Fill in a Valid Independent Contractor Pay Stub Template

Common mistakes

-

Failing to include personal information such as name, address, and Social Security number.

-

Not specifying the contractor’s business name if they operate under a business entity.

-

Omitting the payment period, which can lead to confusion about when services were rendered.

-

Incorrectly calculating hours worked or the rate of pay, which affects total earnings.

-

Failing to itemize deductions, such as taxes or insurance, which can lead to misunderstandings about net pay.

-

Not providing a summary of services rendered, which helps clarify what the payment is for.

-

Neglecting to include payment method, such as check or direct deposit, which is important for record-keeping.

-

Using inconsistent formatting for dates or amounts, which can create confusion.

-

Forgetting to sign or date the form, which is essential for validation.

-

Not keeping a copy of the completed pay stub for personal records, which is crucial for future reference.

Learn More on This Form

-

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the payment details for independent contractors. It typically includes information such as the contractor's name, payment amount, date of payment, and any deductions or taxes withheld. This document serves as a record for both the contractor and the hiring entity.

-

Who needs an Independent Contractor Pay Stub?

Independent contractors who provide services to businesses or individuals should receive a pay stub. It helps them keep track of their earnings and provides proof of income for tax purposes. Businesses that hire independent contractors should also provide this documentation to ensure transparency and compliance with tax regulations.

-

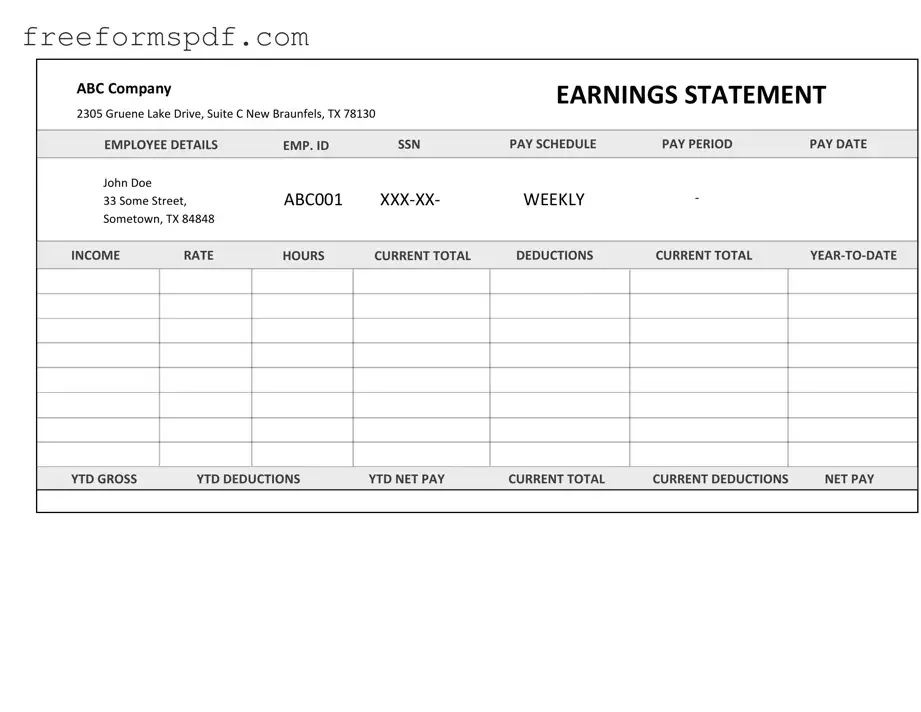

What information is included in a typical pay stub?

A typical Independent Contractor Pay Stub includes:

- The contractor's name and address

- The hiring entity's name and address

- The payment period covered by the stub

- The total payment amount

- Any deductions, such as taxes or fees

- The net amount received

- The date of payment

-

How is an Independent Contractor Pay Stub different from a regular employee pay stub?

The main difference lies in the employment status. Independent contractors are self-employed and typically receive payment without tax withholding. In contrast, regular employees have taxes withheld from their paychecks. Therefore, the pay stub for an independent contractor may not show withholdings for federal or state taxes, while an employee's pay stub would.

-

Do independent contractors need to keep their pay stubs?

Yes, independent contractors should keep their pay stubs. These documents are essential for tracking income, preparing tax returns, and verifying earnings. Maintaining accurate records can help avoid issues with the IRS and ensure proper reporting of income.

-

Can independent contractors create their own pay stubs?

Yes, independent contractors can create their own pay stubs. Various online templates and software options are available to assist with this process. It is important to ensure that the pay stub contains all necessary information to be valid and useful for tax reporting.

-

What should I do if I do not receive a pay stub?

If you do not receive a pay stub, you should contact the hiring entity to request one. It is your right to receive documentation of your earnings. If they refuse or fail to provide it, consider discussing the matter further or seeking advice from a professional.

-

Are there any legal requirements for providing pay stubs to independent contractors?

While specific requirements may vary by state, there is generally no federal law mandating that independent contractors receive pay stubs. However, providing them is considered a best practice for transparency and record-keeping. Always check local regulations to ensure compliance.

Misconceptions

Understanding the Independent Contractor Pay Stub form is essential for both contractors and businesses. However, several misconceptions can lead to confusion. Here are nine common misconceptions explained:

- Independent contractors do not need a pay stub. Many believe that independent contractors are exempt from receiving pay stubs. In reality, providing a pay stub can help clarify earnings and deductions, even if it is not legally required.

- Pay stubs are only for employees. This is incorrect. While traditional employees receive pay stubs, independent contractors can also benefit from them to track their income and expenses.

- All pay stubs look the same. Pay stubs can vary significantly between companies. Different formats and information may be included, depending on the contractor's agreement and the company's practices.

- Independent contractors cannot have deductions. Some believe that independent contractors do not have deductions. However, they may have allowable business expenses that can be deducted from their earnings, which should be reflected on a pay stub.

- Pay stubs are only for tax purposes. While pay stubs can assist with tax calculations, they also serve to provide a clear record of income and payments received, which is beneficial for budgeting and financial planning.

- Independent contractors are always paid the same amount. This misconception overlooks the fact that independent contractors may have variable pay based on hours worked, projects completed, or contractual agreements.

- Pay stubs do not need to include hours worked. Including hours worked on a pay stub can provide transparency. This information can be crucial for contractors who bill by the hour or need to track their time for project management.

- Independent contractors cannot request a pay stub. Contractors have the right to request a pay stub from the businesses they work with. This can help them maintain accurate records of their income.

- Pay stubs are not important for independent contractors. This belief is misleading. Pay stubs can provide valuable documentation for securing loans, applying for credit, and maintaining financial records.

By addressing these misconceptions, independent contractors can better understand the importance of pay stubs and how they can be beneficial in their professional lives.

Browse More Forms

Mortgage Interest Statement - It serves both as an informational tool and a reminder of obligations associated with your mortgage.

To assist with the proper completion of the NYC Payroll Form, many find it helpful to use templates that streamline the reporting process; one such resource can be found at NY Templates, which provides clear guidance and formats for contractors and subcontractors navigating this important requirement.

Scrivener's Affidavit California - This form streamlines the legal process by providing a clear declaration of accuracy from a scrivener.