Attorney-Verified Deed in Lieu of Foreclosure Document for New York State

Common mistakes

-

Not providing complete property information. Ensure the property address and legal description are accurate and fully detailed.

-

Failing to sign the document. Both parties must sign the deed to make it valid.

-

Using incorrect names. Names should match exactly as they appear on the mortgage documents.

-

Not including a date. Each signature should have a date to establish when the agreement was made.

-

Ignoring local laws. Some areas may have specific requirements for deeds in lieu of foreclosure.

-

Not consulting with a legal professional. It’s wise to seek advice to ensure all terms are clear and understood.

-

Overlooking the implications of the deed. Understand how this may affect your credit and future home ownership.

-

Failing to provide a clear title. Make sure there are no liens or other claims against the property.

-

Not keeping copies. Always retain copies of the signed deed for your records.

-

Rushing the process. Take the time to review the document carefully before submission.

Learn More on This Form

-

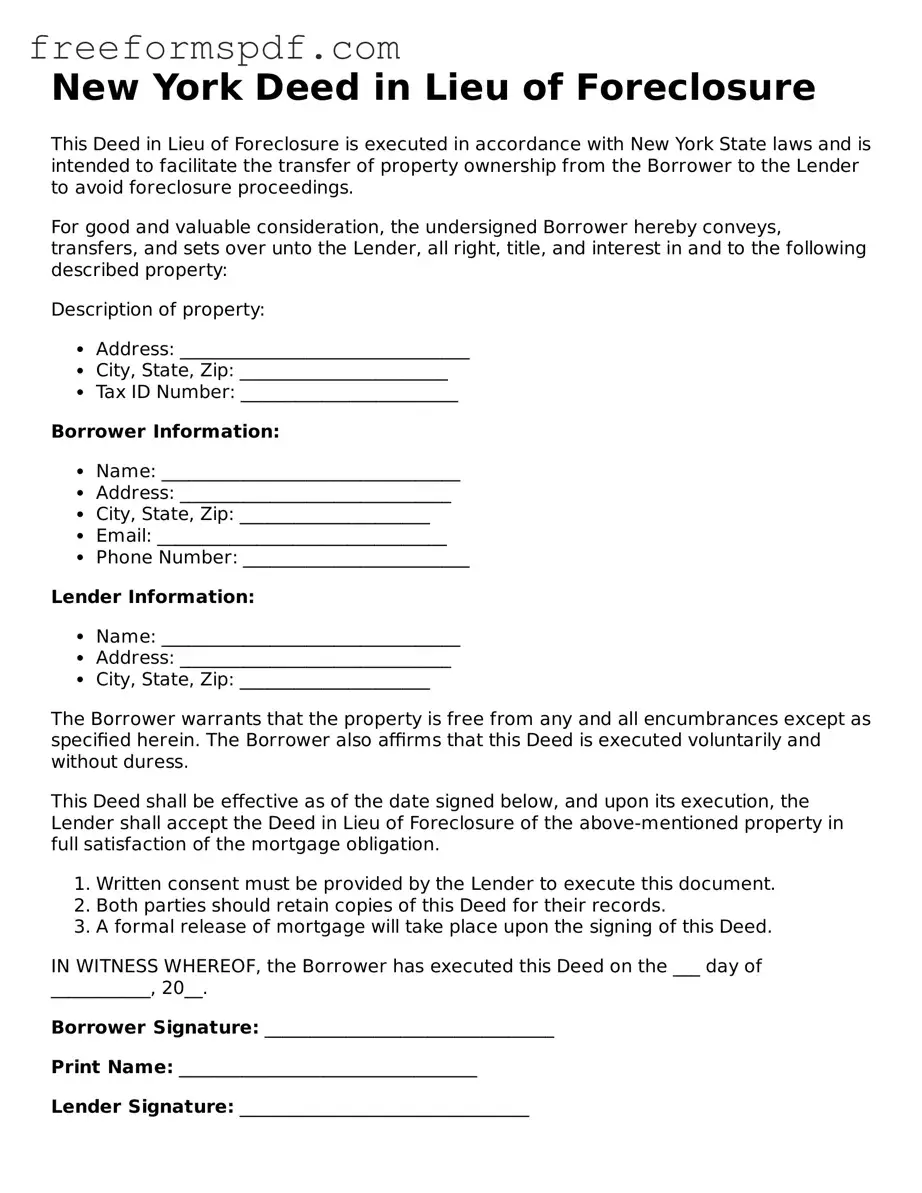

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. This process can help both parties by simplifying the resolution of a defaulted mortgage.

-

How does a Deed in Lieu of Foreclosure work?

In this arrangement, the borrower voluntarily gives the property back to the lender. In exchange, the lender typically agrees to cancel the mortgage debt. This can save the borrower from a lengthy foreclosure process and potential damage to their credit score.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It can help preserve the borrower's credit score compared to a foreclosure.

- The process is often quicker and less costly than foreclosure.

- It allows the borrower to walk away from the property without owing additional debt.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential downsides. The borrower may still face tax consequences if the lender forgives a portion of the debt. Additionally, not all lenders accept a Deed in Lieu of Foreclosure, and the borrower may need to prove they are in financial hardship.

-

What are the requirements to execute a Deed in Lieu of Foreclosure?

Requirements can vary by lender, but generally, the borrower must be in default on their mortgage, provide proof of financial hardship, and be willing to vacate the property. The lender will also typically require a title search to ensure there are no other liens on the property.

-

How do I initiate a Deed in Lieu of Foreclosure?

Start by contacting your lender to discuss your situation. They will provide information on their specific process. It’s also advisable to consult with a real estate attorney or a housing counselor to understand your options and ensure you’re making the best decision for your circumstances.

Misconceptions

When it comes to the New York Deed in Lieu of Foreclosure, there are several misconceptions that can lead to confusion for homeowners facing financial difficulties. Understanding the realities can help individuals make informed decisions. Here are seven common misconceptions:

- It eliminates all debt immediately. Many believe that signing a deed in lieu of foreclosure wipes out all outstanding debts. In reality, while it can relieve you of the mortgage obligation, other debts related to the property, such as taxes or liens, may still exist.

- It’s a quick and easy process. Some homeowners think that a deed in lieu is a simple solution to avoid foreclosure. However, the process often involves negotiations with the lender and can take time to finalize.

- It does not affect credit scores. Another misconception is that a deed in lieu of foreclosure has no impact on credit ratings. In fact, it can significantly affect your credit score, similar to a foreclosure.

- It’s the same as a short sale. Many confuse a deed in lieu with a short sale. While both involve transferring ownership to the lender, a short sale requires selling the property for less than the mortgage balance, whereas a deed in lieu involves voluntarily giving the property back.

- All lenders accept it. Homeowners often assume that all lenders will accept a deed in lieu of foreclosure. However, not all lenders offer this option, and acceptance can depend on specific circumstances.

- It absolves you of legal responsibilities. Some believe that signing a deed in lieu releases them from all legal responsibilities associated with the property. This is not always true; certain obligations, like property maintenance or tax responsibilities, may still apply.

- It guarantees a smooth transition to renting. Lastly, many think that after a deed in lieu, they can easily transition to renting. However, the impact on credit and potential rental applications can complicate this process.

Understanding these misconceptions can empower homeowners to navigate their options more effectively. It's crucial to consult with a knowledgeable professional before making any decisions regarding a deed in lieu of foreclosure.

Some Other Deed in Lieu of Foreclosure State Templates

Deed in Lieu Vs Foreclosure - By signing this deed, homeowners can avoid having a foreclosure entry on their credit reports.

The New York Trailer Bill of Sale form is essential for any transaction involving the sale of a trailer, serving as a formal record that protects both the seller's and buyer's rights. For those looking to simplify this process, you can find a free template at newyorkform.com/free-trailer-bill-of-sale-template, which ensures that all necessary details are captured, making the registration or transfer of a trailer's title in New York straightforward.

Deed in Lieu of Foreclosure Pa - Each lender may have different requirements for processing the Deed in Lieu form.