Gift Deed Document

Common mistakes

-

Not Including a Clear Description of the Gift: One common mistake is failing to provide a detailed description of the property or item being gifted. This can lead to confusion or disputes later on.

-

Incorrectly Identifying the Parties: Ensure that the names of both the giver and the recipient are accurate. Any errors can complicate the transfer process.

-

Omitting Signatures: Both the donor and the recipient must sign the deed. Forgetting to do this invalidates the document.

-

Not Notarizing the Document: In many cases, a gift deed needs to be notarized to be legally binding. Neglecting this step can result in the deed being challenged.

-

Failing to Date the Document: A date is crucial. Without it, the timing of the gift may be questioned, leading to potential legal issues.

-

Ignoring Local Laws: Different states have varying requirements for gift deeds. Not adhering to local laws can render the deed ineffective.

-

Not Keeping Copies: After completing the gift deed, it’s important to keep copies for both the giver and the recipient. This can prevent misunderstandings in the future.

Learn More on This Form

-

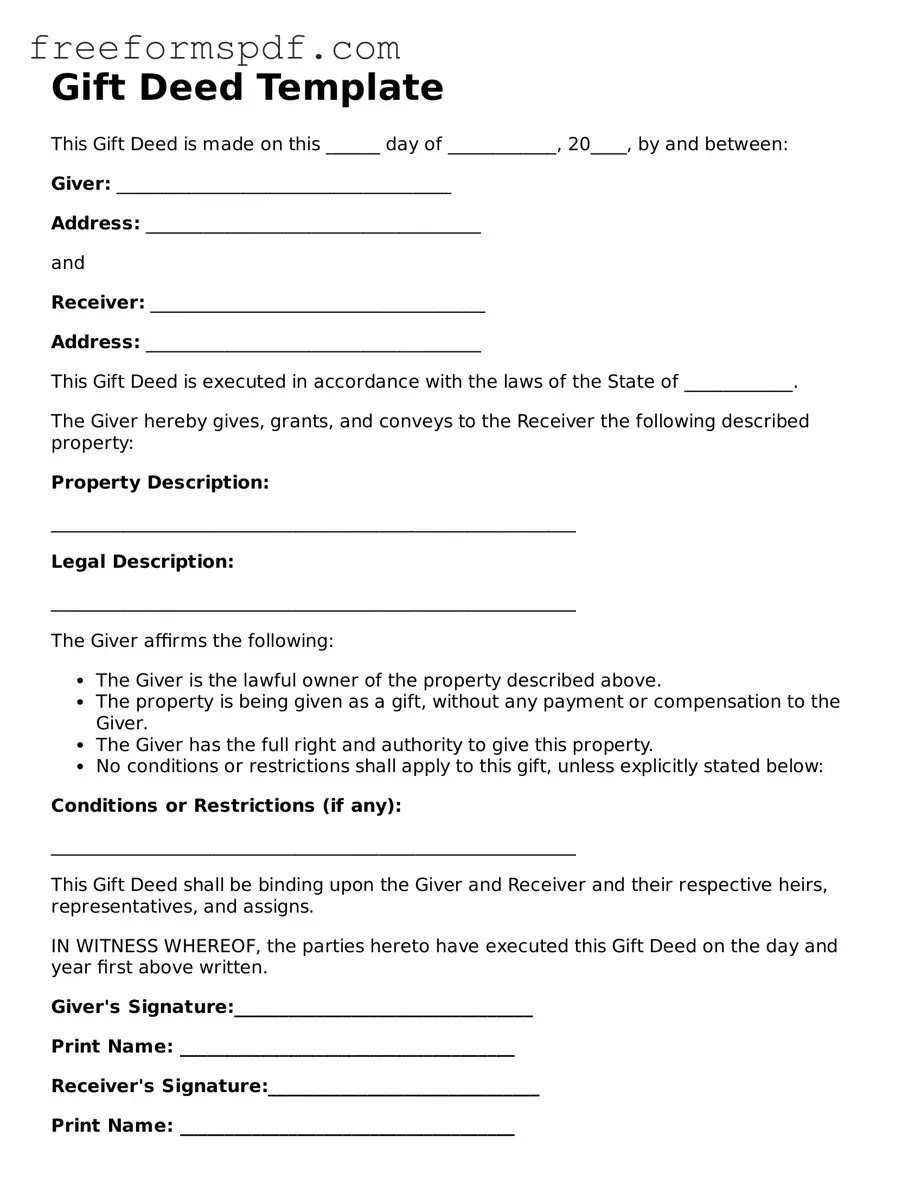

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This form is often used for transferring real estate, personal property, or financial assets.

-

Who can be a donor and a donee?

The donor is the person giving the gift, while the donee is the recipient. Both parties must be competent to enter into a contract, meaning they must be of legal age and mentally capable of understanding the transaction.

-

Is a Gift Deed revocable?

Generally, a Gift Deed is irrevocable, meaning once the gift is made and the deed is executed, the donor cannot take it back. However, certain conditions may allow revocation, such as fraud or undue influence.

-

What information is required to complete a Gift Deed?

To complete a Gift Deed, you typically need the following information:

- Full names and addresses of the donor and donee

- Description of the property being gifted

- Details regarding any conditions or restrictions on the gift

- Date of the transaction

-

Does a Gift Deed need to be notarized?

While notarization is not always legally required, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes in the future.

-

Are there tax implications for a Gift Deed?

Yes, there may be tax implications for both the donor and the donee. The IRS allows a certain amount to be gifted each year without tax consequences. Gifts exceeding this amount may require the donor to file a gift tax return.

-

Can a Gift Deed be used for real estate?

Yes, a Gift Deed is commonly used for transferring real estate. However, it is important to follow local laws and regulations regarding property transfers to ensure the deed is valid.

-

What happens if the donor passes away before the gift is completed?

If the donor passes away before the gift is completed, the property will typically become part of the donor's estate. The gift may not be honored unless it was formally executed and delivered before the donor's death.

-

How can disputes regarding a Gift Deed be resolved?

Disputes can often be resolved through negotiation or mediation. If these methods fail, legal action may be necessary. It is advisable to consult with a legal professional to navigate any complex issues.

-

Where can I obtain a Gift Deed form?

Gift Deed forms can be obtained from various sources, including legal stationery stores, online legal document providers, or local government offices. It is important to ensure that the form complies with state laws.

Misconceptions

Understanding the Gift Deed form can be challenging, and several misconceptions often arise. Here are five common misunderstandings about this important legal document:

-

Gift Deeds are only for real estate transactions.

Many people believe that Gift Deeds can only be used to transfer ownership of real estate. In reality, Gift Deeds can also be used for various types of personal property, including vehicles, jewelry, and other valuable items.

-

A Gift Deed does not require any formalities.

Some individuals think that a Gift Deed can simply be created verbally or through an informal note. However, to be legally valid, a Gift Deed typically must be in writing, signed by the giver, and may require witnesses or notarization, depending on state laws.

-

Once a Gift Deed is signed, it cannot be revoked.

While a Gift Deed is generally considered irrevocable once executed, there are exceptions. For instance, if the gift was made under duress or if the giver has not yet delivered the gift, it may be possible to challenge the validity of the deed.

-

Gift Deeds are tax-free.

Many people assume that gifts made through a Gift Deed are entirely tax-free. However, the IRS has specific rules regarding gift taxes. If the value of the gift exceeds a certain threshold, the giver may be required to file a gift tax return, although they might not owe any tax.

-

Only family members can be recipients of a Gift Deed.

It is a common belief that only family members can receive gifts through a Gift Deed. In fact, anyone can be a recipient, including friends or charitable organizations, as long as the giver intends to make a gift without expecting anything in return.

Clarifying these misconceptions can help individuals make informed decisions when considering the use of a Gift Deed. Understanding the nuances of this document is crucial for ensuring that gifts are transferred smoothly and legally.

Other Types of Gift Deed Forms:

United States Tod - Ultimately, this deed is about making sure that your property goes where you want, when you want, after you're gone.

California Corrective Deed - This form minimizes complications that arise from deed inaccuracies.

When engaging in a vehicle transaction, it is crucial to have a documented process in place; using a concise Motor Vehicle Bill of Sale can facilitate this. This form not only proves the transfer of ownership but also outlines important details concerning the vehicle, including its condition, price, and specific sale terms. For those in New York looking for a reliable template to ensure all necessary information is recorded accurately, you can find one at https://newyorkform.com/free-motor-vehicle-bill-of-sale-template/.

Deed in Lieu of Foreclosure Template - This option is typically chosen when a homeowner can no longer afford their mortgage payments.