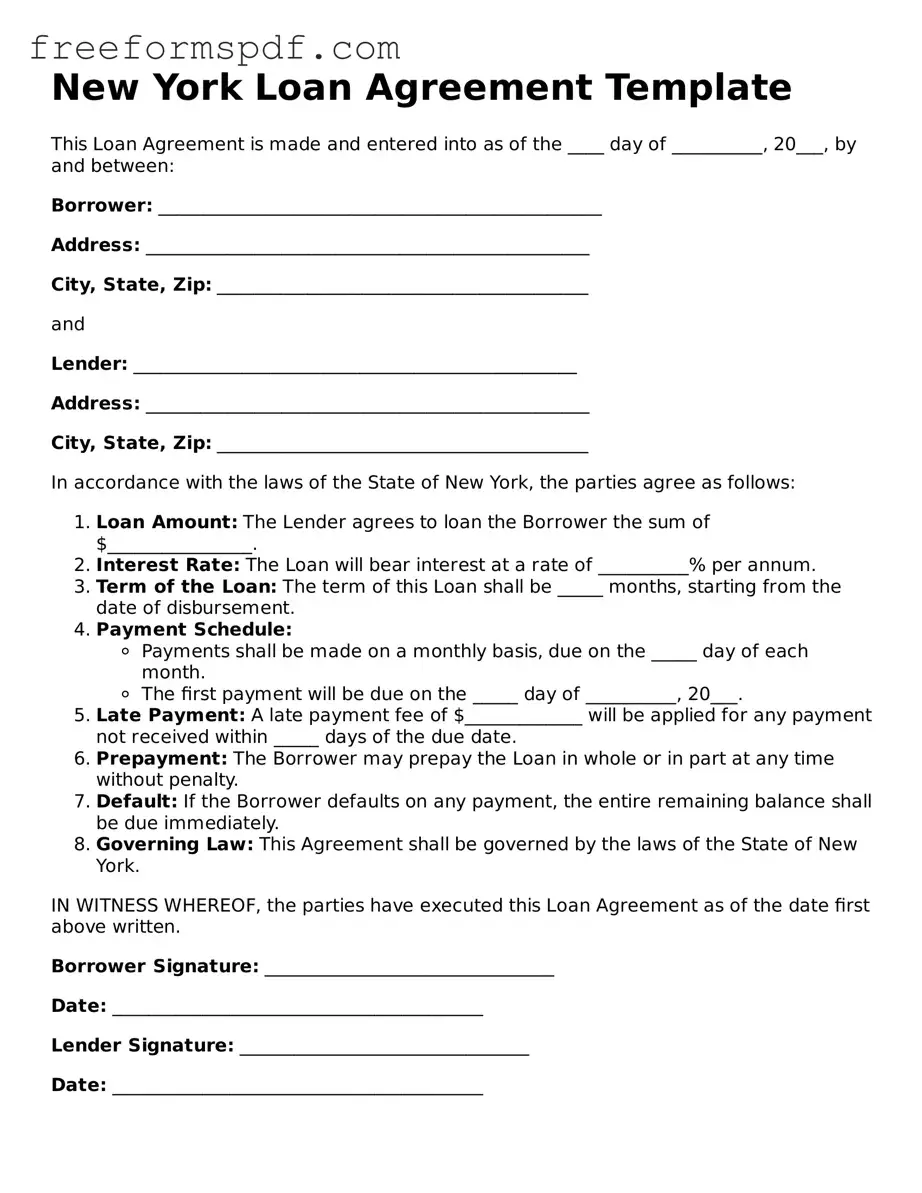

What is a New York Loan Agreement?

A New York Loan Agreement is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. It specifies the loan amount, interest rate, repayment schedule, and any collateral involved. This agreement serves to protect both parties by clearly defining their rights and responsibilities.

-

Who needs a Loan Agreement?

Anyone who is lending or borrowing money should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Having a formal agreement helps to avoid misunderstandings and provides legal recourse if the terms are not met.

-

What are the key components of a Loan Agreement?

A typical Loan Agreement includes:

- The names and addresses of the borrower and lender

- The loan amount

- The interest rate and how it is calculated

- The repayment schedule

- Any collateral securing the loan

- Conditions for default and remedies

-

Is a Loan Agreement legally binding?

Yes, a properly executed Loan Agreement is legally binding in New York. Both parties must sign the document, and it is advisable to have it notarized to enhance its enforceability. This means that if either party fails to meet the terms, the other party can take legal action.

-

Can I modify a Loan Agreement after it has been signed?

Modifications to a Loan Agreement can be made, but they must be documented in writing and signed by both parties. Verbal agreements or informal changes are not legally enforceable, so it is crucial to ensure any amendments are clear and agreed upon.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take specific actions as outlined in the agreement. This may include demanding immediate repayment, charging late fees, or taking legal action to recover the owed amount. If collateral was provided, the lender may also have the right to seize it.

-

Are there any state-specific laws I should be aware of?

Yes, New York has specific laws governing loans, including interest rate limits and disclosure requirements. It is essential to ensure that the Loan Agreement complies with these regulations to avoid penalties or unenforceability.

-

Do I need a lawyer to create a Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is highly recommended. A legal professional can ensure that the agreement is comprehensive, compliant with state laws, and tailored to the specific needs of both parties.

-

Can a Loan Agreement be used for business loans?

Absolutely. A Loan Agreement can be used for both personal and business loans. When used for business purposes, it may include additional clauses related to the business's operational requirements or conditions specific to the industry.

-

Where can I find a template for a New York Loan Agreement?

Templates for New York Loan Agreements can be found online through legal document services or local law firms. However, it is advisable to customize any template to fit the specific situation and ensure compliance with New York law.

Misconceptions

When it comes to the New York Loan Agreement form, there are several misconceptions that can lead to confusion. Understanding these can help ensure that you navigate the loan process smoothly. Here’s a list of common misunderstandings:

- All loan agreements are the same. Many people believe that all loan agreements follow the same format and terms. In reality, each agreement can vary significantly based on the lender, the type of loan, and individual circumstances.

- You don’t need to read the agreement. Some borrowers skip reading the loan agreement, thinking it’s just a formality. However, it’s crucial to understand the terms, interest rates, and repayment schedules before signing.

- Only large loans require a formal agreement. Many assume that only significant loans need a formal loan agreement. However, even small loans can benefit from a written agreement to clarify expectations and protect both parties.

- Verbal agreements are sufficient. Some believe that a verbal agreement is enough to secure a loan. However, having a written loan agreement is essential for legal protection and clarity.

- Loan agreements can’t be modified. Many think that once a loan agreement is signed, it cannot be changed. In fact, modifications can be made if both parties agree, but it’s important to document any changes in writing.

- Loan agreements are only for personal loans. Some people think that loan agreements are only necessary for personal loans. In truth, they are also vital for business loans, mortgages, and even informal loans between friends or family.

- Once signed, the lender has all the power. There’s a misconception that the lender has all the control once the agreement is signed. Borrowers also have rights and responsibilities that are outlined in the agreement, and they should be aware of them.

By clearing up these misconceptions, borrowers can approach the New York Loan Agreement with a better understanding, ensuring a smoother loan experience.

Some Other Loan Agreement State Templates

Loan Agreement Template Texas - This agreement highlights the importance of timely payments.

The New York DTF-84 form serves as a vital resource for businesses looking to apply for Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification and is essential in navigating the sales tax benefits landscape. For more information and resources, visit NY Templates, which provides necessary guidance for completing the application correctly and efficiently to ensure eligibility for these important tax incentives.