Fill in a Valid IRS 1120 Template

Common mistakes

-

Not using the correct version of the form. The IRS updates forms periodically. Always check that you have the latest version.

-

Failing to provide accurate business information. Ensure that your business name, address, and Employer Identification Number (EIN) are correct.

-

Overlooking required signatures. The form must be signed by an authorized person. A missing signature can delay processing.

-

Incorrectly calculating income and deductions. Double-check your figures to avoid errors that could lead to audits or penalties.

-

Not including all necessary schedules. Depending on your business activities, additional schedules may be required. Missing them can lead to incomplete filings.

-

Neglecting to report foreign income or assets. If your business has international dealings, you must report these accurately to avoid penalties.

-

Using outdated accounting methods. Ensure your accounting practices align with IRS requirements. This helps in accurate reporting.

-

Missing deadlines for filing. Late submissions can incur penalties. Keep track of important dates to avoid this mistake.

-

Not seeking professional help when needed. If your tax situation is complex, consider consulting a tax professional to ensure accuracy.

Learn More on This Form

-

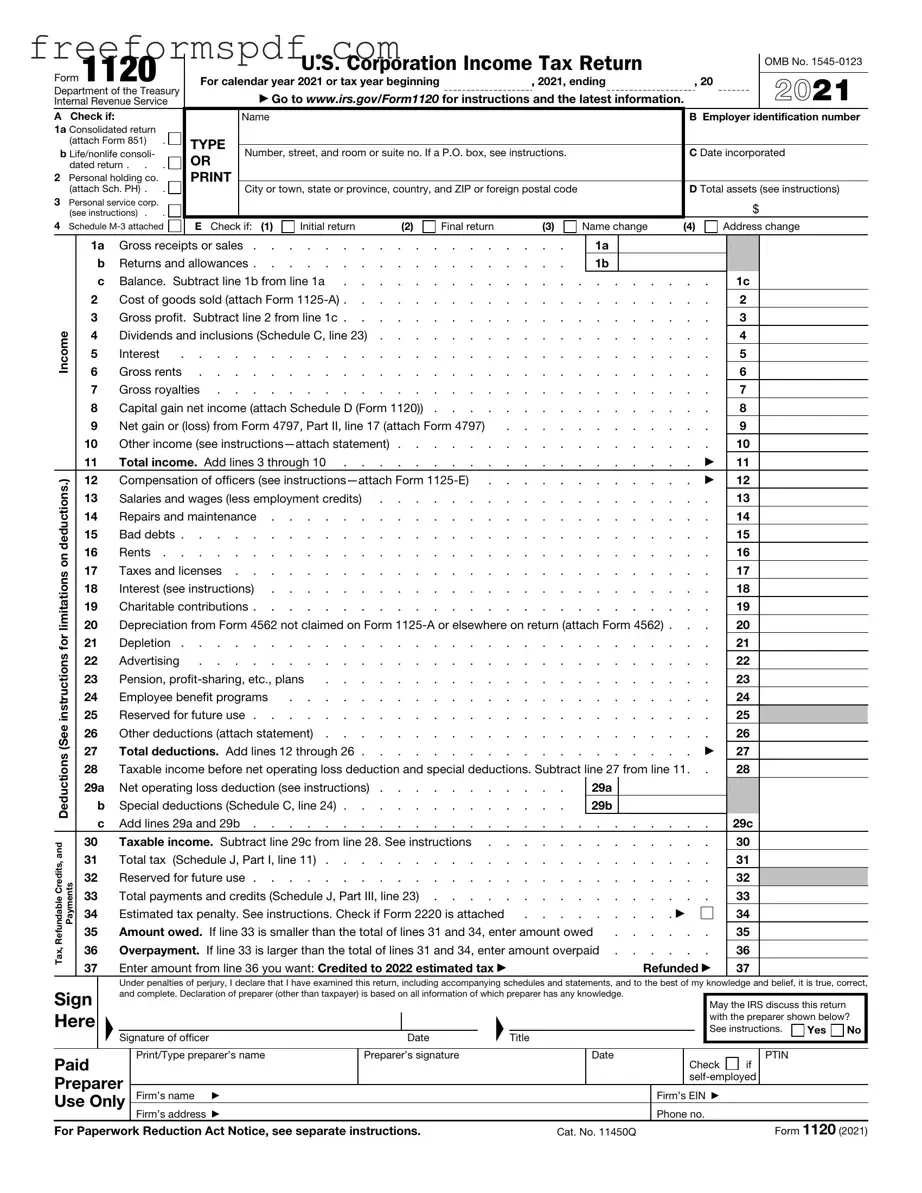

What is IRS Form 1120?

IRS Form 1120 is the U.S. Corporation Income Tax Return. It is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. Corporations that are taxed as separate entities must file this form annually.

-

Who needs to file Form 1120?

Any corporation that is considered a C corporation under U.S. tax law is required to file Form 1120. This includes domestic corporations and certain foreign corporations that have income effectively connected with a U.S. trade or business.

-

What is the deadline for filing Form 1120?

The deadline for filing Form 1120 is the 15th day of the fourth month after the end of the corporation's tax year. For most corporations that follow the calendar year, this means the form is due on April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

-

What information is required on Form 1120?

Form 1120 requires various pieces of information, including:

- The corporation's name and address

- The Employer Identification Number (EIN)

- Income details, including gross receipts and dividends

- Deductions for expenses such as salaries, rent, and interest

- Tax credits the corporation is claiming

-

Can Form 1120 be filed electronically?

Yes, Form 1120 can be filed electronically. The IRS encourages electronic filing as it speeds up processing times and reduces errors. Corporations can use IRS-approved software to file electronically or engage a tax professional who can submit the form on their behalf.

-

What happens if a corporation fails to file Form 1120?

If a corporation fails to file Form 1120 by the deadline, it may face penalties. The IRS typically imposes a penalty of $210 for each month the return is late, up to a maximum of 12 months. Additionally, failure to file can result in interest accruing on any unpaid taxes.

-

Are there any special considerations for foreign corporations?

Yes, foreign corporations that have income effectively connected with a U.S. trade or business must file Form 1120-F, which is specifically designed for foreign entities. However, if a foreign corporation is engaged in a business in the U.S. and meets certain criteria, it may also need to file Form 1120.

-

What are the tax rates for corporations filing Form 1120?

As of 2023, corporations are generally taxed at a flat rate of 21% on their taxable income. This rate applies to all C corporations, regardless of their income level. However, different rates may apply for specific types of income, such as capital gains.

-

Where can I find instructions for completing Form 1120?

Instructions for completing Form 1120 can be found on the IRS website. The IRS provides a detailed guide that outlines how to fill out each section of the form, including explanations of various lines and requirements for deductions and credits.

-

Can a corporation amend its Form 1120?

Yes, a corporation can amend its Form 1120 by filing Form 1120-X, Amended U.S. Corporation Income Tax Return. This form allows corporations to correct errors or make changes to their previously filed returns. It is important to file an amendment as soon as the corporation becomes aware of any discrepancies.

Misconceptions

The IRS Form 1120 is a crucial document for corporations, but many misconceptions surround it. Here are nine common misunderstandings:

- Only large corporations need to file Form 1120. Many people believe that only large corporations are required to file this form. In reality, any corporation, regardless of size, must file Form 1120 if it is recognized as a corporation by the IRS.

- Filing Form 1120 is optional for corporations. Some assume that filing is optional. However, corporations must file Form 1120 annually to report their income, gains, losses, deductions, and credits.

- All corporations pay taxes at the same rate. There is a misconception that all corporations are taxed at the same rate. Tax rates can vary based on the corporation's income level and specific tax provisions.

- Form 1120 is only for profit-making corporations. Some believe that only profitable corporations need to file. However, even if a corporation incurs losses, it still must file Form 1120.

- Filing Form 1120 is the same as filing personal tax returns. Many think that the process is similar to filing individual tax returns. While both involve reporting income, the requirements and forms differ significantly.

- All income is taxable on Form 1120. A common myth is that all income reported on Form 1120 is taxable. Certain types of income, like tax-exempt interest, may not be subject to federal income tax.

- Corporations can ignore deadlines. Some corporations believe they can file at their convenience. However, Form 1120 has strict deadlines, and failure to file on time can result in penalties.

- Once filed, Form 1120 cannot be amended. There is a belief that once the form is submitted, it cannot be changed. In fact, corporations can file an amended return if they need to correct errors.

- Form 1120 is the only tax form corporations need. Many think that Form 1120 is the only form required. Corporations may also need to file additional forms, depending on their activities and tax situations.

Browse More Forms

Yugioh Decklist Form - Completing this form accurately reflects your dedication to the game.

When engaging in a motorcycle transaction, utilizing the proper documentation is crucial, and the New York Motorcycle Bill of Sale form is integral to this process. This form not only safeguards the interests of both parties involved but also ensures a clear record of the sale. For those seeking a reliable template for this document, they can refer to NY Templates for assistance, making the process smoother and more efficient.

Statement of Facts California Dmv - Changes in registration status for organ donation can be requested any time.