Fill in a Valid Membership Ledger Template

Common mistakes

-

Inaccurate Company Name: Failing to enter the correct name of the company can lead to confusion and misallocation of membership interests.

-

Missing Dates: Omitting the date of issuance or transfer can create discrepancies in record-keeping and affect the validity of the transactions.

-

Incorrect Membership Interest Amount: Entering the wrong amount paid for the membership interest can result in financial inaccuracies and disputes.

-

Improper Certification Numbers: Not including the correct certificate numbers or leaving them blank can complicate the tracking of issued interests.

-

Incomplete Transfer Information: Failing to provide details about the transferor and transferee can hinder the clarity of ownership changes.

-

Neglecting to Surrender Certificates: Not indicating whether previous certificates were surrendered can lead to duplicate interests being issued.

-

Inaccurate Balance Reporting: Reporting the wrong number of membership interests held can misrepresent an individual's stake in the company.

Learn More on This Form

-

What is the purpose of the Membership Ledger form?

The Membership Ledger form is used to track the issuance and transfer of membership interests or units in a company. It provides a clear record of who owns what and helps maintain accurate ownership details. This is crucial for legal and financial reasons, ensuring that all transactions are documented and transparent.

-

How do I fill out the Membership Ledger form?

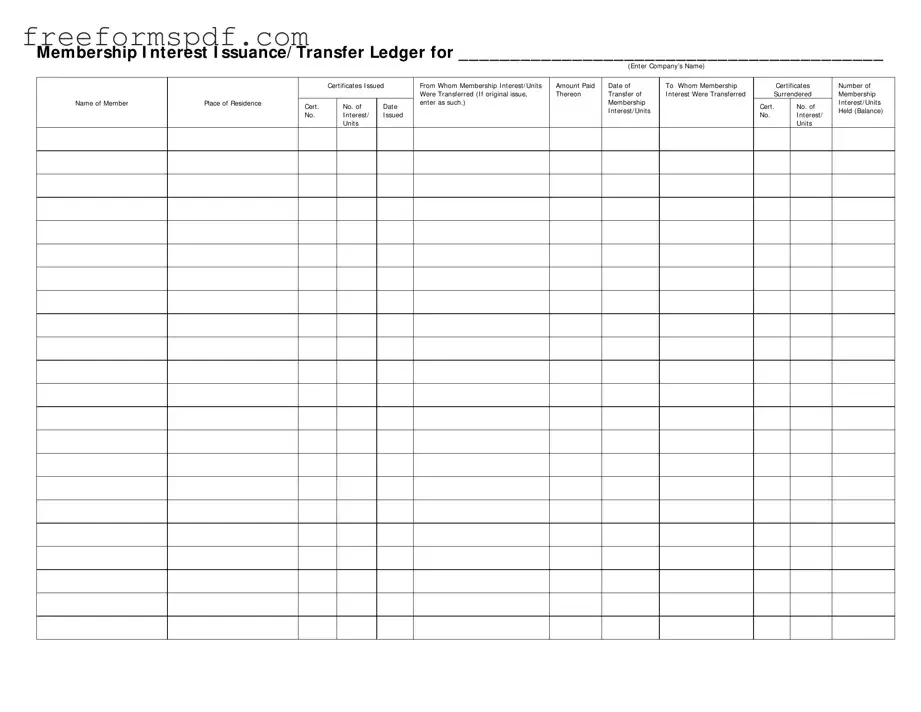

To complete the form, start by entering the company's name at the top. Then, for each transaction, fill in the following details:

- Certificates Issued: Indicate from whom the membership interest or units were issued.

- Amount Paid: Record the amount paid for the membership interest or units.

- Date of Transfer: Enter the date when the transfer occurred.

- To Whom Transferred: List the name of the member who received the transferred interest.

- Place of Residence: Include the address of the member.

- Certificate Numbers: Provide the certificate numbers associated with the membership interests.

- Number of Membership Interests Held: Finally, note the balance of membership interests or units held by the member after the transaction.

-

Why is it important to keep the Membership Ledger up to date?

Keeping the Membership Ledger up to date is essential for several reasons. First, it ensures that all ownership records are accurate, which can prevent disputes among members. Second, it helps in compliance with legal requirements and can be critical during audits. Lastly, an updated ledger provides clarity on the current ownership structure, which is beneficial for decision-making within the company.

-

What happens if I make a mistake on the Membership Ledger form?

If you notice a mistake after filling out the form, it is important to correct it promptly. Depending on the error, you may need to strike through the incorrect information and write the correct details next to it. Always initial the change to indicate that it was made intentionally. For significant errors, consider creating a new entry to ensure clarity and maintain an accurate record.

-

Who should have access to the Membership Ledger?

Access to the Membership Ledger should be limited to authorized personnel only. This typically includes company executives, legal advisors, and accounting staff. Keeping the ledger secure is vital to protect sensitive ownership information. Regular audits can help ensure that only those who need access to the ledger can view it.

Misconceptions

Misconceptions about the Membership Ledger form can lead to confusion and errors. Here are nine common misunderstandings:

- The form is only for new members. This is incorrect. The Membership Ledger is used for tracking all membership interests, including transfers and issuances, regardless of when they occur.

- Only the company can fill out this form. Not true. While the company is responsible for maintaining the ledger, members can also provide necessary information for transfers.

- All fields are optional. This is a misconception. Certain fields, such as the name of the member and the amount paid, are mandatory for accurate record-keeping.

- Transfers can be recorded at any time without documentation. This is misleading. Proper documentation is essential to validate any transfer of membership interest.

- The ledger is only for tracking ownership. This is an oversimplification. It also tracks the history of membership interests, including amounts paid and dates of transfer.

- Once filled out, the form cannot be amended. This is false. Corrections can be made, but they must be documented properly to ensure transparency.

- Membership interests can be transferred verbally. This is incorrect. All transfers must be documented in writing and reflected in the ledger.

- The ledger is only important during audits. This is a misconception. Maintaining an accurate ledger is crucial for ongoing management and compliance.

- Only the latest information matters. This is misleading. Historical data in the ledger is vital for understanding the full context of membership interests.

Understanding these points can help ensure that the Membership Ledger is used correctly and effectively.

Browse More Forms

Annual Physical Exam Form - Specify strengths and weaknesses in the physical examination section.

In order to streamline the rental process and adhere to regulations, landlords and property managers can utilize resources such as the NY Templates, which offer helpful templates for completing the Nyc Apartment Registration Form effectively.

Class a Cdl Pre Trip Inspection Pictures - Ensure child safety locks are engaged if children are traveling.

Building Proposal - It assists in establishing timelines for project milestones and completion.