Fill in a Valid IRS 941 Template

Common mistakes

-

Failing to include the correct Employer Identification Number (EIN). Ensure that your EIN is accurate to avoid processing delays.

-

Incorrectly reporting wages and tips. Double-check that all amounts match your payroll records.

-

Neglecting to account for any adjustments. If you made corrections to prior quarters, these must be reflected on the form.

-

Forgetting to sign the form. A missing signature can lead to rejection of the submission.

-

Using the wrong tax period. Ensure that you are filing for the correct quarter.

-

Not including all necessary schedules. If applicable, make sure to attach any required schedules for adjustments or credits.

-

Submitting the form late. Late submissions can result in penalties, so file on time.

-

Inaccurate calculations of tax liability. Verify all calculations to prevent underpayment or overpayment issues.

-

Providing inconsistent information. Ensure that the data matches what is reported on other forms, such as W-2s.

-

Ignoring IRS instructions. Always read the instructions carefully to avoid common pitfalls.

Learn More on This Form

-

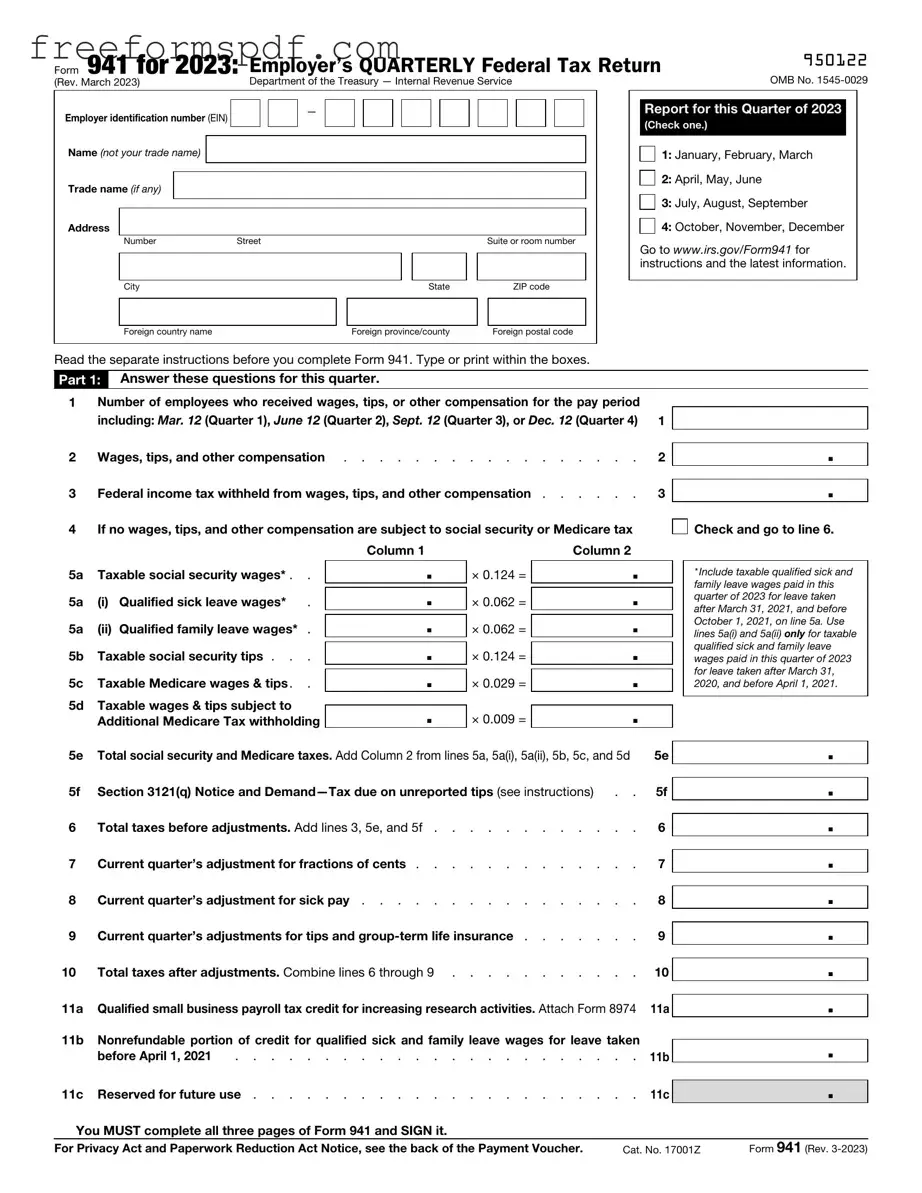

What is IRS Form 941?

IRS Form 941 is a quarterly tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form also reports the employer's share of Social Security and Medicare taxes. It helps the IRS track how much tax employers are collecting and remitting on behalf of their employees.

-

Who needs to file Form 941?

Any employer who pays wages to employees must file Form 941. This includes businesses, non-profits, and other organizations that have employees. If an employer has no employees during a quarter, they may not need to file Form 941 for that period.

-

When is Form 941 due?

Form 941 is due four times a year. The deadlines are:

- April 30 for the first quarter (January - March)

- July 31 for the second quarter (April - June)

- October 31 for the third quarter (July - September)

- January 31 for the fourth quarter (October - December)

If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

-

How do I file Form 941?

Employers can file Form 941 electronically using the IRS e-file system or submit a paper form by mail. Electronic filing is often faster and more secure. To file by mail, employers should send the completed form to the address specified in the form's instructions based on their location.

-

What information is required on Form 941?

Form 941 requires several key pieces of information, including:

- Employer identification information (name, address, and EIN)

- Total number of employees

- Wages, tips, and other compensation

- Income tax withheld

- Social Security and Medicare taxes

-

What happens if I don’t file Form 941?

Failing to file Form 941 can result in penalties and interest charges. The IRS may impose fines for late filing or failure to file. Additionally, not filing can lead to issues with employee tax records, potentially affecting their tax returns.

-

Can I amend Form 941?

Yes, employers can amend Form 941 by filing Form 941-X. This form is used to correct errors on previously filed 941 forms. It is important to file the amendment as soon as the error is discovered to avoid penalties.

-

What is the difference between Form 941 and Form 944?

Form 941 is for employers who have a significant number of employees and file quarterly, while Form 944 is for smaller employers who have a lower payroll tax liability and file annually. The IRS determines which form an employer should use based on their tax liability.

-

Where can I find help with Form 941?

The IRS provides instructions and resources on their website for completing Form 941. Additionally, many tax professionals and accountants can assist with filing and understanding the form.

-

What should I do if I made a mistake on my Form 941?

If a mistake is made on Form 941, it is essential to correct it promptly. Use Form 941-X to amend the original form. Be sure to follow the instructions carefully to ensure the correction is processed correctly.

Misconceptions

The IRS Form 941 is a crucial document for employers, but many misconceptions surround it. Understanding the truth behind these myths can help ensure compliance and avoid penalties. Here are ten common misconceptions about the IRS 941 form:

- Only large businesses need to file Form 941. Many believe that only large employers are required to file this form. In reality, any employer who pays wages to employees must file Form 941, regardless of the size of the business.

- Form 941 is only for federal taxes. Some think that this form is solely for reporting federal income taxes. However, it also reports Social Security and Medicare taxes withheld from employees’ wages.

- Filing Form 941 is optional. A common misconception is that filing this form is optional for employers. In fact, it is mandatory for employers who withhold taxes from employees’ paychecks.

- Form 941 can be filed anytime during the year. Many believe they can file Form 941 at their convenience. In truth, it must be filed quarterly, with specific deadlines for each quarter.

- Form 941 only needs to be filed if there are employees. Some employers think they can skip filing if they have no employees for a particular quarter. However, even if no wages were paid, a Form 941 must still be filed, indicating that no taxes were due.

- There is no penalty for late filing. A misconception exists that there are no consequences for late filing. In reality, the IRS imposes penalties for late submissions, which can add up quickly.

- Form 941 is the same as Form 940. Some confuse Form 941 with Form 940, which is used for federal unemployment taxes. Each form serves a different purpose and must be filed separately.

- Once filed, Form 941 cannot be amended. Many believe that they cannot change their filing once it is submitted. However, employers can amend Form 941 if they discover errors or need to make corrections.

- All tax credits are automatically applied. Some employers think that any tax credits they qualify for will automatically be applied when filing Form 941. It is essential to claim these credits explicitly on the form.

- Filing electronically is not an option. A misconception is that Form 941 must be filed on paper. In fact, employers can file electronically, which can expedite processing and reduce errors.

Understanding these misconceptions is vital for compliance and effective tax management. Employers should remain informed about their responsibilities regarding Form 941 to avoid unnecessary complications.

Browse More Forms

Texas Hub Certification - This form collects all necessary information to understand the membership structure of the company.

The detailed Hold Harmless Agreement form serves as an important tool for mitigating liability risks during events or activities, ensuring that parties understand their responsibilities and protections.

Test Drive Form Pdf - Be ready to provide all documentation in case of an incident.

Cuddle Application - Rejuvenate your spirit with the help of a cuddle companion.