Motor Vehicle Bill of Sale Document

Motor Vehicle Bill of Sale - Customized for Each State

Common mistakes

-

Failing to include the full names of both the buyer and the seller. It is essential that both parties' names are clearly printed to avoid any confusion.

-

Not providing the vehicle identification number (VIN). This unique identifier is crucial for accurately documenting the sale and ensuring the vehicle's history is traceable.

-

Omitting the sale price. The form must reflect the agreed-upon price to establish the transaction's legitimacy and for tax purposes.

-

Using incorrect dates. The date of sale should be accurate, as it marks the official transfer of ownership.

-

Not signing the document. Both the buyer and the seller must sign the bill of sale to validate the agreement and confirm the transaction.

-

Forgetting to include odometer readings. This information is important for both parties to understand the vehicle's mileage at the time of sale.

-

Leaving out any disclosures about the vehicle's condition. If the vehicle has any known issues, these should be disclosed to protect both parties.

-

Not keeping a copy of the completed form. Both the buyer and seller should retain a copy for their records to avoid future disputes.

Learn More on This Form

-

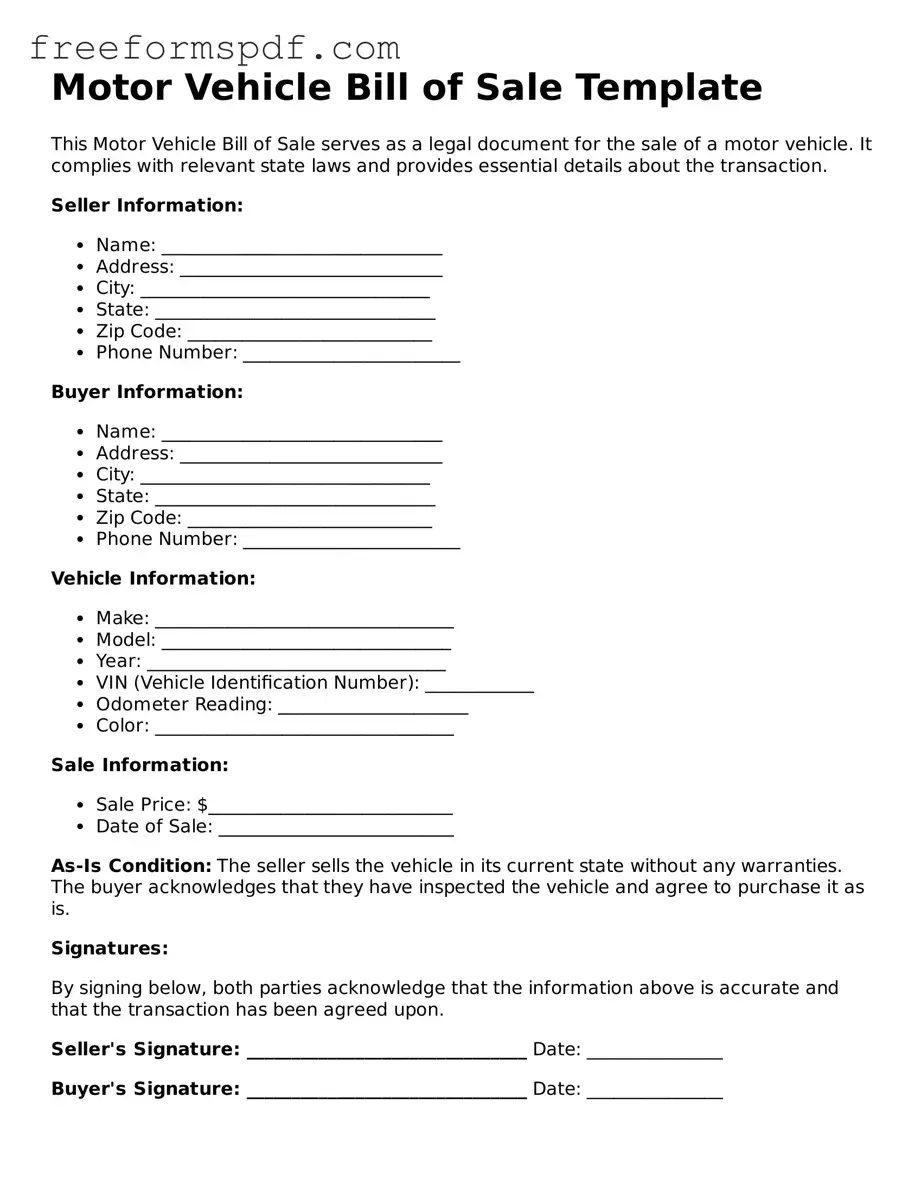

What is a Motor Vehicle Bill of Sale?

A Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. It serves as proof of the transaction and includes important details about the vehicle and the parties involved.

-

Why do I need a Bill of Sale?

The Bill of Sale is crucial for several reasons. It provides evidence that the vehicle has been sold and outlines the terms of the sale. This document can protect both the buyer and seller in case of disputes regarding the transaction. Additionally, many states require a Bill of Sale for vehicle registration purposes.

-

What information is included in a Motor Vehicle Bill of Sale?

A typical Bill of Sale includes the following details:

- The names and addresses of the buyer and seller

- The vehicle identification number (VIN)

- The make, model, and year of the vehicle

- The sale price

- The date of the sale

- Any warranties or guarantees

-

Do I need to have the Bill of Sale notarized?

Not all states require notarization of a Bill of Sale. However, having it notarized can add an extra layer of authenticity and may be beneficial if any disputes arise in the future. Always check your state’s requirements to be sure.

-

Is a Bill of Sale the same as a title transfer?

No, a Bill of Sale is not the same as a title transfer. While the Bill of Sale documents the sale, the title transfer is the official process that changes the ownership of the vehicle in the state's records. Both documents are often needed to complete the sale properly.

-

Can I use a generic Bill of Sale template?

Yes, many people use generic templates for a Bill of Sale. However, it’s important to ensure that the template complies with your state’s laws and includes all necessary information. Customizing it to reflect the specific details of your transaction is advisable.

-

What if the vehicle has a lien on it?

If there is a lien on the vehicle, it must be resolved before the sale can be completed. The seller should inform the buyer about the lien, and the lienholder may need to be involved in the sale process to ensure that the title can be transferred free of any claims.

-

How does the Bill of Sale affect taxes?

In many states, the Bill of Sale is used to determine the sales tax owed on the vehicle purchase. The buyer may need to present the Bill of Sale when registering the vehicle to calculate the appropriate taxes based on the sale price documented in the form.

-

What should I do after completing the Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, the seller should keep a copy for their records. The buyer should also keep a copy, as it may be required for vehicle registration. Additionally, both parties should ensure that the title is properly transferred according to their state’s regulations.

Misconceptions

The Motor Vehicle Bill of Sale form is an important document for anyone buying or selling a vehicle. However, several misconceptions exist about this form that can lead to confusion. Here are seven common misunderstandings:

-

It is only necessary for used vehicles.

Many people believe that a Bill of Sale is only required for used vehicles. In reality, it is beneficial for both new and used vehicles. This document serves as proof of the transaction regardless of the vehicle's age.

-

A Bill of Sale is the same as a title transfer.

While a Bill of Sale provides evidence of the sale, it does not replace the need for a title transfer. The title is the legal document that proves ownership and must be transferred separately.

-

It is not needed if the vehicle is a gift.

Some people think that a Bill of Sale is unnecessary if the vehicle is given as a gift. However, documenting the transaction with a Bill of Sale can help clarify ownership and avoid future disputes.

-

Only the seller needs to sign the form.

This is a common misconception. Both the buyer and the seller should sign the Bill of Sale to validate the transaction and confirm agreement on the terms.

-

The form does not need to be notarized.

In many states, notarization is not required for a Bill of Sale. However, having it notarized can provide an extra layer of security and help prevent fraud.

-

It can be handwritten or typed without any issues.

While a Bill of Sale can be handwritten or typed, it is crucial that it includes all necessary information. A poorly filled-out form may lead to complications during the registration process.

-

It is not important for tax purposes.

Some individuals underestimate the importance of a Bill of Sale for tax purposes. This document can serve as proof of the transaction price, which is essential when calculating sales tax.

Understanding these misconceptions can help ensure a smoother vehicle transaction process. Always consider consulting local regulations to ensure compliance with state-specific requirements.

Other Types of Motor Vehicle Bill of Sale Forms:

Printable Livestock Bill of Sale - The Bill of Sale serves to protect both buyer and seller in the transaction.

To assist you in creating a proper documentation process for your motorcycle sale, you can find a comprehensive template at Legal PDF Documents, which simplifies the preparation of the Arizona Motorcycle Bill of Sale form.

Land Bill of Sale - Using a Bill of Sale reduces potential liability for sellers regarding sold items.