Fill in a Valid Goodwill donation receipt Template

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields on the receipt form. This can include missing names, addresses, or the date of the donation. Incomplete forms may lead to difficulties in obtaining tax deductions.

-

Incorrect Valuation of Donated Items: Donors often underestimate or overestimate the value of their items. The IRS requires a fair market value for tax purposes. Providing inaccurate valuations can result in complications during tax filing.

-

Failure to Keep a Copy: Some people neglect to retain a copy of the completed receipt. Keeping a copy is essential for record-keeping and can be important if the donation needs to be verified later.

-

Not Listing All Donated Items: Donors sometimes list only a few items instead of providing a comprehensive list. A detailed inventory helps substantiate the donation's value and supports potential tax deductions.

Learn More on This Form

-

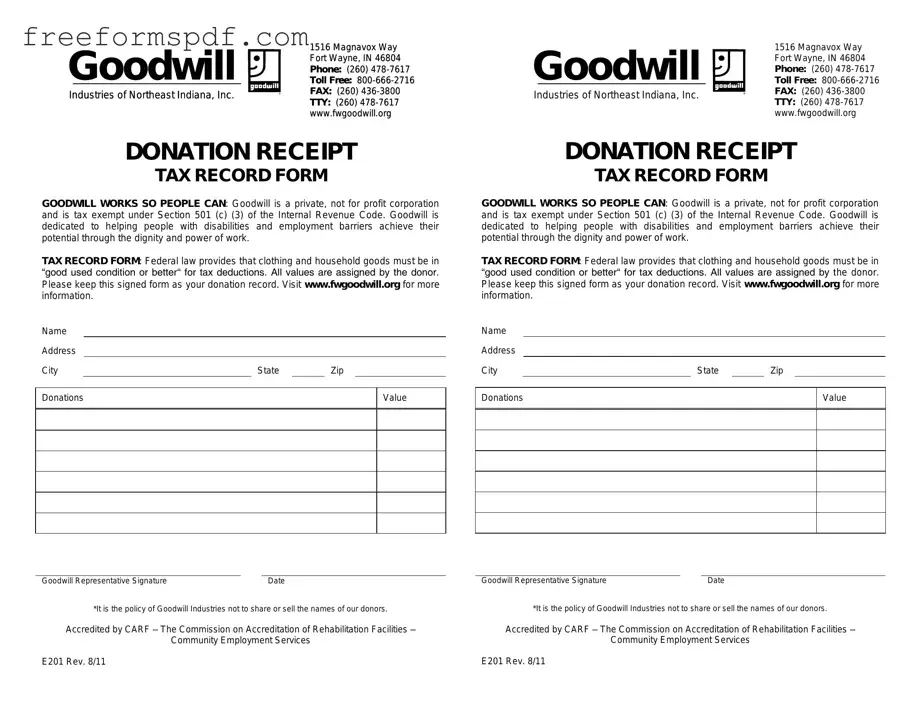

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they make a charitable contribution to Goodwill Industries. This receipt serves as proof of the donation and includes details such as the date of the donation, a description of the items donated, and the donor's name and address.

-

Why do I need a donation receipt?

The donation receipt is important for several reasons. First, it provides you with documentation for tax purposes. When you file your taxes, you may be able to deduct the value of your donated items, and the receipt serves as evidence of your contribution. Additionally, having a receipt can help you keep track of your charitable giving throughout the year.

-

How do I obtain a Goodwill donation receipt?

To obtain a Goodwill donation receipt, simply bring your donated items to a Goodwill location. After you drop off your items, a staff member will provide you with a receipt. If you are donating items through a scheduled pickup, the driver will also provide a receipt at the time of pickup.

-

What information is included on the receipt?

The Goodwill donation receipt typically includes:

- The name and address of the donor

- The date of the donation

- A description of the items donated (though specific values are not assigned)

- The name of the Goodwill location receiving the donation

Keep in mind that the receipt does not include a monetary value for the items, as it is up to the donor to determine the fair market value for tax purposes.

-

Can I use the receipt for online donations?

Yes, if you make an online donation to Goodwill, you will receive a digital receipt via email. This receipt will contain the same information as a physical receipt and can be used for tax purposes. Be sure to keep this email in a safe place for your records.

Misconceptions

Many people have questions about the Goodwill donation receipt form. Misunderstandings can lead to confusion. Here are seven common misconceptions.

- All donations are tax-deductible. Not every donation qualifies for a tax deduction. The items must be in good condition and you should itemize your deductions on your tax return.

- You must have a receipt for every item donated. While it’s good practice to keep receipts, you may not need a receipt for smaller donations. However, having one helps if you need to prove your contributions.

- Goodwill sets the value of your donations. Goodwill does not determine the value of your items. You are responsible for assessing the fair market value of your donations.

- Donations can only be made during business hours. You can drop off donations at any time at designated donation bins, even when stores are closed.

- All items donated will be sold in stores. Some items may be recycled or disposed of if they are not suitable for resale. Goodwill aims to make the best use of all donations.

- You can only donate clothing. Goodwill accepts a wide range of items, including furniture, electronics, and household goods. Check with your local Goodwill for specifics.

- The receipt is only for tax purposes. While the receipt is useful for taxes, it also serves as a record of your charitable giving. Keeping it can help you track your donations over time.

Understanding these points can help clarify the purpose and use of the Goodwill donation receipt form. Being informed can make the donation process smoother and more beneficial for everyone involved.

Browse More Forms

Do Advance Directives Have to Be Notarized - The directive should be completed thoughtfully, considering possible future scenarios.

It is important for landlords to effectively utilize the New York Notice to Quit form to initiate the eviction process, and for this purpose, resources like NY Templates can provide helpful guidance in preparing this essential document.

Medication Administration Record Template Excel - The clear layout helps avoid confusion during busy medication rounds.