Attorney-Verified Articles of Incorporation Document for New York State

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is not checking the availability of the chosen business name. Ensure it is unique and complies with New York's naming regulations.

-

Missing Registered Agent Information: Every corporation must designate a registered agent. Forgetting to include this information can delay the incorporation process.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. A vague or overly broad purpose can lead to confusion or rejection of the application.

-

Failure to Include Incorporator Details: The form requires the name and address of the incorporator. Omitting this information can result in a denial of the application.

-

Inadequate Number of Shares: When specifying the number of shares, ensure that the amount is appropriate for the corporation's needs. Too few shares can limit growth opportunities.

-

Ignoring Filing Fees: Each submission requires a fee. Failing to include the correct payment can lead to processing delays or rejection.

-

Not Following Submission Guidelines: The Articles of Incorporation must be submitted according to specific guidelines. Ignoring these can result in a return of the application.

-

Overlooking Additional Requirements: Depending on the nature of the business, additional permits or licenses may be needed. Neglecting these can lead to legal complications down the line.

Learn More on This Form

-

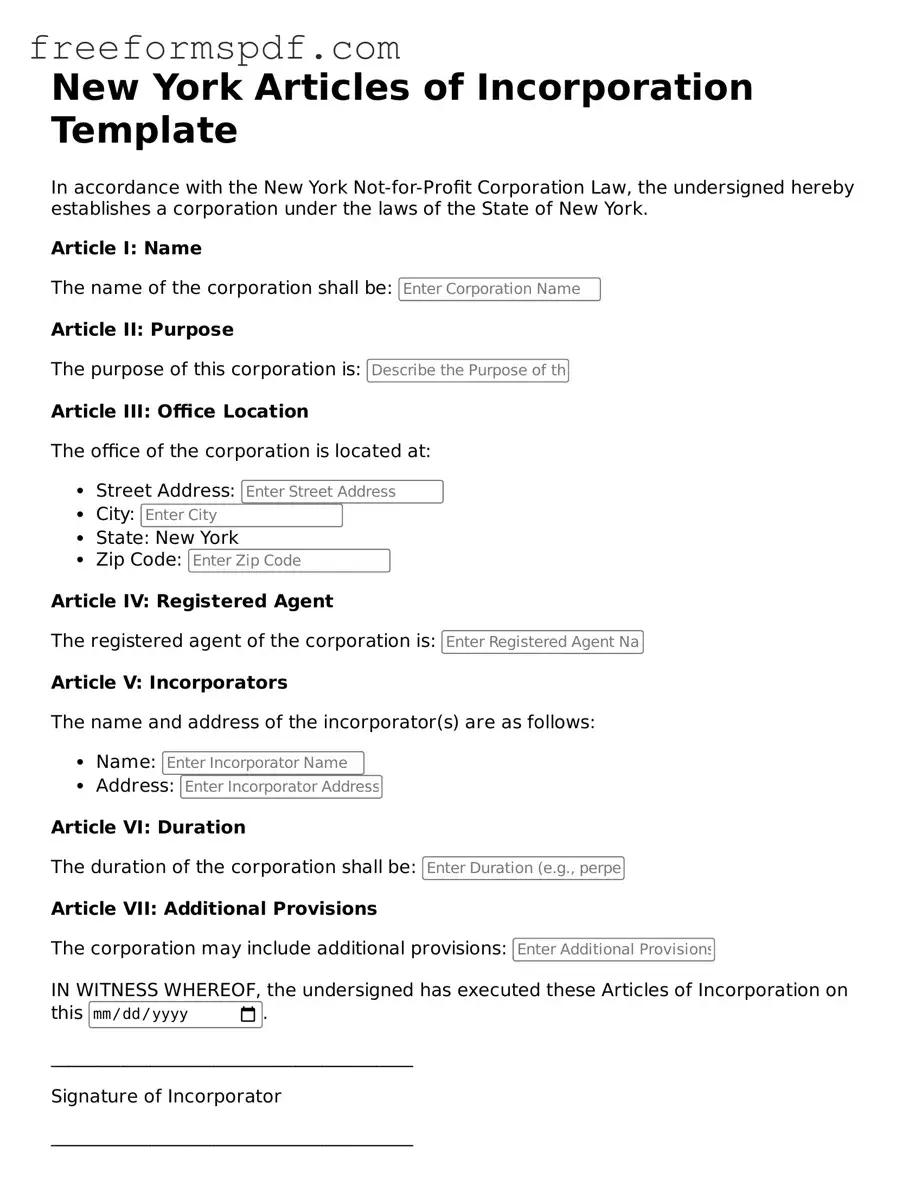

What are the Articles of Incorporation?

The Articles of Incorporation are legal documents that establish a corporation in New York. They outline essential information about the corporation, including its name, purpose, and the number of shares it is authorized to issue. This document is filed with the New York Department of State to formally create the corporation.

-

Who needs to file Articles of Incorporation?

Anyone looking to start a corporation in New York must file Articles of Incorporation. This includes individuals or groups wanting to form a for-profit or non-profit corporation. It’s an essential step for those who wish to limit personal liability and create a separate legal entity for their business activities.

-

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key details:

- The name of the corporation

- The purpose of the corporation

- The address of the corporation's principal office

- The name and address of the registered agent

- The number of shares the corporation is authorized to issue

Providing accurate and complete information is crucial for the approval of your filing.

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online, by mail, or in person at the New York Department of State. If filing online, visit the Department's website and follow the instructions. If you choose to file by mail, send your completed form along with the required filing fee to the appropriate address. Make sure to keep a copy of the submitted documents for your records.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New York varies depending on the type of corporation you are forming. Generally, the fee is around $125. It’s important to check the latest fee schedule on the New York Department of State’s website, as fees may change.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online filings are processed more quickly than those submitted by mail. You can expect a turnaround time of approximately 2-3 weeks for mailed submissions. If you need expedited service, there are options available for an additional fee.

-

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a Certificate of Incorporation from the New York Department of State. This certificate serves as official proof that your corporation is legally established. After receiving this certificate, you can begin conducting business under your corporation’s name and must comply with other ongoing requirements, such as obtaining necessary licenses and permits.

Misconceptions

Many people have misunderstandings about the New York Articles of Incorporation form. Here are some common misconceptions:

- Misconception 1: The Articles of Incorporation are the same as the business license.

- Misconception 2: Only large companies need to file Articles of Incorporation.

- Misconception 3: Filing Articles of Incorporation guarantees business success.

- Misconception 4: You can file Articles of Incorporation at any time without restrictions.

- Misconception 5: The Articles of Incorporation must be complex and lengthy.

- Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 7: You do not need legal help to file the Articles of Incorporation.

This is not true. The Articles of Incorporation establish your business as a legal entity, while a business license allows you to operate in a specific location.

In reality, any business that wants to be recognized as a corporation must file these documents, regardless of size.

Filing does not ensure success. It simply provides a legal structure. Success depends on many factors, including management and market conditions.

While you can file at any time, certain deadlines and requirements may apply depending on your business structure and state regulations.

This is a misconception. The form can be straightforward and concise, focusing on essential information about your business.

In fact, you can amend the Articles if needed. Changes might be necessary as your business grows or its structure changes.

While some people file on their own, seeking legal assistance can help avoid mistakes and ensure compliance with all requirements.

Some Other Articles of Incorporation State Templates

Washington Sos Business Search - Filing fees are typically associated with submitting the Articles of Incorporation.

Oregon Incorporation - Many businesses seek assistance with drafting their Articles of Incorporation.

Understanding the ADP Pay Stub form is essential for employees looking to grasp their earnings and deductions for each pay period. This document not only highlights compensation and taxes withheld but also serves as a valuable resource for managing finances. For those seeking efficient resources, templates like the Fast PDF Templates can be incredibly helpful in navigating this financial information.

Pennsylvania Corporation Commission - This document outlines the basic structure and purpose of the corporation.

Virginia Business License Cost - Clarifies tax responsibilities of the corporation.