Loan Agreement Document

Loan Agreement Document Subtypes

Common mistakes

Filling out a Loan Agreement form can be a straightforward process, but many people make common mistakes that can lead to complications later on. Here are nine mistakes to avoid:

-

Not reading the terms carefully.

Many individuals rush through the terms and conditions, missing important details that could affect their financial obligations.

-

Providing inaccurate personal information.

Errors in names, addresses, or social security numbers can lead to delays in processing the loan or even denial.

-

Failing to disclose existing debts.

Not mentioning other loans or financial obligations can give lenders a distorted view of your financial situation.

-

Ignoring the interest rate.

Some borrowers overlook the significance of the interest rate, which can greatly impact the total cost of the loan.

-

Not understanding the repayment schedule.

Confusion about when payments are due can lead to missed payments and penalties.

-

Overlooking fees and charges.

Many loan agreements include various fees that may not be immediately obvious. These can add up and affect the overall cost.

-

Neglecting to ask questions.

Borrowers often hesitate to seek clarification on terms they do not understand, which can lead to misunderstandings.

-

Not keeping copies of the agreement.

Failing to retain a copy of the signed loan agreement can create difficulties if disputes arise in the future.

-

Signing without reviewing.

Some individuals sign the agreement without taking the time to review it thoroughly, leading to potential regrets later.

By being aware of these common mistakes, individuals can navigate the Loan Agreement process more effectively and protect their financial interests.

Learn More on This Form

-

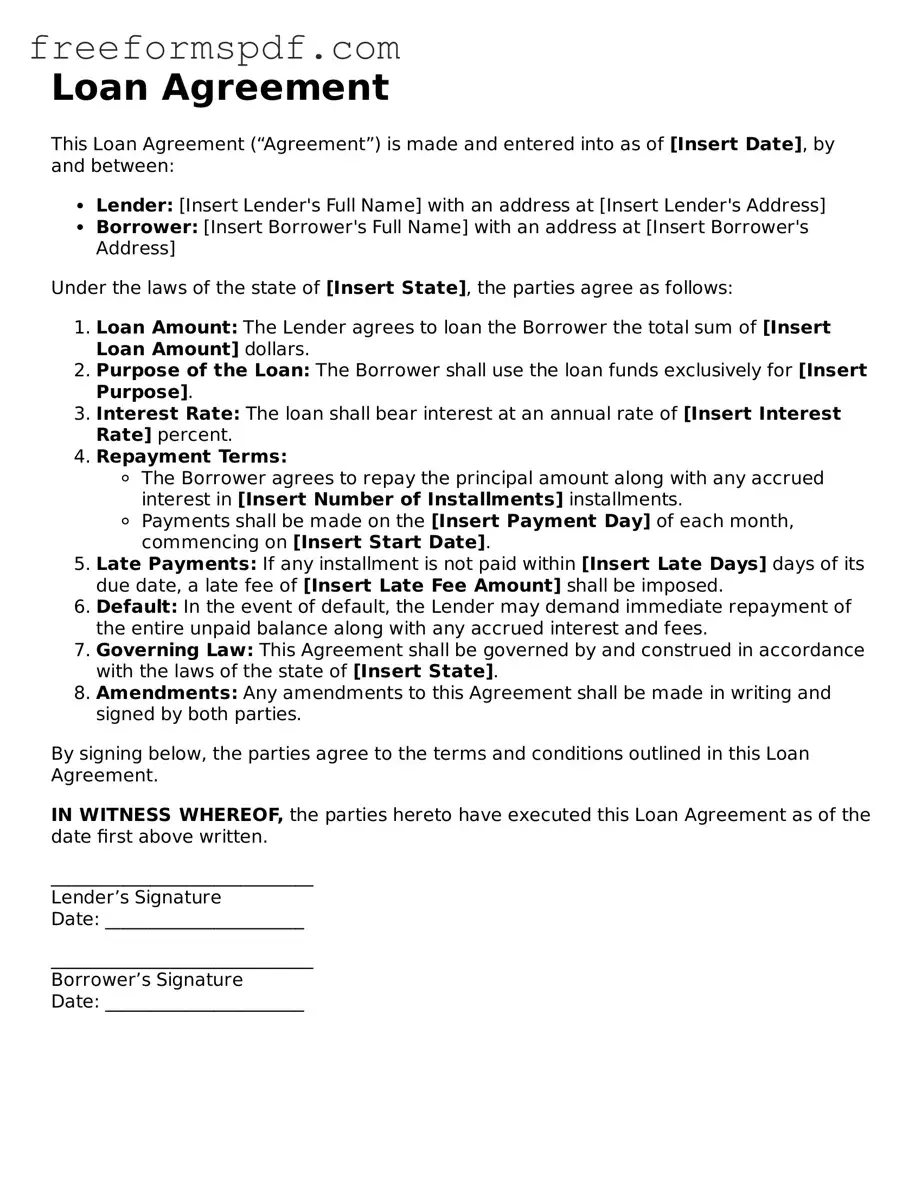

What is a Loan Agreement?

A Loan Agreement is a legal document that outlines the terms and conditions under which one party lends money to another. This agreement specifies the amount borrowed, interest rates, repayment schedule, and any other obligations of both the lender and borrower.

-

Who should use a Loan Agreement?

Individuals or entities that are borrowing or lending money should use a Loan Agreement. This includes personal loans between friends or family, as well as business loans between companies or financial institutions.

-

What information is typically included in a Loan Agreement?

- The names and addresses of the lender and borrower

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Consequences of late payments or defaults

- Any collateral securing the loan

-

Is a Loan Agreement legally binding?

Yes, a Loan Agreement is legally binding as long as it meets the necessary legal requirements. This includes having clear terms, being signed by both parties, and not violating any laws. If one party fails to uphold their end of the agreement, the other party may have legal recourse.

-

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may have the right to take legal action to recover the owed amount. This can include initiating collection processes or pursuing a lawsuit. The specific consequences will depend on the terms outlined in the Loan Agreement.

-

Do I need a lawyer to create a Loan Agreement?

While it is not strictly necessary to have a lawyer draft a Loan Agreement, consulting one can provide valuable guidance. A lawyer can ensure that the agreement complies with local laws and adequately protects the interests of both parties.

-

How can I ensure my Loan Agreement is enforceable?

To ensure enforceability, the Loan Agreement should be clear, detailed, and signed by both parties. It is also important to follow any applicable laws regarding lending practices. Keeping records of all communications and payments related to the loan can further support enforceability.

Misconceptions

Loan agreements are important documents that outline the terms of borrowing money. However, several misconceptions can lead to confusion. Here are six common misunderstandings about loan agreements:

-

All loan agreements are the same.

This is not true. Loan agreements can vary significantly based on the lender, the type of loan, and the borrower's financial situation. Each agreement should be reviewed carefully to understand its specific terms.

-

You don’t need to read the entire agreement.

Many people believe they can skip reading the fine print. However, it’s crucial to read the entire document to understand all terms, conditions, and obligations.

-

Signing a loan agreement is just a formality.

This misconception can be dangerous. Signing a loan agreement is a legal commitment. It’s essential to understand what you are agreeing to before signing.

-

Loan agreements are only for large amounts of money.

Some think loan agreements apply only to significant loans like mortgages or car loans. In reality, any loan, regardless of size, can have an associated agreement.

-

Once signed, you cannot negotiate the terms.

This is a common myth. While it may be challenging, borrowers can often negotiate terms before signing. Open communication with the lender can lead to better conditions.

-

Loan agreements are only necessary for personal loans.

Many believe that only personal loans require a formal agreement. In fact, business loans, student loans, and even informal loans among friends should ideally have a written agreement.

Understanding these misconceptions can help borrowers navigate their loan agreements more effectively and make informed decisions.

Popular Forms:

Progressive Logo - This document should not be altered in any way.

The NYCERS F266 form is a vital application for members in Tier 3 and Tier 4 seeking to claim their Vested Retirement Benefit after leaving City service. For those navigating the process, resources such as NY Templates can provide helpful guidance in completing the form accurately, ensuring that benefits are received without delay and that a beneficiary is designated for any death benefits.

Citibank Atm Deposit - This form is essential for convenient banking through direct deposit.

How to File a Mechanics Lien in California - This form aids in recovering costs from property owners who default on payments.