Attorney-Verified Durable Power of Attorney Document for New York State

Common mistakes

-

Not specifying powers clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. The form allows for a range of financial and legal decisions, but if these are not explicitly stated, it can lead to confusion or disputes later on.

-

Inadequate agent selection: Choosing the wrong person as an agent can have serious consequences. It is important to select someone who is trustworthy and capable of handling financial matters. Sometimes, individuals choose family members or friends without considering their ability to manage responsibilities effectively.

-

Not signing or dating the form: A Durable Power of Attorney is not valid unless it is properly signed and dated. Some individuals forget to sign the document or neglect to include the date, which can render the form ineffective when it is needed.

-

Failing to have witnesses or notarization: Depending on the circumstances, the form may require witnesses or notarization to be legally binding. Omitting these steps can lead to challenges regarding the validity of the document, especially in situations where the agent needs to act on behalf of the principal.

Learn More on This Form

-

What is a Durable Power of Attorney (DPOA)?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become unable to do so yourself. Unlike a regular Power of Attorney, a DPOA remains effective even if you become incapacitated.

-

Who can be appointed as an agent in a DPOA?

You can choose any competent adult as your agent. This can be a family member, friend, or a professional such as an attorney. It is important to select someone you trust to make decisions on your behalf.

-

What powers can I grant to my agent?

You have the flexibility to grant a wide range of powers to your agent, including the ability to manage bank accounts, pay bills, make investment decisions, and handle real estate transactions. You can specify which powers your agent will have and which they will not.

-

Do I need to have a lawyer to create a DPOA?

While it is not mandatory to have a lawyer, it is advisable to consult one. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes.

-

How do I create a Durable Power of Attorney in New York?

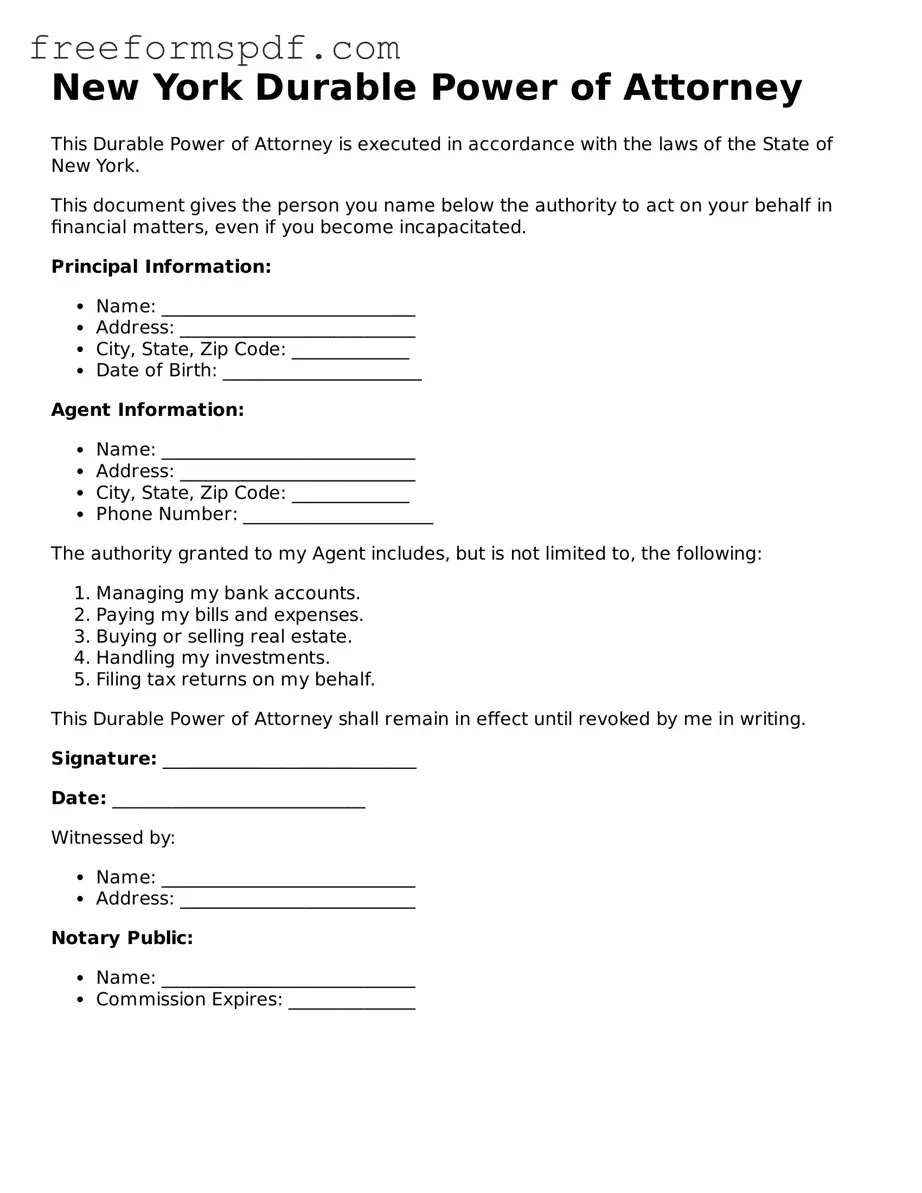

To create a DPOA in New York, you must complete the official form, which includes your information, your agent's information, and the powers you wish to grant. After filling it out, you must sign it in the presence of a notary public.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your DPOA at any time as long as you are still competent. To do this, you should create a written notice of revocation and inform your agent and any institutions that may have a copy of the original DPOA.

-

What happens if I do not have a DPOA?

If you become incapacitated without a DPOA in place, your family may need to go through a court process to appoint a guardian to manage your affairs. This process can be time-consuming and costly.

-

Is a DPOA effective immediately?

A DPOA can be set to take effect immediately upon signing, or it can be made effective only upon your incapacity. You should clearly indicate your preference in the document.

-

Are there any limitations to the powers granted in a DPOA?

Yes, you can place specific limitations on the powers granted to your agent. For instance, you may choose to restrict certain financial transactions or require that your agent consult with another person before making decisions.

-

How long does a Durable Power of Attorney last?

A DPOA remains in effect until you revoke it, until your death, or until a court invalidates it. It is important to review your DPOA periodically to ensure it still meets your needs.

Misconceptions

Understanding the New York Durable Power of Attorney form is essential for making informed decisions about financial and legal matters. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important document:

-

It only becomes effective when I become incapacitated.

Many people believe that a Durable Power of Attorney is only activated when they are unable to make decisions. In reality, it can be effective immediately upon signing, depending on how it is drafted.

-

My agent can do anything they want with my money.

While your agent does have significant authority, they must act in your best interest. There are legal obligations to manage your finances responsibly.

-

I can’t revoke it once it’s signed.

You retain the right to revoke a Durable Power of Attorney at any time, as long as you are mentally competent. This can be done through a written notice.

-

It’s the same as a regular Power of Attorney.

A Durable Power of Attorney differs from a regular Power of Attorney in that it remains valid even if you become incapacitated. Regular powers of attorney become void under such circumstances.

-

My spouse automatically has authority to act on my behalf.

While spouses often have certain rights, they do not automatically have the authority to make decisions for you without a Durable Power of Attorney in place.

-

It’s only for older adults.

Anyone, regardless of age, can benefit from having a Durable Power of Attorney. Unexpected events can happen at any time, making it wise for all adults to consider this document.

-

My agent must be a lawyer.

Your agent can be anyone you trust, such as a family member or friend. They do not need to be a legal professional to act on your behalf.

-

Once I create it, I don’t need to think about it again.

It’s important to review your Durable Power of Attorney periodically, especially after major life changes, such as marriage, divorce, or the birth of a child.

-

It can’t be used for medical decisions.

A Durable Power of Attorney is primarily for financial matters. For medical decisions, you would need a separate document, such as a Health Care Proxy.

-

All states have the same rules regarding Durable Powers of Attorney.

Each state has its own laws governing Durable Powers of Attorney. It’s crucial to understand the specific requirements and implications in New York.

By clarifying these misconceptions, individuals can better navigate the complexities of a Durable Power of Attorney and ensure their wishes are respected.

Some Other Durable Power of Attorney State Templates

Virginia Power of Attorney - Regular discussions with your agent about your wishes help ensure they are prepared to represent you.

The Texas Motor Vehicle Bill of Sale form is crucial for anyone looking to finalize a vehicle transaction in Texas. This document provides essential details about both the buyer and seller, alongside important vehicle information to help ensure a seamless transfer of ownership. To facilitate this process, you can access the Automotive Bill of Sale form and ensure you have all necessary information at your fingertips.

Free Durable Power of Attorney Form Pdf - A Durable Power of Attorney can cover financial, medical, and legal matters, depending on how it is drafted.

Oregon Durable Power of Attorney - An agent must act in your best interests and follow any specific instructions you provide.