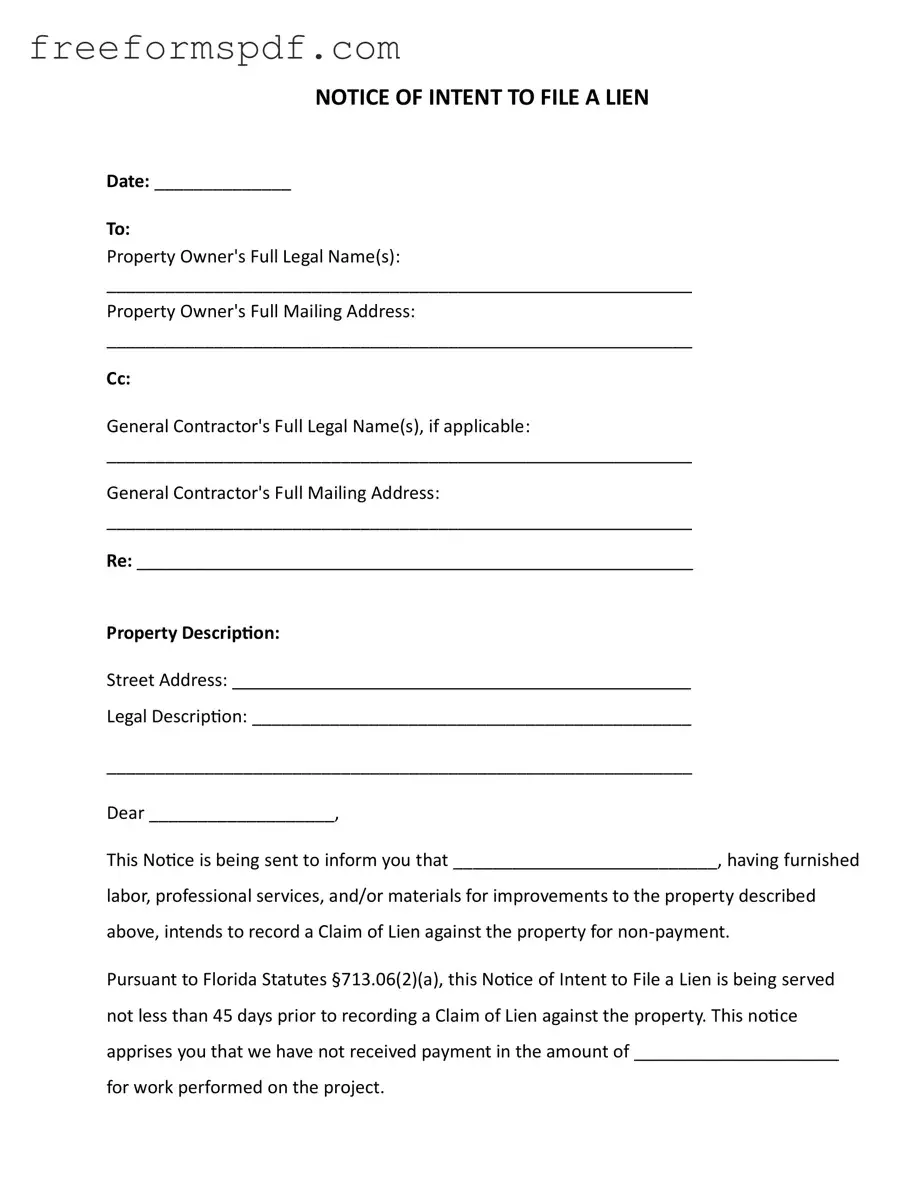

Fill in a Valid Intent To Lien Florida Template

Common mistakes

-

Incomplete Property Owner Information: Failing to provide the full legal name and mailing address of the property owner can lead to delays. Ensure all details are accurate and complete.

-

Missing General Contractor Details: If applicable, neglecting to include the general contractor's name and mailing address may cause confusion. This information is crucial for proper communication.

-

Incorrect Property Description: Providing an inaccurate street address or legal description can invalidate the lien. Double-check these details to ensure they match public records.

-

Failure to State the Amount Due: Omitting the specific amount owed for services rendered can weaken your position. Clearly state the total amount to avoid misunderstandings.

-

Ignoring the 45-Day Requirement: Not sending the notice at least 45 days before filing a lien can jeopardize your claim. Adhere strictly to this timeline to maintain your rights.

-

Neglecting to Include a Certificate of Service: Forgetting to document how the notice was delivered can lead to complications. Always include this certification to prove that the notice was served properly.

-

Not Following Up: Failing to contact the property owner after sending the notice may result in missed opportunities for resolution. Be proactive in seeking payment and addressing any concerns.

Learn More on This Form

-

What is the purpose of the Intent to Lien Florida form?

The Intent to Lien Florida form serves as a formal notification to property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice must be sent at least 45 days before the actual lien is recorded, giving the property owner an opportunity to resolve the payment issue.

-

Who needs to use the Intent to Lien form?

This form is typically used by contractors, subcontractors, or suppliers who have not received payment for work performed or materials supplied on a construction project. It is essential for those who want to protect their right to file a lien against the property if payment is not made.

-

What are the consequences of ignoring the Intent to Lien notice?

If the property owner fails to respond or make payment within 30 days of receiving the notice, the contractor or supplier may proceed to record a lien against the property. This could lead to foreclosure proceedings, and the property owner may also incur additional costs such as attorney fees and court expenses.

-

How should the Intent to Lien notice be delivered?

The notice can be delivered through various methods, including certified mail, registered mail, hand delivery, delivery by a process server, or publication. It is crucial to keep a record of how the notice was served, as this information may be needed in any future legal proceedings.

Misconceptions

Understanding the Intent To Lien form in Florida is essential for property owners and contractors alike. Here are eight common misconceptions about this important document:

- It is a lien itself. Many believe that sending an Intent To Lien automatically places a lien on the property. In reality, it is a notice that a lien may be filed if payment is not made.

- It can be sent at any time. Some think they can send this notice whenever they choose. However, Florida law requires that it be sent at least 45 days before filing a Claim of Lien.

- It guarantees payment. There is a misconception that sending this notice ensures payment will be received. While it serves as a warning, it does not guarantee that the property owner will pay.

- Only contractors can send it. Some assume that only general contractors can issue this notice. In fact, any party who has provided labor or materials can send an Intent To Lien.

- It must be notarized. Many believe that notarization is required for the Intent To Lien. However, Florida law does not mandate notarization for this document.

- It is unnecessary if there is a contract. Some think that having a written contract eliminates the need for this notice. However, sending an Intent To Lien is still advisable to protect one’s rights.

- It is only for residential properties. There is a belief that this form applies only to residential properties. In reality, it can be used for both residential and commercial properties.

- Once sent, it cannot be revoked. Some individuals think that sending the notice is final. However, it can be retracted if payment is made or an agreement is reached.

By understanding these misconceptions, property owners and contractors can navigate the lien process more effectively and protect their interests.

Browse More Forms

Fedex Door Tag Authorizing Release - This form can be a helpful tool for busy schedules that don’t allow for package receipt.

For landlords and tenants navigating the complexities of rental agreements, it is important to familiarize themselves with the New York Notice to Quit form, which can be found through resources such as NY Templates. This form not only serves as a formal notification for vacating the rental property but also helps clarify the rights and responsibilities of both parties during the eviction process.

Broker Price Opinion Form - Employment conditions in the area are recorded to understand economic factors.

Free Printable Direction to Pay Form - Improves turnaround time for vehicle restoration services.