Fill in a Valid IRS Schedule C 1040 Template

Common mistakes

-

Neglecting to Report All Income: Many individuals overlook the importance of reporting every dollar earned. Whether it’s cash, checks, or electronic payments, all income must be included. Failing to do so can lead to discrepancies and potential audits.

-

Inaccurate Expense Deductions: Some may mistakenly claim expenses that are not directly related to their business. It's crucial to differentiate between personal and business expenses. Only legitimate business costs should be deducted.

-

Forgetting to Keep Records: Documentation is vital. Many people fail to maintain adequate records of their income and expenses. Without proper documentation, it becomes challenging to justify deductions if questioned by the IRS.

-

Incorrectly Classifying Business Structure: Individuals sometimes misidentify their business type. Whether you're a sole proprietor, LLC, or partnership, the classification affects how you fill out the form and the taxes you owe.

-

Missing Deadlines: Timeliness is essential. Some individuals fail to file their Schedule C by the deadline, leading to penalties and interest. It's important to be aware of tax deadlines to avoid unnecessary fees.

Learn More on This Form

-

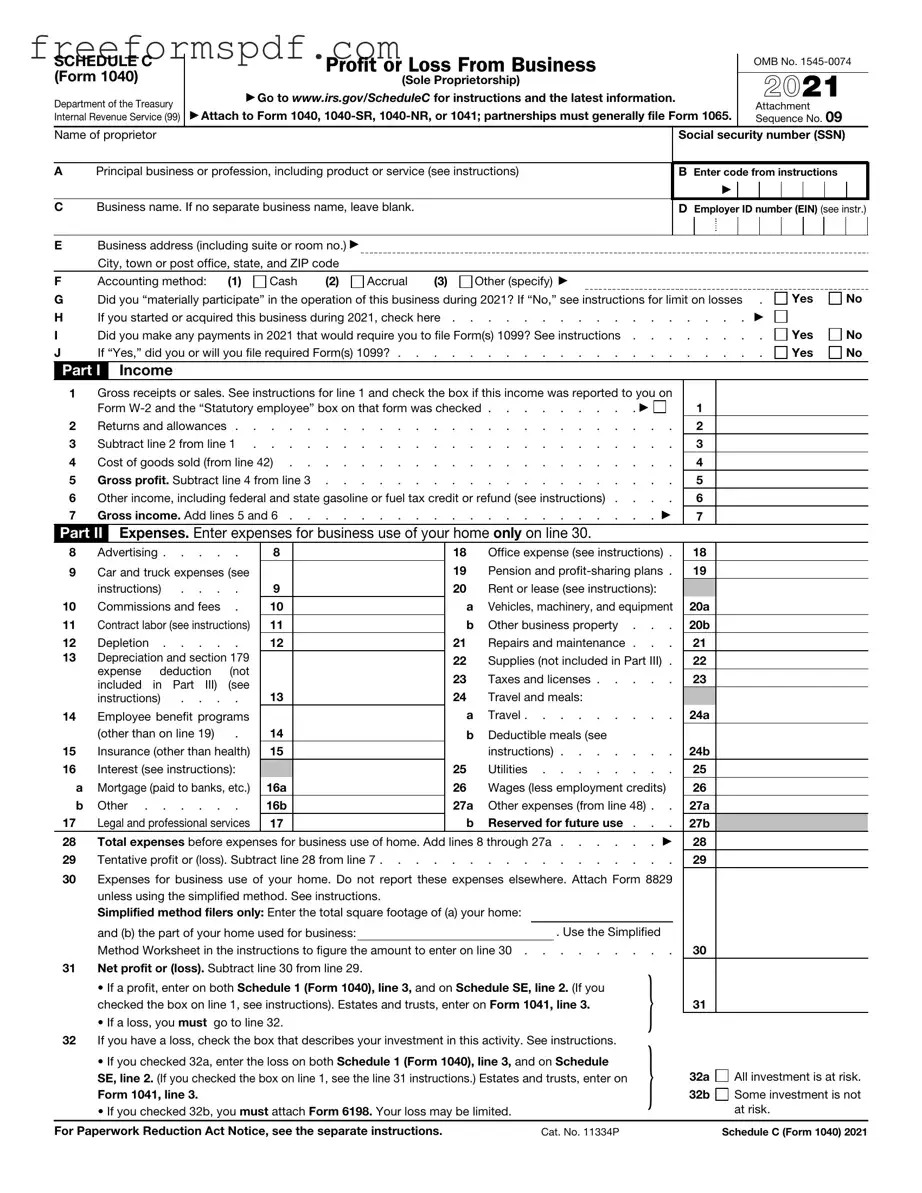

What is IRS Schedule C?

IRS Schedule C is a tax form used by sole proprietors to report income and expenses related to their business. It is part of the Form 1040, which individual taxpayers file annually. This form allows business owners to detail their revenue, deduct eligible expenses, and calculate their net profit or loss for the tax year.

-

Who needs to file Schedule C?

Individuals who operate a business as a sole proprietor must file Schedule C. This includes freelancers, independent contractors, and small business owners. If you earn income from self-employment, you are generally required to file this form, regardless of whether your business is full-time or part-time.

-

What types of expenses can be deducted on Schedule C?

Schedule C allows for a variety of business expenses to be deducted. Common deductible expenses include:

- Cost of goods sold

- Advertising and marketing costs

- Home office expenses

- Vehicle expenses related to business use

- Utilities and rent for business premises

- Professional fees, such as legal and accounting services

It is important to keep accurate records of all expenses to substantiate your deductions during tax filing.

-

How is net profit or loss calculated on Schedule C?

Net profit or loss is calculated by subtracting total business expenses from total business income. This figure is reported on your Form 1040 and can affect your overall tax liability. If your expenses exceed your income, you may report a net loss, which could potentially reduce your taxable income.

Misconceptions

Understanding the IRS Schedule C (Form 1040) is essential for anyone running a business as a sole proprietor. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important tax form:

- Only large businesses need to file Schedule C. Many people believe that only businesses with significant revenue must file this form. In reality, any sole proprietor, regardless of income level, must report their business income and expenses using Schedule C.

- All business expenses are fully deductible. While many expenses can be deducted, not all are fully deductible. For example, certain types of meals and entertainment may only be partially deductible, and personal expenses cannot be claimed as business expenses.

- Filing Schedule C guarantees a tax refund. Some individuals think that submitting this form will automatically result in a tax refund. However, whether a refund is received depends on overall tax liability and withholding, not solely on the information reported on Schedule C.

- Schedule C is only for self-employed individuals. This form is primarily for sole proprietors, but it can also be used by individuals who are part of a partnership or who are independent contractors, as long as they report their income and expenses correctly.

- Income reported on Schedule C is not subject to self-employment tax. Many people mistakenly believe that income reported on Schedule C is exempt from self-employment tax. However, this income is indeed subject to self-employment tax, which funds Social Security and Medicare.

- You can only deduct expenses if you have receipts. While having receipts is ideal for documentation, you can still deduct expenses based on reasonable estimates if you can substantiate them with other records, such as bank statements or invoices.

- Filing Schedule C is the same as filing personal taxes. Some individuals think that completing Schedule C is the same as filing their personal tax return. In fact, Schedule C is a part of the overall Form 1040 and specifically focuses on business income and expenses.

- Once you file Schedule C, you cannot change your business structure. People often believe that filing Schedule C locks them into being a sole proprietor. In reality, individuals can change their business structure at any time, but they may need to file additional forms to reflect that change.

- All income must be reported on Schedule C. Some individuals are under the impression that only business income needs to be reported on Schedule C. However, all income, including any additional sources, must be reported on the overall tax return, even if it does not relate directly to the business.

- There is no deadline for filing Schedule C. Many people think they can file Schedule C whenever they want. However, like other tax forms, it must be filed by the tax deadline, which is typically April 15 for most taxpayers.

Clarifying these misconceptions can help individuals better navigate their tax responsibilities and ensure compliance with IRS regulations.

Browse More Forms

Ubc Designated Learning Institution Number - Disclosure of potential health issues aims to ensure public health and safety within Canada.

When engaging in the sale of a motorcycle in New York, it's crucial to utilize the New York Motorcycle Bill of Sale form to ensure a smooth transaction, as this document serves to clarify the details and protect the interests of both parties involved. For additional templates and resources, you can visit NY Templates, where you can find helpful documents tailored for your needs.

Broker Price Opinion Form - A comprehensive analysis evaluates current market conditions affecting the property.

Affidavit of Death of Joint Tenant - It serves as a legal statement confirming the death of a joint tenant, required for property title updates.