Letter of Intent to Purchase Business Document

Common mistakes

-

Failure to Clearly Define Terms: Individuals often neglect to specify critical terms such as the purchase price, payment structure, and any contingencies. Without clarity, misunderstandings can arise later in negotiations.

-

Inadequate Due Diligence: Some buyers rush through the due diligence process, overlooking essential details about the business's financial health, liabilities, or operational issues. This oversight can lead to costly surprises post-purchase.

-

Ignoring Confidentiality: Many individuals forget to include a confidentiality clause. This omission can expose sensitive business information to competitors or the public, undermining the seller's position.

-

Vague Language: Using ambiguous terms can lead to confusion. For example, phrases like "reasonable efforts" or "as soon as possible" lack specificity and can create disputes over obligations.

-

Neglecting to Outline Conditions: Buyers sometimes fail to outline conditions that must be met before the sale is finalized. These conditions could include financing approval or satisfactory inspection results.

-

Omitting Important Dates: Individuals may forget to include key dates, such as the timeline for due diligence or the closing date. Clear timelines help manage expectations and ensure accountability.

-

Not Seeking Legal Advice: Some buyers attempt to navigate the process without professional guidance. This decision can lead to significant legal pitfalls that could have been avoided with expert input.

-

Failing to Address Non-Compete Agreements: Buyers often overlook the importance of including non-compete clauses in the letter. Such clauses can protect the buyer from competition from the seller after the sale.

-

Overlooking the Importance of Signatures: Lastly, individuals sometimes forget to ensure that all necessary parties sign the document. A missing signature can render the letter unenforceable, jeopardizing the entire transaction.

Learn More on This Form

-

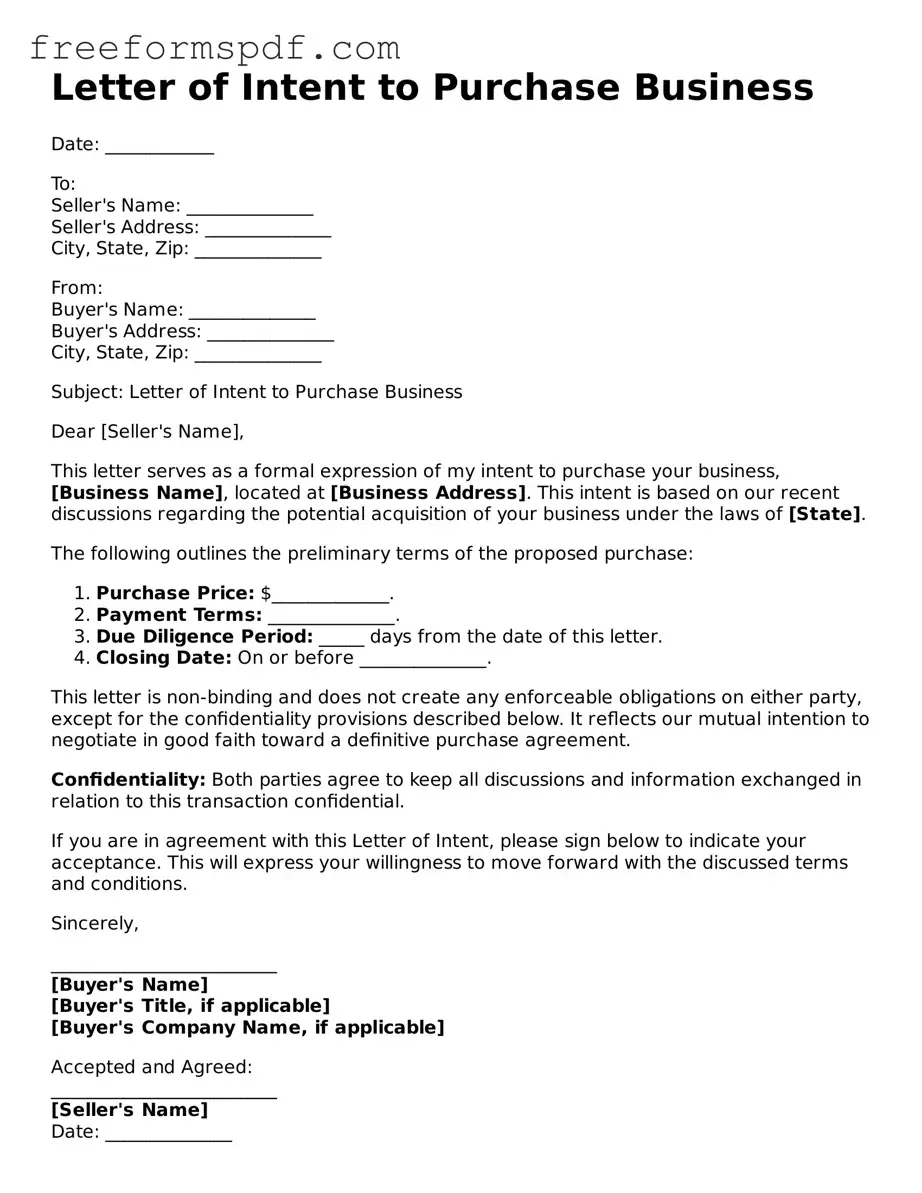

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary agreement between a buyer and seller regarding the sale of a business. It serves as a starting point for negotiations and sets the framework for the final purchase agreement. The LOI typically includes key terms such as the purchase price, payment structure, and any contingencies that must be met before the sale is finalized.

-

Why is a Letter of Intent important?

The LOI is important because it helps both parties clarify their intentions and expectations before entering into a formal contract. It can also protect the interests of both the buyer and seller by establishing a mutual understanding of the deal's terms. By doing so, it reduces the likelihood of misunderstandings or disputes later in the process.

-

What should be included in a Letter of Intent?

A comprehensive LOI should include:

- The names and contact information of both parties.

- A description of the business being sold.

- The proposed purchase price and payment terms.

- Any conditions that need to be met before the sale can proceed.

- A timeline for due diligence and closing the deal.

- Confidentiality agreements, if necessary.

-

Is a Letter of Intent legally binding?

The LOI is generally not a legally binding document, but it can include binding provisions, such as confidentiality agreements or exclusivity clauses. It is important to specify which parts of the LOI are binding and which are not. This clarity helps both parties understand their obligations as they move forward in the negotiation process.

-

How long does it take to prepare a Letter of Intent?

The time it takes to prepare a Letter of Intent can vary depending on the complexity of the deal and the responsiveness of both parties. In many cases, it can be drafted in a few days, especially if both parties have already discussed the key terms. However, if there are many details to negotiate, it may take longer.

-

Can a Letter of Intent be modified?

Yes, a Letter of Intent can be modified. If both parties agree to changes, they can amend the LOI to reflect new terms. It is important to document any modifications in writing to avoid confusion later. Clear communication is key to ensuring both parties are on the same page.

-

What happens after a Letter of Intent is signed?

Once the LOI is signed, both parties typically move into the due diligence phase. This involves the buyer investigating the business's financials, operations, and legal standing. If everything checks out, the parties will then negotiate and draft a formal purchase agreement, which is a legally binding contract that finalizes the sale.

-

Should I seek legal advice when drafting a Letter of Intent?

It is advisable to seek legal advice when drafting a Letter of Intent. An attorney can help ensure that the document accurately reflects your intentions and protects your interests. They can also provide guidance on any legal implications of the terms included in the LOI, making the process smoother for both parties.

Misconceptions

When considering a Letter of Intent (LOI) to Purchase a Business, many people hold misconceptions that can lead to confusion or missteps in the process. Here are eight common misconceptions explained:

- It is a legally binding contract. Many believe that an LOI is a legally binding agreement. In reality, while it outlines intentions, it is often not legally enforceable unless specified otherwise.

- It guarantees the sale will happen. An LOI expresses interest but does not guarantee that the sale will be completed. Factors such as due diligence and negotiations can affect the outcome.

- It must be complex and lengthy. Some think that an LOI needs to be detailed and complicated. However, a simple and clear LOI can effectively communicate intentions without unnecessary complexity.

- Only buyers need to sign it. There is a misconception that only the buyer needs to sign the LOI. In many cases, both parties should sign to acknowledge their intentions.

- It is only necessary for large transactions. Some believe that LOIs are only for big business deals. In fact, any size transaction can benefit from a Letter of Intent to clarify intentions.

- It replaces the need for a formal contract. An LOI does not replace the need for a formal purchase agreement. It serves as a preliminary step before drafting a more detailed contract.

- It cannot be modified once signed. Many think that an LOI is set in stone once signed. However, it can be amended if both parties agree to the changes.

- It is only for buyers. Some assume that only buyers use LOIs. Sellers can also use them to outline their expectations and terms during negotiations.

Understanding these misconceptions can help individuals navigate the process of purchasing a business more effectively and avoid potential pitfalls.

Other Types of Letter of Intent to Purchase Business Forms:

Letter of Intent to Sue Example - It should be direct and professional, avoiding emotional language and accusations.

How to Write a Letter of Intent for a Job - This document reinforces the employer’s interest in the candidate’s future with the company.

Completing the required documentation is a crucial step for Alabama homeschoolers, and understanding the specifics of the process can greatly impact your journey. By submitting the necessary Homeschool Letter of Intent, parents not only fulfill legal requirements but also pave the way for a structured educational experience at home.

Letter of Intent to Purchase - Can document discussions about the property’s financing options.