Fill in a Valid Mortgage Statement Template

Common mistakes

-

Missing Essential Information: Failing to fill in key details like the account number, payment due date, or the amount due can lead to processing delays.

-

Incorrect Account Number: Entering the wrong account number can result in payments being applied to the wrong account, causing confusion and potential fees.

-

Ignoring Late Fee Details: Not paying attention to the late fee policy may lead to unexpected charges if payments are submitted after the due date.

-

Inaccurate Payment Amount: Submitting an incorrect payment amount can result in insufficient funds, leading to additional fees and complications.

-

Overlooking Partial Payment Policy: Not understanding that partial payments are held in a suspense account can cause frustration if the mortgage balance doesn’t decrease as expected.

-

Neglecting to Review Account History: Failing to check recent account history can prevent borrowers from recognizing patterns in their payments and understanding their current status.

Learn More on This Form

-

What is a Mortgage Statement?

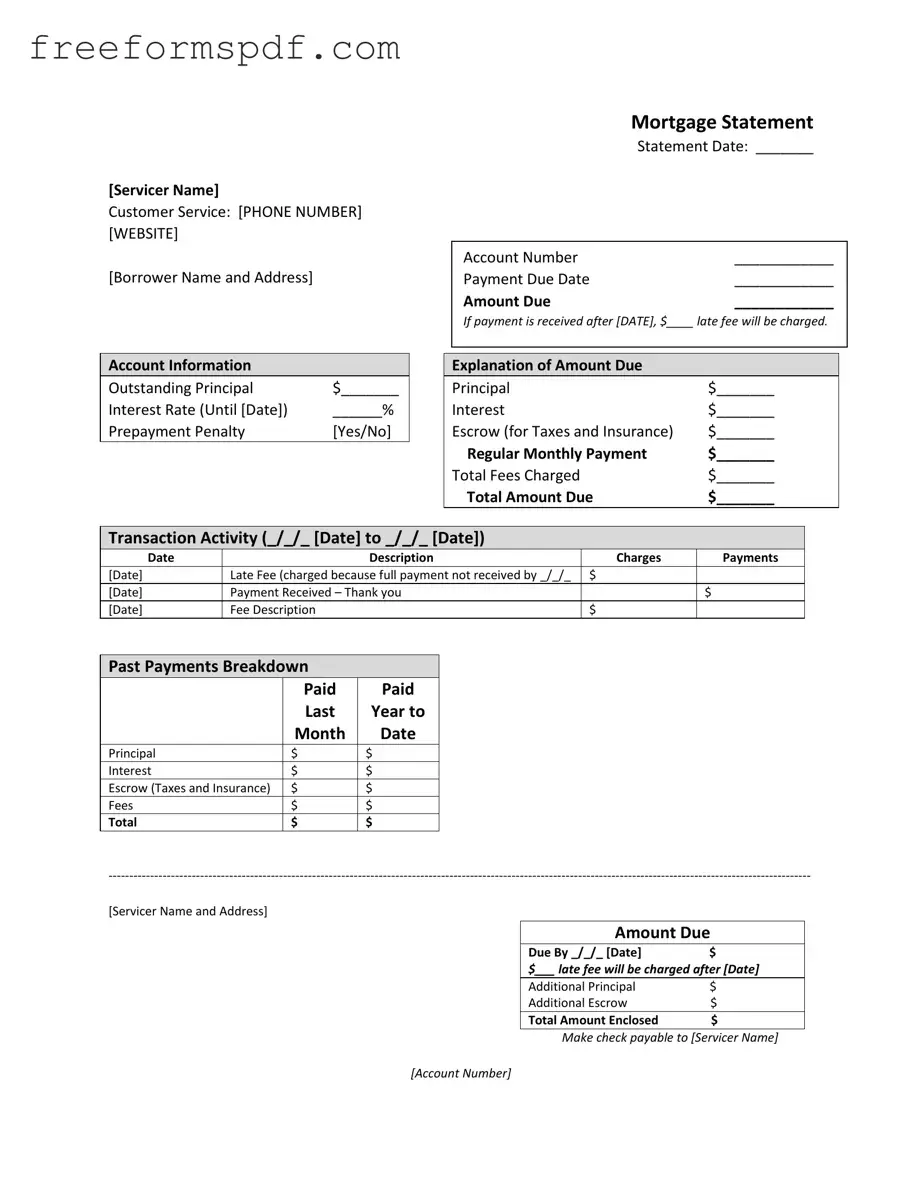

A mortgage statement is a document provided by your mortgage servicer that outlines the details of your mortgage account. It includes important information such as your outstanding principal balance, interest rate, payment due date, and any fees that may apply. This statement helps you keep track of your mortgage obligations and payments.

-

How do I read my Mortgage Statement?

Your mortgage statement is organized into sections. The top section typically includes your account information, such as the servicer's name, your account number, and the payment due date. Below that, you will find a breakdown of the amount due, including principal, interest, and any escrow for taxes and insurance. It may also list transaction activity, showing recent payments and any fees incurred.

-

What should I do if I see an error on my Mortgage Statement?

If you notice an error, it is essential to contact your mortgage servicer immediately. Use the customer service number provided on the statement to report the issue. Be prepared to provide details about the error and any supporting documentation you may have. Your servicer is obligated to investigate and correct any inaccuracies.

-

What happens if I miss a payment?

If you miss a payment, your mortgage statement will indicate that you are delinquent. This may result in late fees being charged to your account. If payments remain unpaid, the situation could escalate, leading to potential foreclosure. It is crucial to address missed payments promptly to avoid further complications.

-

What is a prepayment penalty?

A prepayment penalty is a fee that some lenders charge if you pay off your mortgage early. This penalty is intended to compensate the lender for the interest they would have earned had you continued making regular payments. Your mortgage statement will indicate whether a prepayment penalty applies to your loan.

-

What is an escrow account?

An escrow account is a special account set up by your mortgage servicer to hold funds for property taxes and homeowners insurance. Each month, a portion of your mortgage payment is deposited into this account. When taxes and insurance premiums are due, the servicer uses the funds from the escrow account to make payments on your behalf.

-

How can I make a payment?

You can make a payment by following the instructions provided on your mortgage statement. Typically, you can pay online through the servicer's website, by mail using a check, or over the phone. Ensure that you include your account number and any other required information to ensure proper crediting of your payment.

-

What should I do if I am experiencing financial difficulty?

If you are facing financial challenges, it is important to reach out to your mortgage servicer as soon as possible. They may offer options such as loan modification or forbearance. Additionally, your mortgage statement may provide resources for mortgage counseling or assistance programs to help you navigate your situation.

-

What are partial payments?

Partial payments are amounts less than your total monthly payment. If you make a partial payment, it will not be applied to your mortgage balance but will instead be held in a separate suspense account. Once you pay the remaining balance, the funds will then be applied to your mortgage. It is advisable to pay the full amount to avoid complications.

Misconceptions

Understanding the Mortgage Statement form can be challenging. Here are five common misconceptions that may lead to confusion:

- All payments are applied immediately. Many believe that once a payment is made, it is applied directly to the mortgage balance. In reality, partial payments are held in a separate suspense account until the full amount is received.

- The late fee is automatically applied. Some borrowers think that a late fee will be charged regardless of the circumstances. However, the fee is only applied if the payment is not received by the specified due date.

- The statement is only for record-keeping. Many view the mortgage statement as a mere summary of payments. In fact, it serves as a crucial tool for tracking payment history, outstanding principal, and any fees incurred.

- Escrow payments are optional. Some homeowners believe that escrow payments for taxes and insurance are not mandatory. However, if your mortgage includes an escrow account, these payments are required to ensure that taxes and insurance are paid on time.

- Delinquency notices are just reminders. It is a misconception that delinquency notices are simply friendly reminders. They indicate serious issues, such as potential fees and the risk of foreclosure if the mortgage is not brought current.

Being informed about these misconceptions can help homeowners better manage their mortgage obligations and avoid potential pitfalls.

Browse More Forms

Form Dr-835 - Keep a copy of the completed form for your records.

When it comes to documenting the sale of a motorcycle, a thorough understanding of the essential Arizona Motorcycle Bill of Sale is key for both buyers and sellers. This form not only acts as a record of the transaction but also ensures that the ownership transfer process is conducted legally and transparently. For more information on this, check out our guide on the Arizona Motorcycle Bill of Sale essentials.

Letter Authorizing Child to Travel - This consent form can prevent potential legal issues while traveling.