Fill in a Valid Florida Commercial Contract Template

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Missing details about the buyer, seller, or property can lead to misunderstandings and complications later on.

-

Incorrect Purchase Price: Entering the wrong purchase price or failing to specify the deposit amounts can cause confusion. It’s crucial to ensure that these numbers are accurate and clearly stated.

-

Ignoring Deadlines: Many people overlook the importance of deadlines, especially regarding acceptance and financing. Missing these dates can jeopardize the entire transaction.

-

Not Understanding Financing Terms: Buyers often make the mistake of not fully understanding the financing terms they agree to. This includes interest rates, loan amounts, and other conditions that can impact their financial obligations.

-

Overlooking Title Issues: Failing to address title conditions or potential encumbrances can lead to significant issues down the road. It's essential to clarify how the seller will convey title and any potential liabilities attached to it.

-

Neglecting Inspection Rights: Buyers sometimes forget to include their right to conduct inspections or fail to specify the due diligence period. This can limit their ability to assess the property’s condition before closing.

Learn More on This Form

-

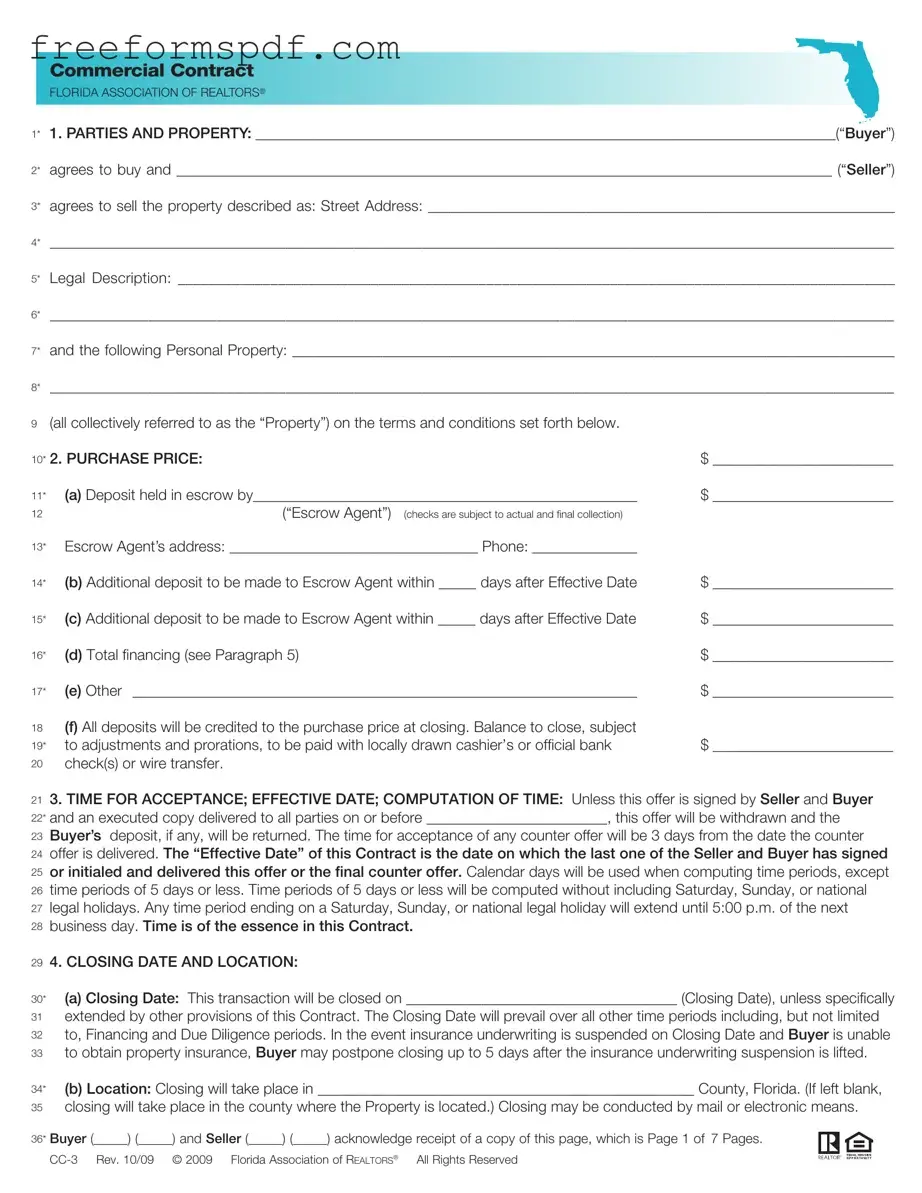

What is the purpose of the Florida Commercial Contract form?

The Florida Commercial Contract form is designed to facilitate the sale of commercial real estate in Florida. It outlines the terms and conditions agreed upon by the buyer and seller, including the purchase price, financing details, and contingencies that may affect the transaction. The form serves to protect the interests of both parties by clearly defining their obligations and rights throughout the process.

-

Who are the parties involved in the contract?

The contract involves two main parties: the buyer and the seller. The buyer is the individual or entity purchasing the property, while the seller is the individual or entity selling the property. Each party must provide their name and contact information, ensuring that all parties are clearly identified in the contract.

-

What is included in the property description section?

The property description section includes the street address, legal description, and any personal property included in the sale. It is crucial that this information is accurate and comprehensive, as it defines the exact property being sold. This section helps avoid disputes regarding what is included in the transaction.

-

How is the purchase price structured in the contract?

The purchase price is outlined in the contract and includes details about any deposits made, the total financing amount, and other financial considerations. The contract specifies how deposits will be held in escrow, credited to the purchase price at closing, and the balance due at closing. Clear financial terms help ensure that both parties understand their financial commitments.

-

What is the significance of the closing date?

The closing date is the date on which the transaction is finalized, and ownership of the property is transferred from the seller to the buyer. It is essential for both parties to adhere to this date, as it can affect financing, inspections, and other critical aspects of the sale. The contract may allow for extensions under specific circumstances, such as issues with insurance underwriting.

-

What happens if the buyer cannot secure financing?

If the buyer is unable to obtain financing despite making a good faith effort, they have the option to cancel the contract. The buyer must notify the seller within a specified timeframe. If the buyer fails to obtain loan approval, they may either waive the financing contingency or terminate the contract, which allows for the return of their deposit.

-

What are the seller's obligations regarding the title of the property?

The seller is responsible for conveying marketable title to the property, free of liens and encumbrances, except for those disclosed in the contract. The seller must provide evidence of title, such as a title insurance commitment or an abstract of title, within a specified timeframe. The buyer has the right to examine the title and raise any concerns about defects.

-

What is the due diligence period, and why is it important?

The due diligence period is a specified timeframe during which the buyer can conduct inspections and investigations to determine the property's suitability for their intended use. This period allows the buyer to assess the property's condition, zoning, and other factors. If the buyer finds the property unacceptable, they can terminate the contract without penalty.

-

What should parties know about the escrow agent?

The escrow agent is responsible for holding and disbursing funds according to the terms of the contract. Both parties authorize the escrow agent to manage the transaction's financial aspects. The agent is not liable for misdelivery unless it results from willful breach or gross negligence. Clear communication with the escrow agent is essential for a smooth transaction.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large businesses.

- Misconception 2: Once signed, the contract cannot be changed.

- Misconception 3: The buyer is responsible for all repairs after the sale.

- Misconception 4: The closing date is fixed and cannot be changed.

- Misconception 5: The seller must provide a warranty on the property.

- Misconception 6: All deposits are non-refundable.

This form is designed for any commercial real estate transaction, regardless of the size of the business. It can be used by small business owners, investors, and larger corporations alike.

While the contract is binding once executed, it can be modified if both parties agree to the changes in writing. This flexibility allows for adjustments based on negotiations or unforeseen circumstances.

The contract allows buyers to conduct inspections and negotiate repairs before closing. Buyers can request repairs or credits for any issues discovered during the due diligence period.

Although the contract specifies a closing date, it can be extended if both parties agree. This allows for adjustments based on financing, inspections, or other conditions that may arise.

The Florida Commercial Contract typically states that properties are sold "as is," meaning the seller is not obligated to provide warranties. Buyers should conduct thorough inspections to assess property conditions.

Deposits can be refunded under certain conditions outlined in the contract. If the buyer cannot secure financing or if specific contingencies are not met, the deposit may be returned to the buyer.

Browse More Forms

High School Transcript - A foundational document for lifelong educational and career pursuits.

Printable Gift Certificate - Celebrate milestones with a gift certificate for endless possibilities.

To facilitate a smooth transaction when buying or selling a vehicle, it's essential to utilize a Motor Vehicle Bill of Sale form, which not only confirms the transfer of ownership but also captures crucial details about the vehicle, such as its condition and sale terms. For a convenient option, you can access a free template here: https://newyorkform.com/free-motor-vehicle-bill-of-sale-template.

Fedex Door Tag Authorizing Release - FedEx aims to accommodate your preferences while maintaining package security.