LLC Share Purchase Agreement Document

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details in the agreement. Missing names, addresses, or specific terms can lead to misunderstandings later.

-

Incorrect Valuation: Buyers and sellers often miscalculate the value of shares. This can result in disputes over the price and may affect the legitimacy of the agreement.

-

Omitting Contingencies: Some people neglect to include important contingencies, such as financing or regulatory approvals. This oversight can create complications if conditions change.

-

Failure to Sign: It may seem obvious, but forgetting to sign the agreement is a common mistake. Without signatures, the document lacks legal enforceability.

-

Not Consulting Professionals: Many individuals attempt to navigate the process without legal or financial advice. This can lead to errors that may have been easily avoided with expert guidance.

Learn More on This Form

-

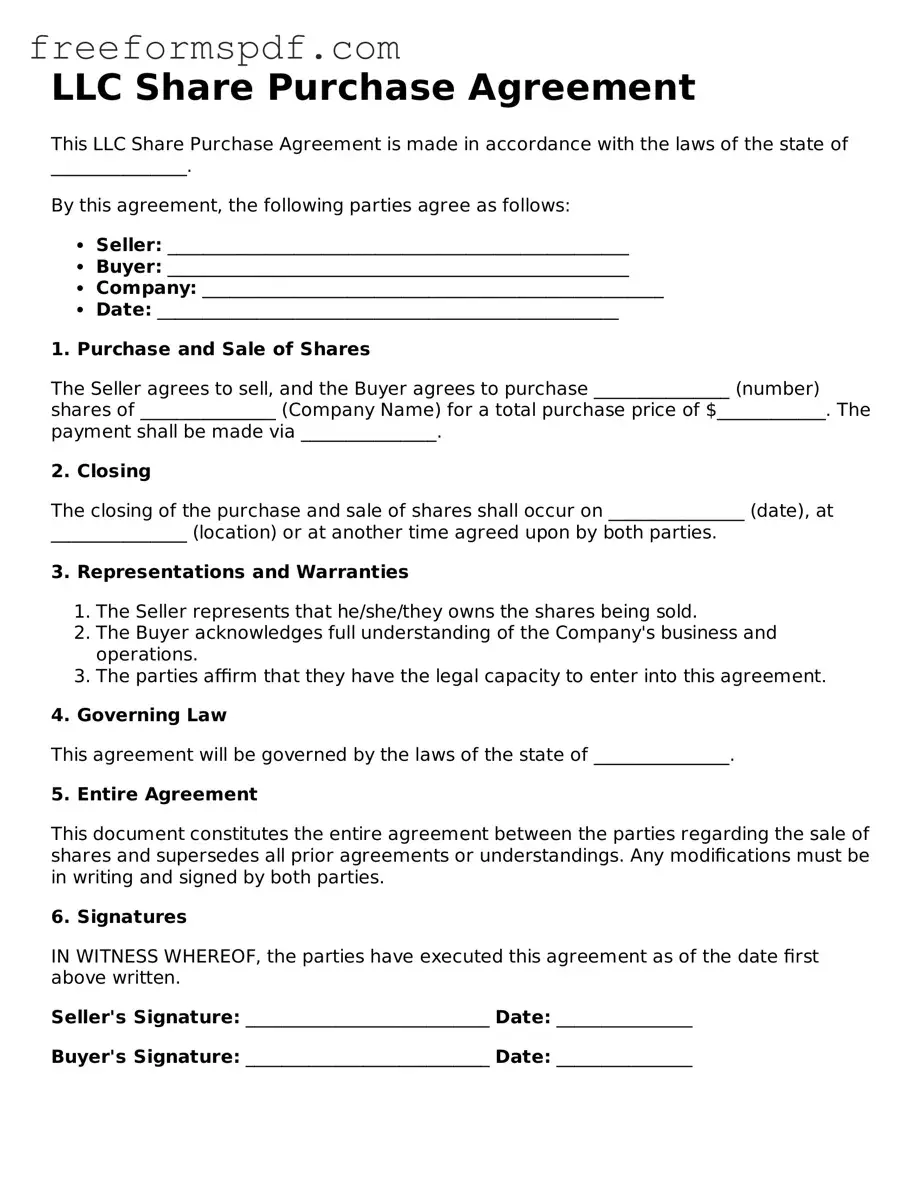

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which an individual or entity agrees to buy shares in a Limited Liability Company (LLC). This agreement serves to protect both the buyer and the seller by clearly defining the rights and obligations of each party involved in the transaction.

-

Why is an LLC Share Purchase Agreement important?

This agreement is crucial because it establishes a clear understanding of the transaction. It details the purchase price, payment terms, and any representations or warranties made by the seller. By having a written agreement, parties can avoid misunderstandings and disputes that may arise during or after the sale.

-

What key elements should be included in the agreement?

- Identification of the parties involved

- Description of the shares being sold

- Purchase price and payment terms

- Representations and warranties by the seller

- Conditions for closing the sale

- Indemnification provisions

Including these elements ensures that both parties have a comprehensive understanding of the transaction and its implications.

-

How does the process of completing an LLC Share Purchase Agreement work?

The process typically begins with negotiations between the buyer and the seller. Once both parties agree on the terms, the agreement is drafted. After reviewing the document for accuracy and completeness, both parties will sign it. Finally, the transfer of shares is executed according to the terms laid out in the agreement.

-

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but such changes must be agreed upon by both parties. It is advisable to document any modifications in writing to ensure clarity and avoid future disputes. Amendments can include changes to payment terms, timelines, or other relevant details.

Misconceptions

Many people have misunderstandings about the LLC Share Purchase Agreement. Here are some common misconceptions:

- All LLCs require a Share Purchase Agreement. Not every LLC needs this agreement. It primarily applies when ownership interests are being sold or transferred.

- Only large LLCs use Share Purchase Agreements. Small and medium-sized LLCs can also benefit from having this agreement in place, especially during ownership changes.

- A Share Purchase Agreement is the same as an Operating Agreement. These are different documents. The Operating Agreement outlines the management structure, while the Share Purchase Agreement focuses on the sale of ownership interests.

- Once signed, a Share Purchase Agreement cannot be changed. Parties can negotiate changes to the agreement as long as all involved agree to the modifications.

- All terms in the agreement are non-negotiable. Many terms can be negotiated, including price, payment structure, and warranties.

- A Share Purchase Agreement protects only the seller. This agreement offers protections for both the buyer and the seller, ensuring clear terms for the transaction.

- Legal advice is unnecessary for a Share Purchase Agreement. Consulting a legal professional is wise. They can help ensure that the agreement meets all legal requirements and protects your interests.

- Once the agreement is signed, the buyer automatically takes control. Control transfer may depend on additional steps, such as filing documents with the state or changing management roles.

- A Share Purchase Agreement is only about money. While financial terms are crucial, the agreement also covers responsibilities, rights, and other important aspects of the ownership transition.

Popular Forms:

Osha 301 Requirements - Facilitates the assessment of potential workers' compensation benefits.

The Nyc Apartment Registration Form plays a vital role in streamlining the rental process for landlords and property managers in New York City, and resources like NY Templates can provide useful guidance for ensuring that all registration requirements are met efficiently.

Online Promissory Note - This document can help buyers understand their financial commitments associated with the car.

Ca Release of Liability - Both parties will benefit from the clear delineation of liability provided by the form.