Fill in a Valid Generic Direct Deposit Template

Common mistakes

-

Failing to fill in all required boxes. Each section of the form must be completed. Missing information can lead to processing delays.

-

Incorrectly entering the Social Security Number. This number must be formatted correctly as XXX-XX-XXXX. Any errors can result in rejection of the form.

-

Not verifying the account number. Ensure that the account number is accurate, including any hyphens, and that it matches what is on file with the financial institution.

-

Using a deposit slip to verify the routing number. It is essential to obtain the routing number directly from the financial institution to avoid errors.

-

Neglecting to indicate the type of account. Clearly specify whether the account is a savings or checking account, as this is crucial for proper processing.

-

Forgetting to sign and date the form. A signature is required for authorization, and without it, the form is invalid.

-

Not including the effective date of the changes. Indicate when the direct deposit should begin to ensure timely processing.

-

Failing to obtain a signature from a joint account holder if applicable. If the account is joint, both parties must authorize the direct deposit.

-

Overlooking to confirm with the financial institution about their direct deposit policies. It is advisable to call and verify that they accept direct deposits.

Learn More on This Form

-

What is a Generic Direct Deposit form?

A Generic Direct Deposit form is a document that allows you to authorize your employer or another entity to deposit funds directly into your bank account. This can include payroll, benefits, or other payments. By using this form, you eliminate the need for paper checks, making the process faster and more secure.

-

How do I fill out the Generic Direct Deposit form?

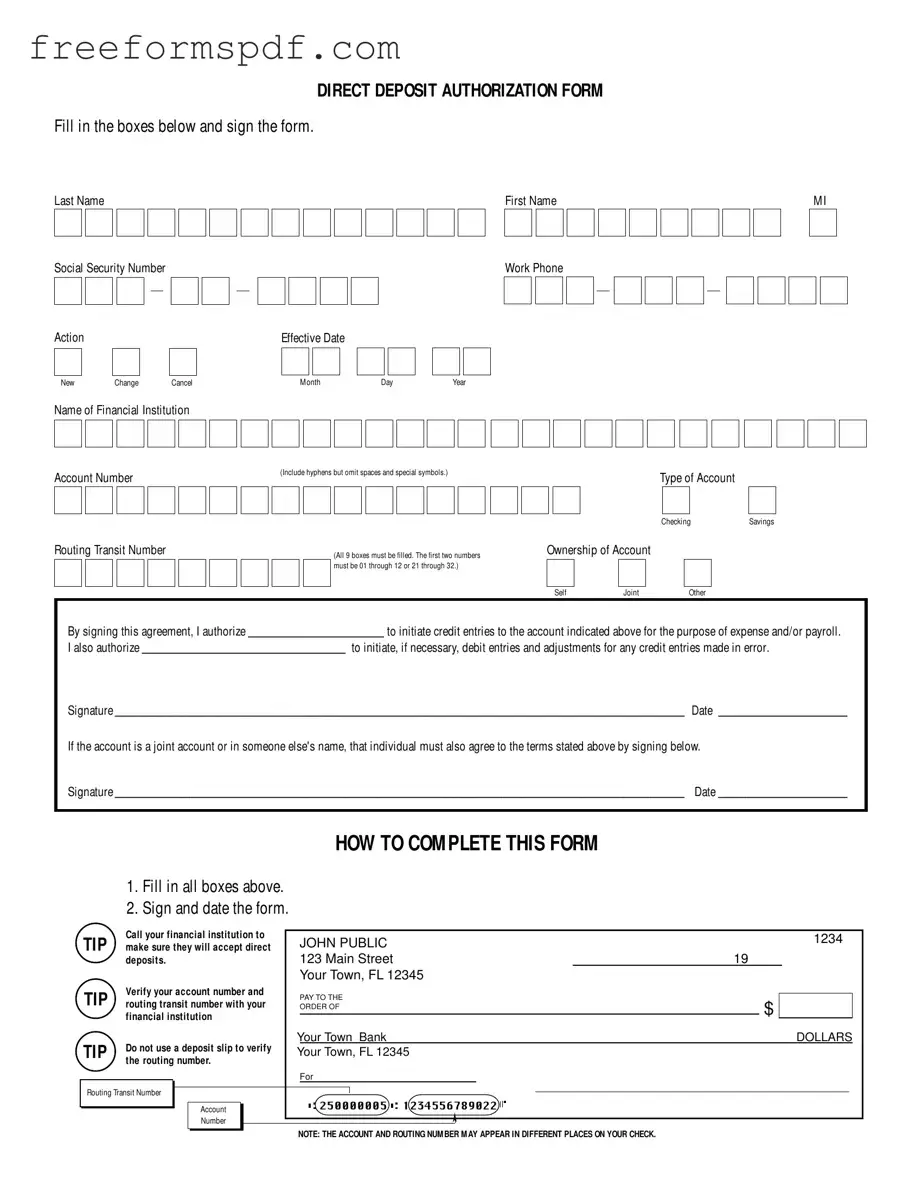

Filling out the form is straightforward. Start by entering your personal information, including your last name, first name, and Social Security Number. Next, indicate whether this is a new setup, a change, or a cancellation. You’ll also need to provide your work phone number, the name of your financial institution, your account number, and the routing transit number. Make sure to double-check that all numbers are correct and that you've signed and dated the form at the end.

-

What if I have a joint account?

If you have a joint account, both account holders must agree to the terms of the direct deposit. This means that the other individual will also need to sign the form. It’s crucial to ensure that both parties are on board to avoid any issues with the direct deposit process.

-

Why is it important to verify my account and routing numbers?

Verifying your account and routing numbers is essential to ensure that your funds are deposited correctly. Mistakes in these numbers can lead to delays or even misdirected deposits. Always confirm these numbers with your financial institution, and remember not to use a deposit slip for verification, as it may contain different information.

Misconceptions

Misconceptions about the Generic Direct Deposit form can lead to confusion and errors. Here are five common misunderstandings:

- Only employees can use the form. Many people believe that only employees of a company can utilize the Generic Direct Deposit form. In reality, anyone receiving payments—such as freelancers, contractors, or vendors—can also use this form to set up direct deposit.

- The routing number is optional. Some individuals think that the routing number is not necessary for setting up direct deposit. However, this number is crucial. It ensures that funds are directed to the correct financial institution.

- All banks accept the form without verification. There is a misconception that all banks will automatically accept the Generic Direct Deposit form. In fact, it’s essential to verify with your financial institution that they accept direct deposits and that the information provided is correct.

- Only one signature is needed for joint accounts. Many assume that for joint accounts, only one signature is required on the form. This is incorrect. Both account holders must sign the form to authorize the direct deposit.

- Filling out the form is straightforward and error-proof. While the form may seem simple, errors can occur if the information is not filled out correctly. It’s vital to double-check details like the account number and routing number to avoid issues with deposits.

Browse More Forms

Geico Partners - Each supplement request must be accompanied by this completed form.

For those looking to protect sensitive information, understanding the importance of a structured Non-disclosure Agreement process is crucial. This legal instrument ensures confidentiality and sets the stage for secure business dealings where sharing proprietary knowledge is involved. You can explore more about creating an effective Non-disclosure Agreement in your dealings through this detailed guide.

Ncl Parental Consent Form - This form fosters an atmosphere of safety and preparedness for all participants.

Simple Boyfriend Application Form - Looking for someone who enjoys deep conversations.