Fill in a Valid Louisiana act of donation Template

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Missing names, addresses, or identification numbers can lead to delays or complications in the donation process.

-

Incorrect Property Description: Accurately describing the property being donated is crucial. Errors in the property description can result in legal disputes or misunderstandings about what is being transferred.

-

Failure to Sign: A common oversight is neglecting to sign the form. Without a signature, the act of donation is not valid, and the intended transfer of property will not take place.

-

Not Notarizing the Document: Some individuals overlook the requirement for notarization. A notary public's signature is often necessary to authenticate the document, ensuring it is legally binding.

-

Ignoring Witness Requirements: Depending on the type of donation, witnesses may be required. Failing to have the appropriate number of witnesses can invalidate the donation.

-

Not Reviewing State-Specific Laws: Each state has its own regulations regarding property donations. Ignoring Louisiana's specific requirements can lead to errors that affect the donation's legality.

-

Assuming the Process is Complete: After submitting the form, some individuals believe the process is finished. In reality, follow-up actions may be necessary to ensure the donation is properly recorded and recognized.

Learn More on This Form

-

What is the Louisiana Act of Donation Form?

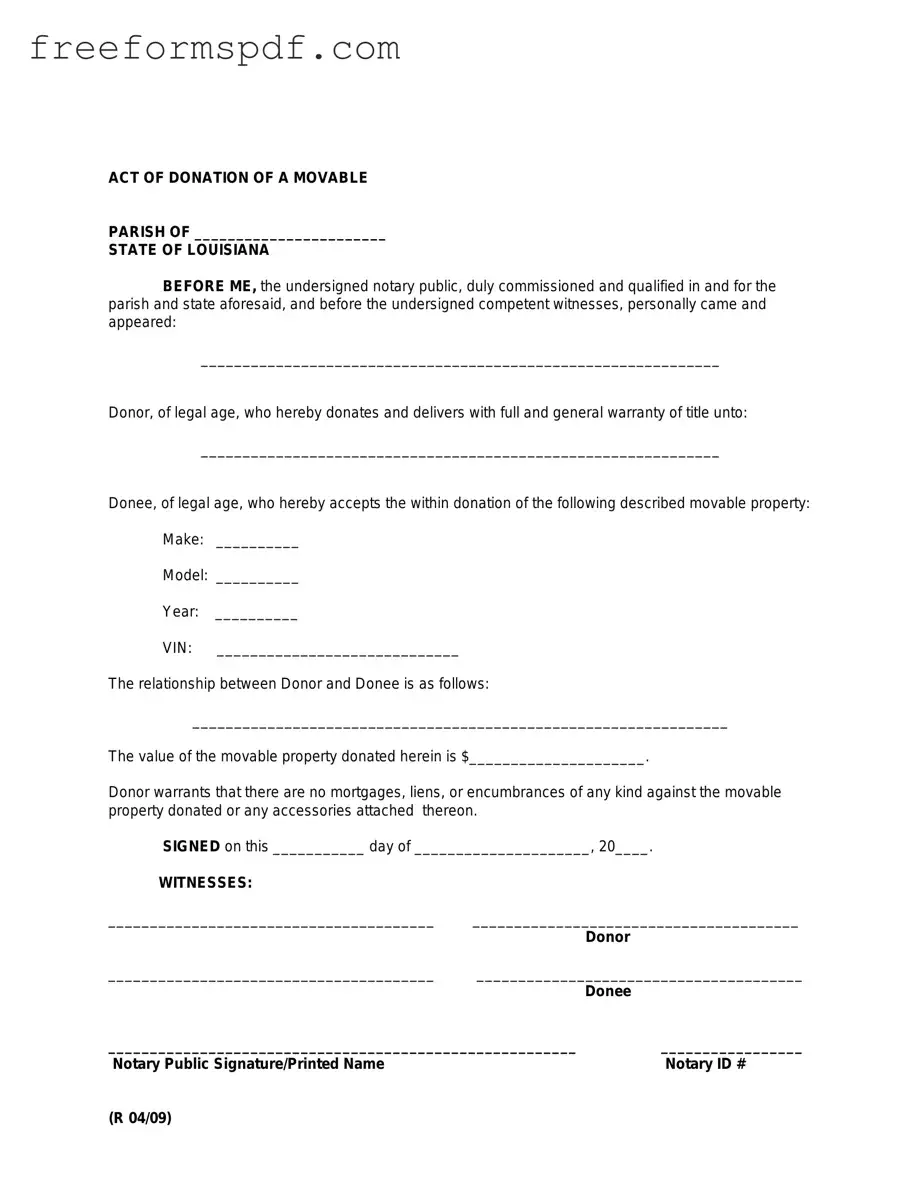

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is commonly used for gifts of real estate, personal property, or other assets. It is important to note that the act of donation must be made voluntarily and should be documented properly to ensure that the transfer is legally binding.

-

Who can use the Act of Donation Form?

Any individual who wishes to donate property can use the Act of Donation Form. This includes parents donating property to their children, friends giving gifts to each other, or any other situation where one party wishes to give property to another. However, both the donor (the person giving the property) and the donee (the person receiving the property) must be legally competent to enter into the agreement.

-

Are there any legal requirements for completing the form?

Yes, there are specific legal requirements that must be followed when completing the Louisiana Act of Donation Form. The form must be in writing and signed by the donor. In certain cases, it may also require notarization or witnesses to ensure its validity. Additionally, if the donation involves real estate, it must be recorded in the parish where the property is located to provide public notice of the transfer.

-

What are the tax implications of making a donation?

Donating property can have tax implications for both the donor and the donee. The donor may be eligible for a gift tax exclusion, which allows a certain amount to be gifted tax-free each year. The donee may also need to consider how the property will be valued for tax purposes. It is advisable to consult with a tax professional to understand the specific implications of a donation and to ensure compliance with tax laws.

Misconceptions

The Louisiana act of donation form is an important legal document, yet many misconceptions surround it. Understanding these myths can help individuals navigate the donation process more effectively. Here are ten common misconceptions:

- The act of donation is only for large gifts. Many believe that only significant assets can be donated. In reality, even smaller gifts can be formalized through this act.

- Donations made through this act are not legally binding. Some think that the act of donation is merely a suggestion. However, once properly executed, it is a legally binding document.

- Only real estate can be donated. While real estate is commonly associated with this act, it can also apply to personal property, such as vehicles or valuable collections.

- The donor must be present during the signing. This misconception suggests that the donor must be physically present. In some cases, it is possible to sign the document in advance or have a representative act on their behalf.

- The act of donation requires a notary public. While having a notary is recommended for added validity, it is not always a legal requirement for all types of donations.

- Donations can be revoked easily. Many think that once a donation is made, it can be easily undone. However, revoking a donation can be complicated and may require legal action.

- The recipient must accept the donation immediately. Some believe that the recipient must take possession of the donated item right away. Acceptance can occur at a later date, depending on the circumstances.

- All donations are subject to taxes. While some donations may incur tax implications, many gifts, especially between family members, can be exempt from taxes.

- The act of donation is the same as a will. This misconception arises from the idea that both documents serve similar purposes. However, an act of donation transfers ownership immediately, while a will takes effect only after death.

- Once signed, the act cannot be altered. Many assume that changes are impossible after signing. In fact, amendments can be made, but they must follow specific legal procedures.

By dispelling these misconceptions, individuals can better understand the implications and processes surrounding the Louisiana act of donation form, ensuring that their intentions are clearly communicated and legally upheld.

Browse More Forms

Dnd 5e Form Fillable Character Sheet - Constitution: A score indicating health and stamina, affecting overall resilience against damage.

To facilitate the homeschooling process in Arizona, parents should familiarize themselves with the requirements and format of the comprehensive Homeschool Letter of Intent document, which serves as the formal notification to the state of their educational choices.

How to File a Mechanics Lien in California - Understanding statutory requirements can enhance the claim's strength.