Investment Letter of Intent Document

Common mistakes

-

Failing to provide accurate personal information. It’s crucial to double-check names, addresses, and contact details.

-

Not specifying the amount of investment clearly. Ambiguity can lead to misunderstandings later.

-

Overlooking the deadline for submission. Late submissions may result in disqualification.

-

Neglecting to read the instructions thoroughly. Each form may have unique requirements that must be followed.

-

Forgetting to sign the document. A missing signature can render the entire form invalid.

-

Using unclear or vague language. Be specific about intentions and expectations to avoid confusion.

-

Not providing supporting documents when required. These documents often substantiate the claims made in the form.

-

Ignoring the importance of a clear investment strategy. Outlining goals helps clarify the purpose of the investment.

-

Submitting the form without reviewing it. Errors can easily be overlooked, so a final check is essential.

-

Failing to keep a copy of the submitted form. Having a record can be beneficial for future reference.

Learn More on This Form

-

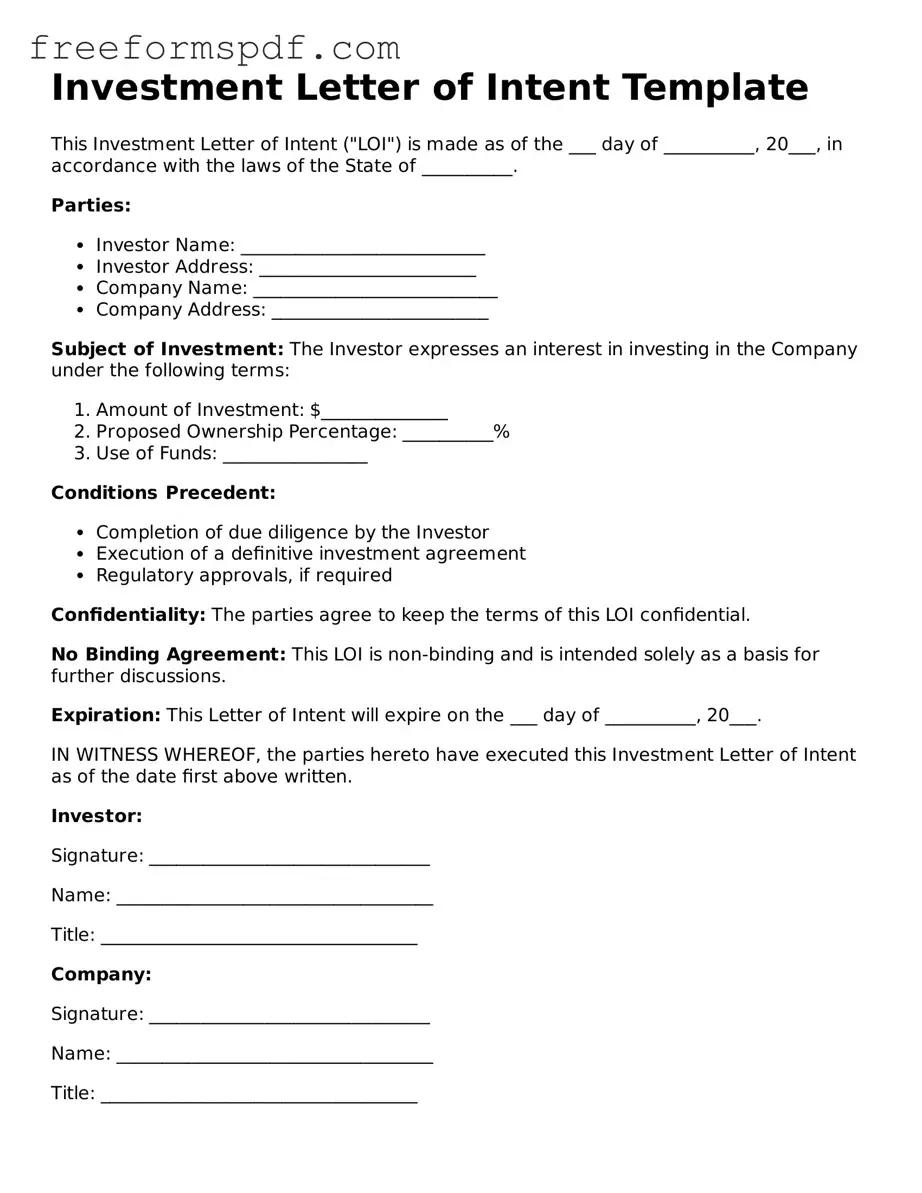

What is an Investment Letter of Intent (LOI)?

An Investment Letter of Intent is a document that outlines the preliminary understanding between parties who intend to engage in a business transaction or investment. It serves as a formal expression of interest and lays the groundwork for negotiating a more detailed agreement. While not legally binding in most cases, it signifies a commitment to move forward and often includes key terms that will be negotiated further.

-

What are the key components of an Investment LOI?

Typically, an Investment Letter of Intent includes several essential elements:

- Parties Involved: Identification of the entities or individuals entering into the agreement.

- Investment Amount: Specification of the financial commitment being proposed.

- Purpose of Investment: A description of what the funds will be used for, whether it be for expansion, research, or other business activities.

- Timeline: An outline of the expected timeline for completing the transaction.

- Confidentiality Clause: Provisions to protect sensitive information shared during negotiations.

- Exclusivity Period: If applicable, a timeframe during which the parties agree not to pursue other offers.

-

Is an Investment LOI legally binding?

Generally, an Investment Letter of Intent is not legally binding, meaning that the parties involved are not legally obligated to proceed with the investment. However, certain sections, such as confidentiality clauses or exclusivity agreements, may carry binding implications. It is crucial for parties to clearly indicate which parts of the LOI are intended to be binding and which are not.

-

Why is an Investment LOI important?

An Investment Letter of Intent is important for several reasons. First, it provides a framework for negotiation, allowing both parties to clarify their intentions and expectations. Second, it demonstrates a serious interest in pursuing the investment, which can help build trust between the parties. Finally, it can serve as a tool for securing financing or attracting additional investors, as it showcases a commitment to a particular venture.

-

What should I consider before signing an Investment LOI?

Before signing an Investment Letter of Intent, consider the following:

- Clarity of Terms: Ensure that all terms are clearly defined and understood.

- Future Obligations: Be aware of any commitments you may be making, even if the LOI is not fully binding.

- Legal Review: It may be wise to have a legal professional review the document to ensure it aligns with your interests.

- Impact on Negotiations: Understand how signing the LOI may affect your ability to negotiate with other parties.

-

Can an Investment LOI be modified after signing?

Yes, an Investment Letter of Intent can be modified after signing, but both parties must agree to the changes. It is advisable to document any amendments in writing to avoid misunderstandings in the future. Open communication between the parties is essential during this process to ensure that all modifications are mutually acceptable.

Misconceptions

The Investment Letter of Intent (LOI) is often misunderstood. Here are nine common misconceptions about this important document:

- It is a legally binding contract. Many believe that signing an LOI means they are legally obligated to proceed with the investment. In reality, an LOI is typically non-binding and serves as a preliminary agreement outlining the intentions of the parties involved.

- It guarantees funding. Some think that an LOI guarantees that funds will be available. However, it simply expresses an interest in pursuing a deal and does not ensure that financing will be provided.

- It is only for large investments. While LOIs are often associated with significant transactions, they can be used for investments of any size. Smaller deals can also benefit from the clarity an LOI provides.

- It is unnecessary if a formal contract is in place. Even when a formal contract is being drafted, an LOI can be useful. It helps clarify the terms and intentions before the final agreement is reached.

- All LOIs are the same. Each LOI can differ based on the specific circumstances of the investment. The content and terms can vary widely, tailored to the needs of the parties involved.

- It is a waste of time. Some may view the LOI as an unnecessary step. However, it can save time by aligning expectations and reducing misunderstandings later in the negotiation process.

- Only one party needs to sign it. An LOI typically requires signatures from all involved parties to be effective. This mutual agreement indicates that everyone is on the same page regarding the intentions outlined.

- It cannot be modified. Many believe that once an LOI is signed, its terms are set in stone. In fact, parties can negotiate and amend the LOI as needed before finalizing the investment.

- It does not need to be reviewed by legal counsel. Some investors assume that an LOI is straightforward and does not require legal review. Consulting with legal counsel can help ensure that the document accurately reflects the intentions and protects the interests of all parties.

Other Types of Investment Letter of Intent Forms:

How to Do Letter of Intent - It is important to make your project compelling and actionable.

To initiate the homeschooling process in Arizona, parents must complete the necessary documentation, including the Homeschool Intent Letter, which communicates their intent to the state and is pivotal for adherence to legal requirements.