Fill in a Valid Gift Letter Template

Common mistakes

-

Not Including All Required Information: Many people forget to provide essential details such as the donor's name, address, and relationship to the recipient. Omitting any of this information can lead to delays or rejection of the gift letter.

-

Incorrect Amount Specification: Some individuals write the gift amount incorrectly or fail to clarify whether it is in words or numbers. This can create confusion and may require additional clarification.

-

Failure to Sign: A common oversight is neglecting to sign the gift letter. Without a signature, the document may not be considered valid.

-

Not Dating the Letter: Some forget to include the date on the gift letter. This information is crucial for establishing when the gift was made.

-

Inadequate Explanation of the Gift: People often fail to provide a clear statement indicating that the funds are a gift and not a loan. This can raise questions about the nature of the transaction.

-

Using Incorrect Terminology: Misusing terms like "gift" and "loan" can lead to misunderstandings. It’s important to use clear language to avoid any ambiguity.

-

Not Including Supporting Documentation: Some individuals neglect to attach necessary documents, such as bank statements or proof of funds. This can hinder the verification process.

Learn More on This Form

-

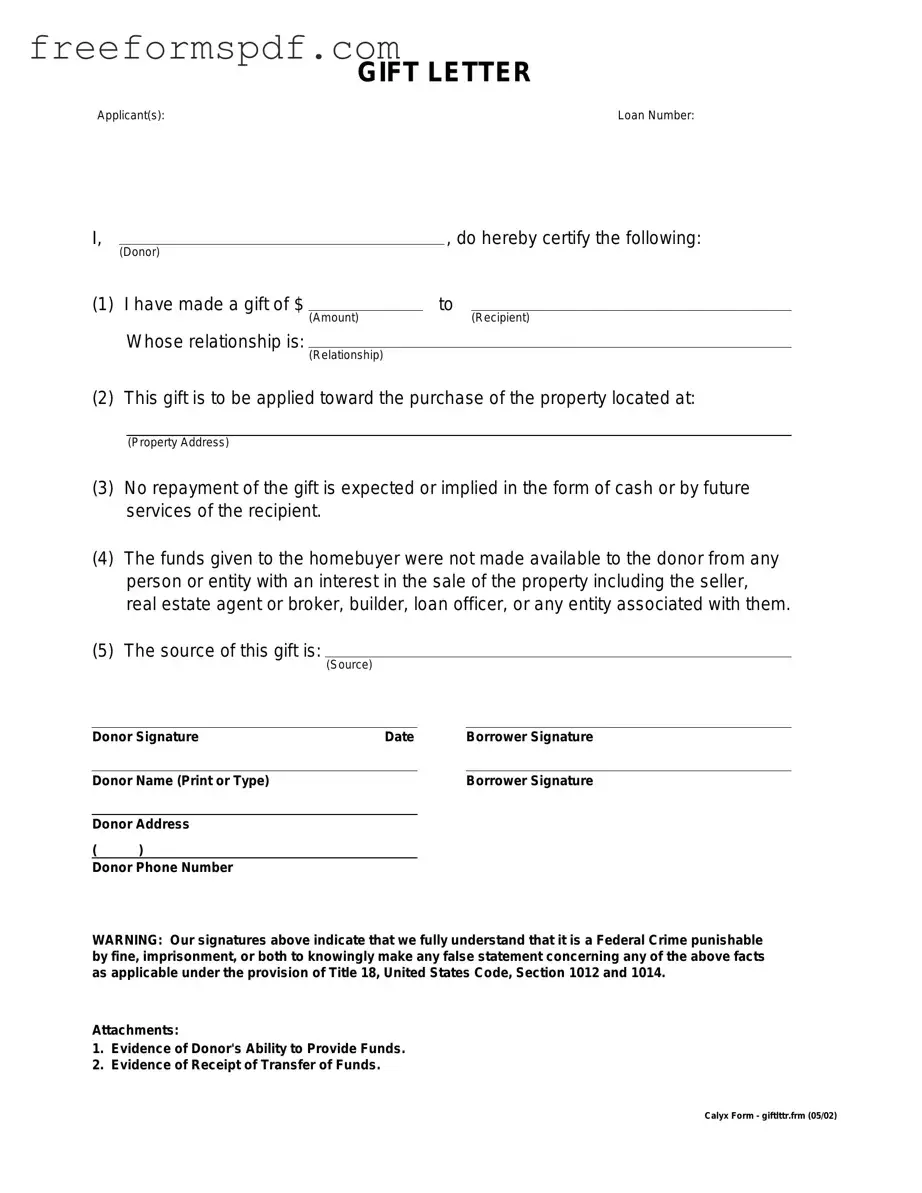

What is a Gift Letter form?

A Gift Letter form is a document used to confirm that a monetary gift has been given to a recipient, typically for the purpose of helping with a down payment on a home. This letter serves as proof that the funds are a gift and not a loan, which is crucial for lenders during the mortgage approval process.

-

Who typically needs a Gift Letter?

Individuals who are purchasing a home and receiving financial assistance from family members or friends often need a Gift Letter. Lenders require this documentation to ensure that the funds do not need to be repaid, which could affect the borrower’s financial stability.

-

What information should be included in a Gift Letter?

A comprehensive Gift Letter should include:

- The donor's name, address, and relationship to the recipient.

- The recipient's name and address.

- The amount of the gift.

- A statement confirming that the funds are a gift and do not need to be repaid.

- The date of the gift.

-

Is there a specific format for a Gift Letter?

While there is no strict format, a Gift Letter should be clear and concise. It is advisable to type the letter, as it adds a level of professionalism. The letter should be signed by the donor and may need to be notarized, depending on the lender's requirements.

-

Can a Gift Letter be used for any type of loan?

Gift Letters are most commonly used in mortgage applications, particularly for first-time homebuyers. However, some lenders may accept Gift Letters for other types of loans, such as personal loans or student loans. Always check with the specific lender to understand their policies regarding gift funds.

-

Are there limits on the amount of money that can be gifted?

While there is no limit on how much money a donor can give, the IRS does impose a gift tax exclusion limit. For 2023, this limit is $17,000 per recipient per year. Gifts exceeding this amount may require the donor to file a gift tax return. It is essential to consult with a tax professional for guidance on large gifts.

-

What happens if the Gift Letter is not provided?

If a Gift Letter is not submitted, the lender may view the funds as a loan rather than a gift. This misunderstanding could lead to complications in the mortgage approval process, potentially delaying or even jeopardizing the purchase of the home.

-

Can a Gift Letter be revoked?

Once a Gift Letter is signed and the funds are transferred, it is generally considered a completed transaction. However, if the donor wishes to revoke the gift for any reason, it is advisable to communicate this clearly and formally. Keep in mind that revoking a gift can have legal implications, so consulting with a legal expert may be wise.

Misconceptions

Understanding the Gift Letter form is crucial for anyone involved in real estate transactions, especially first-time homebuyers. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

-

The Gift Letter is only necessary for large sums of money.

Many believe that only substantial gifts require a letter. In reality, lenders often request a gift letter regardless of the amount to ensure proper documentation and compliance with their guidelines.

-

A Gift Letter can be verbal.

Some individuals think a simple conversation about the gift suffices. However, lenders require a written Gift Letter to provide clear evidence of the transaction and the intent behind the gift.

-

Anyone can give a gift for a home purchase.

While it may seem like anyone can contribute, lenders typically prefer gifts from family members. Understanding who qualifies as a donor is essential to avoid complications during the loan process.

-

The Gift Letter is the only documentation needed.

Another misconception is that the Gift Letter alone will suffice. In addition to the letter, lenders may ask for bank statements or other proof of funds to verify the source of the gift.

Being aware of these misconceptions can streamline the home buying process and help avoid potential delays or issues with financing. Always consult with your lender for specific requirements related to the Gift Letter form.

Browse More Forms

Free Job Application Template - Stay organized by keeping a copy of your application.

For those completing the NYCERS F266 form, it is also beneficial to explore resources that can simplify the process, such as the NY Templates, which provides a useful template to assist with the application and ensure all necessary information is correctly filled out.

How to Get Acord Insurance Certificate - Filling out the Acord 50 WM allows for a more personal health insurance experience.

Player Evaluation Form Basketball - Highlight the importance of teamwork and player interaction on the court.