Fill in a Valid IRS W-9 Template

Common mistakes

-

Incorrect Name or Business Name: Many people forget to use their full legal name as it appears on their tax return. If you operate a business, ensure you include the business name in the appropriate field.

-

Wrong Taxpayer Identification Number (TIN): Using the wrong TIN can lead to issues. Make sure to double-check your Social Security Number (SSN) or Employer Identification Number (EIN) before submitting the form.

-

Missing Signature: Some individuals neglect to sign the form. A signature is crucial because it certifies that the information provided is accurate. Always remember to sign and date your W-9.

-

Not Indicating the Correct Tax Classification: Failing to select the appropriate tax classification can cause confusion. Whether you are an individual, a corporation, or a partnership, be sure to check the right box.

-

Providing Outdated Information: It’s essential to keep your information current. If your address, name, or TIN changes, you must fill out a new W-9 form to reflect those updates.

Learn More on This Form

-

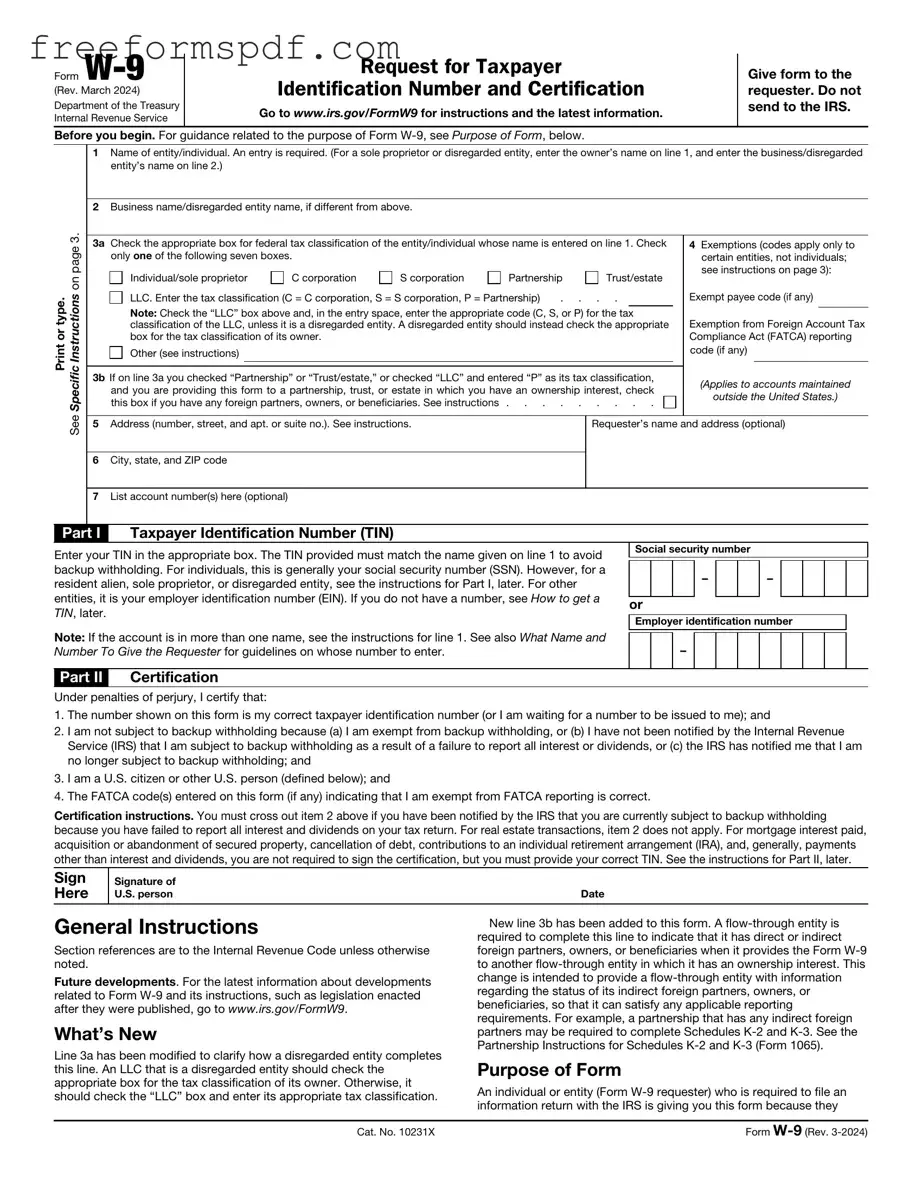

What is the IRS W-9 form?

The IRS W-9 form is a document used in the United States by individuals and businesses to provide their taxpayer identification information to another party. This form is typically requested by clients or companies that need to report payments made to independent contractors or freelancers. By filling out the W-9, you confirm your name, address, and taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

-

Who needs to fill out a W-9 form?

Anyone who is a U.S. citizen or resident alien and receives income that needs to be reported to the IRS may need to fill out a W-9 form. This includes independent contractors, freelancers, and vendors who provide services to businesses. If a business pays you $600 or more in a calendar year, they will likely request a W-9 to report that income to the IRS.

-

How do I fill out a W-9 form?

Filling out a W-9 form is relatively straightforward. You will need to provide your name, business name (if applicable), address, and TIN. Make sure to check the correct box to indicate whether you are an individual, corporation, partnership, or another type of entity. After completing the form, you will sign and date it to certify that the information you provided is accurate.

-

What should I do with the completed W-9 form?

Once you have completed the W-9 form, do not send it to the IRS. Instead, give it to the person or business that requested it from you. They will use the information to prepare the appropriate tax forms, such as the 1099-MISC, which reports the income you received.

-

Is my information on the W-9 form secure?

Your information on the W-9 form is sensitive, as it includes your TIN. It is important to share the form only with trusted individuals or businesses that need it for tax reporting purposes. Always ensure that you are sending the form securely, whether electronically or by mail, to minimize the risk of identity theft.

-

What happens if I don’t fill out a W-9 form?

If you do not fill out a W-9 form when requested, the business may be required to withhold a percentage of your payments for tax purposes. This is known as backup withholding. It is generally set at 24% of the payment amount. To avoid this, it is best to complete and submit the W-9 form promptly when requested.

-

Can I update my W-9 information?

Yes, you can update your W-9 information if there are changes to your name, business name, address, or taxpayer identification number. Simply fill out a new W-9 form with the updated information and provide it to the requester. It is important to keep your information current to ensure accurate tax reporting.

Misconceptions

The IRS W-9 form is a commonly used document, but several misconceptions about it persist. Understanding these misconceptions can help individuals and businesses navigate tax-related matters more effectively. Below are five common misunderstandings regarding the W-9 form.

- Misconception 1: The W-9 form is only for independent contractors.

- Misconception 2: Submitting a W-9 means you will be taxed on that income.

- Misconception 3: The W-9 form is submitted to the IRS.

- Misconception 4: You must provide a Social Security Number (SSN) on the W-9.

- Misconception 5: Once you submit a W-9, you cannot change your information.

While independent contractors often use the W-9 form to provide their taxpayer identification number to clients, it is not limited to them. Any individual or entity that receives income or is required to report income may need to complete a W-9.

Completing a W-9 does not mean that you will automatically owe taxes. The form simply provides information to the payer for reporting purposes. Taxes will depend on the actual income earned and applicable tax laws.

The W-9 form is not submitted directly to the IRS. Instead, it is provided to the individual or business requesting it. They will use the information to prepare other tax forms, such as the 1099.

While many individuals use their SSN, businesses often use an Employer Identification Number (EIN). The form allows for either option, depending on the type of entity completing it.

Individuals can submit a new W-9 form at any time to update their information, such as a change in name or address. It is important to keep the information current for accurate tax reporting.

Browse More Forms

Passport Paperwork - The processing time may increase during peak travel seasons.

To ensure peace of mind, consider completing a comprehensive Last Will and Testament to outline your final wishes and asset distribution. This vital document serves as a safeguard for your loved ones and can provide clarity in difficult times. For more information, feel free to visit our Last Will and Testament form guide.

Employee Change Form Template - Document any changes in employee roles, titles, or grades effectively.

Da 31 - The form allows selection of specific types of leave, like emergency or terminal leave.