Fill in a Valid Erc Broker Market Analysis Template

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to confusion and delays. Each section is crucial for a thorough analysis. Missing details about the property, homeowner, or financing can skew the results and affect the Most Likely Sales Price (MLSP).

-

Neglecting Local Regulations: Different states have specific disclosure requirements. Not being aware of these can result in legal issues or fines. It's essential to include any state-specific disclosures as part of the form to ensure compliance.

-

Overlooking Property Condition: The form requires a detailed assessment of the property's condition. Ignoring issues like water damage, structural problems, or deferred maintenance can misrepresent the property's true state. This oversight could mislead potential buyers and affect marketability.

-

Inaccurate Market Analysis: Underestimating or overestimating the competition can lead to an inaccurate MLSP. It's important to carefully compare the subject property with similar listings and sales in the area. Failing to analyze current market trends can result in pricing the property incorrectly.

Learn More on This Form

-

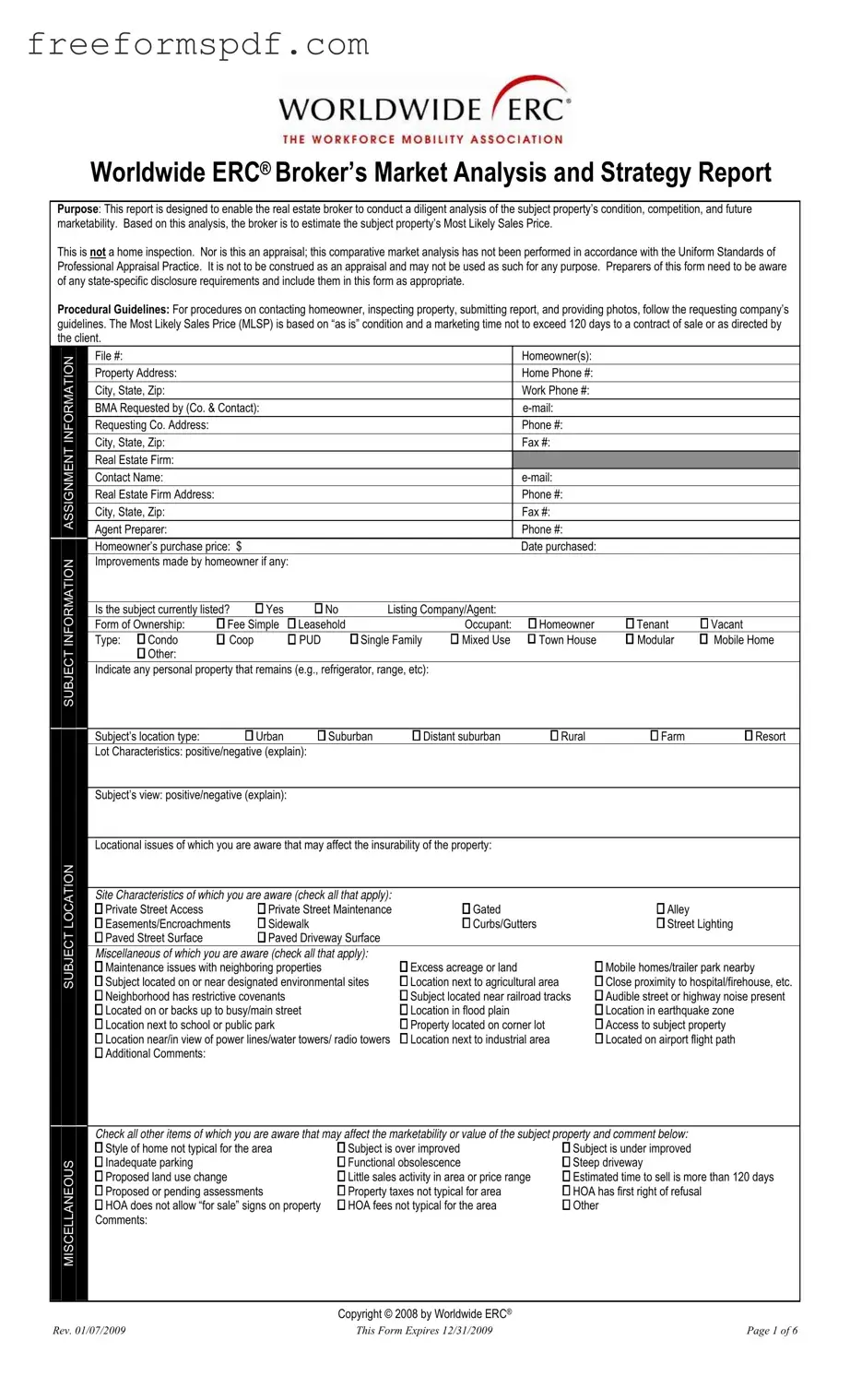

What is the purpose of the ERC Broker Market Analysis form?

The ERC Broker Market Analysis form is designed to help real estate brokers assess a property's condition, competition, and future marketability. The broker uses this information to estimate the property's Most Likely Sales Price (MLSP). It is important to note that this is not an appraisal or home inspection.

-

How is the Most Likely Sales Price determined?

The Most Likely Sales Price is based on the property’s “as is” condition and assumes a marketing time of no more than 120 days to secure a contract of sale. Brokers should also consider local market conditions and comparable properties when making their estimates.

-

What should I include when filling out the form?

When completing the form, include detailed information about the property, such as its address, condition, improvements made, and any issues that may affect insurability or marketability. Be sure to check all applicable boxes and provide comments where necessary.

-

Are there specific guidelines for using the form?

Yes, brokers must follow the requesting company’s guidelines for contacting the homeowner, inspecting the property, submitting the report, and providing photos. Additionally, state-specific disclosure requirements should be included as needed.

-

What types of properties can this analysis be used for?

This analysis can be used for various property types, including single-family homes, condos, townhouses, and mixed-use properties. It is essential to tailor the analysis to the specific characteristics of the subject property.

-

What should I do if I encounter issues during the inspection?

If you discover any issues that could affect the property’s value or marketability, document them clearly on the form. This could include structural problems, environmental concerns, or neighborhood issues that might impact insurability.

-

Can I use this form for properties that are not currently listed for sale?

Yes, the ERC Broker Market Analysis form can be used for properties that are not currently listed. The analysis helps estimate the sales price even if the property is not actively on the market.

-

How often should this form be updated?

It is advisable to update the form whenever there are significant changes to the property or market conditions. Regular updates ensure that the analysis remains accurate and reflective of the current market situation.

Misconceptions

Misconceptions about the ERC Broker Market Analysis form can lead to misunderstandings about its purpose and use. Here are nine common misconceptions:

- This form is an appraisal. The ERC Broker Market Analysis form is not an appraisal. It is a comparative market analysis that helps estimate a property’s Most Likely Sales Price based on various factors.

- It includes a home inspection. The form does not serve as a home inspection. It focuses on market analysis rather than assessing the physical condition of the property.

- All brokers can use it without training. While brokers can use the form, they must be aware of state-specific disclosure requirements and should be trained in its proper use to ensure accuracy.

- The Most Likely Sales Price is guaranteed. The estimated price is based on current market conditions and is not a guarantee of sale. It reflects an informed opinion rather than a definitive value.

- It can be used for any type of property. The form is specifically designed for certain types of properties. Brokers must ensure that it is appropriate for the property they are analyzing.

- The analysis is valid indefinitely. The data and conditions affecting the market can change. The analysis should be updated regularly to reflect current conditions.

- It is universally accepted. Different markets may have varying standards. Brokers should verify that the form meets local market practices and requirements.

- It is solely for residential properties. While primarily used for residential properties, it can also be adapted for certain commercial properties, depending on the context.

- It does not require any additional documentation. Brokers may need to provide supporting documents, such as recent sales data or market trends, to enhance the analysis.

Understanding these misconceptions can help brokers and clients use the ERC Broker Market Analysis form more effectively and avoid potential pitfalls.

Browse More Forms

Dd Form 2656 March 2022 Fillable - The DD 2656 helps clarify each retiree's options regarding benefit management.

Utilizing the New York Motorcycle Bill of Sale form is crucial, as it not only ensures clarity in the transaction but also legitimizes the sale, providing security for both parties involved. For those in need of a reliable template to facilitate this process, resources like NY Templates can be incredibly helpful in guiding you through the necessary steps.

Aia Qualification Statement - The form outlines the contractor’s organizational structure and workforce capacity.