Lady Bird Deed Document

Lady Bird Deed - Customized for Each State

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a clear and accurate description of the property. This can lead to confusion or disputes later on.

-

Not Including All Owners: If there are multiple owners, it’s crucial to list all of them on the deed. Omitting an owner can create complications in the future.

-

Improper Signatures: The deed must be signed by all necessary parties. A missing signature can invalidate the entire document.

-

Failure to Notarize: Many people forget to have the deed notarized. Without a notary, the deed may not be legally recognized.

-

Inaccurate Date: The date on the deed is important. An incorrect date can raise questions about the validity of the document.

-

Ignoring State Requirements: Each state has specific rules regarding Lady Bird Deeds. Failing to follow these can lead to legal issues.

-

Not Updating the Deed: After significant life events, such as marriage or divorce, it’s important to update the deed. Neglecting this step can result in unintended consequences.

Learn More on This Form

-

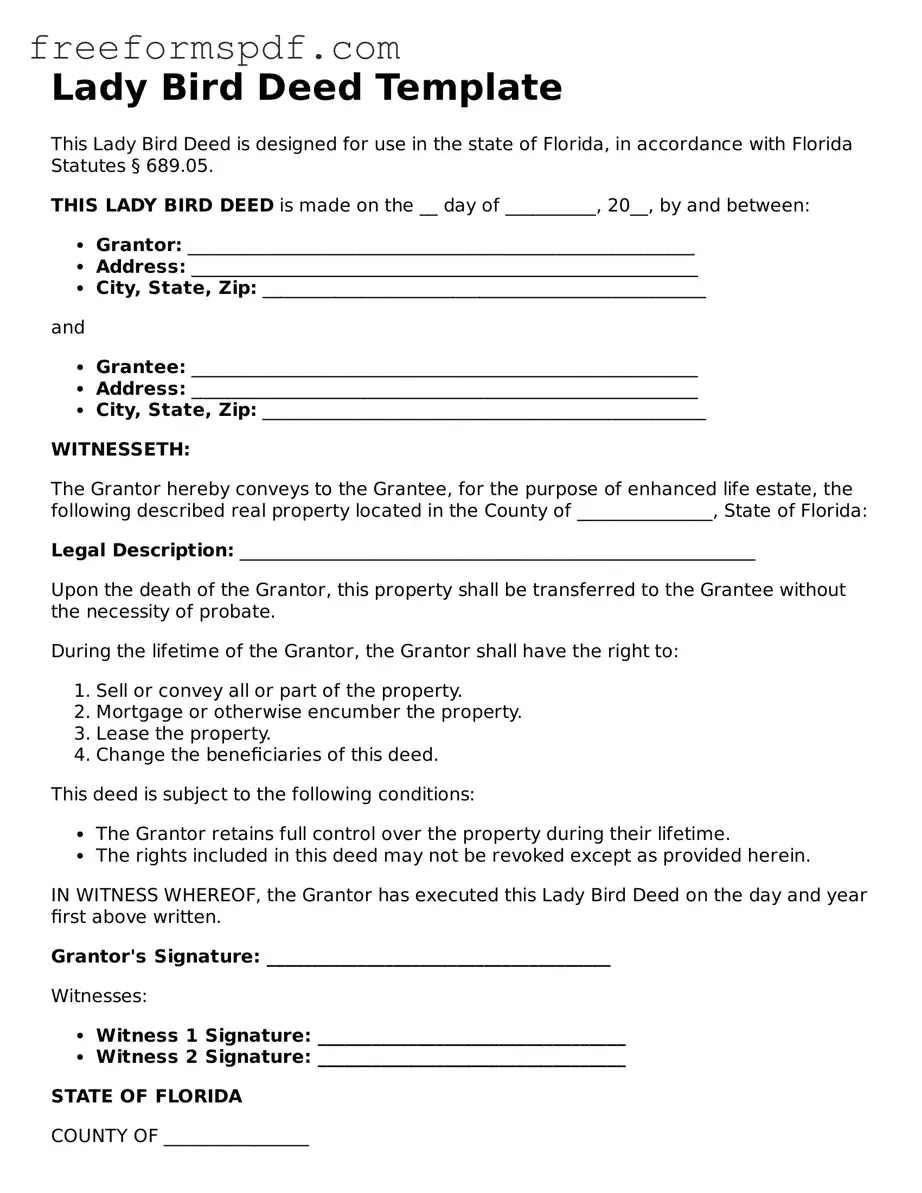

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed can help avoid probate and may provide tax benefits.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control over the property. They can sell, mortgage, or change the beneficiaries at any time. Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

-

What are the benefits of using a Lady Bird Deed?

- Avoids probate, allowing for a quicker transfer of property.

- Retains control of the property during the owner’s lifetime.

- Potentially reduces estate taxes.

- Allows for flexibility in changing beneficiaries.

-

Are there any drawbacks to a Lady Bird Deed?

While there are significant benefits, there are also drawbacks. For example, creditors may still have claims against the property. Additionally, the property may be subject to Medicaid estate recovery, which could affect eligibility for certain benefits.

-

Who should consider using a Lady Bird Deed?

Individuals who wish to pass on their property to heirs without the complexities of probate may find a Lady Bird Deed beneficial. It is particularly suitable for older adults looking to secure their estate while maintaining control of their property.

-

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves drafting the deed with specific language that outlines the life estate and the beneficiaries. It is advisable to consult with an attorney or a qualified professional to ensure that the deed complies with state laws and accurately reflects the owner’s intentions.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a tool used in estate planning. However, several misconceptions surround its use. Here are six common misconceptions:

- It eliminates the need for a will. Many believe that using a Lady Bird Deed means they no longer need a will. This is not true. A Lady Bird Deed only transfers real estate and does not cover other assets.

- It avoids all taxes. Some think that transferring property through a Lady Bird Deed avoids taxes entirely. While it can help avoid probate, it does not necessarily eliminate capital gains taxes or other tax implications.

- It can only be used for primary residences. There is a belief that Lady Bird Deeds are limited to primary residences. In fact, they can be used for other types of real estate as well, including vacation homes and rental properties.

- It automatically transfers property upon death. Many assume that property will automatically transfer to the beneficiary upon the grantor's death. While it does facilitate a smoother transfer, it still requires proper execution and recording.

- It is only beneficial for older adults. Some think that only seniors can benefit from a Lady Bird Deed. However, anyone looking to simplify their estate planning can consider this option, regardless of age.

- It cannot be revoked. There is a misconception that once a Lady Bird Deed is created, it cannot be changed. In reality, the grantor retains the right to revoke or modify the deed at any time during their lifetime.

Understanding these misconceptions can help individuals make informed decisions about their estate planning options.

Other Types of Lady Bird Deed Forms:

Quit Claim Deed Blank Form - A Quitclaim Deed is typically better suited for known relationships.

For a thorough understanding of rental agreements in Arizona, it's crucial to review the necessary components of a well-drafted lease agreement, accessible through the detailed Arizona lease agreement guide.

Deed in Lieu of Foreclosure Template - Both parties need to agree on the terms of this arrangement in writing.