Employee Loan Agreement Document

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes missing names, addresses, or employee identification numbers. Each section of the form is essential for processing the loan.

-

Incorrect Loan Amount: Some borrowers mistakenly enter an incorrect loan amount. Double-checking the figures ensures that the requested amount aligns with the company's policies and the employee's needs.

-

Missing Signatures: A common oversight is neglecting to sign the agreement. Both the employee and the employer must sign the document to validate the terms of the loan.

-

Ignoring Terms and Conditions: Failing to read the terms and conditions can lead to misunderstandings. Employees should carefully review the repayment schedule, interest rates, and any penalties for late payments.

-

Not Keeping a Copy: After submitting the form, some employees forget to keep a copy for their records. Retaining a copy is crucial for future reference and clarifying any potential disputes.

Learn More on This Form

-

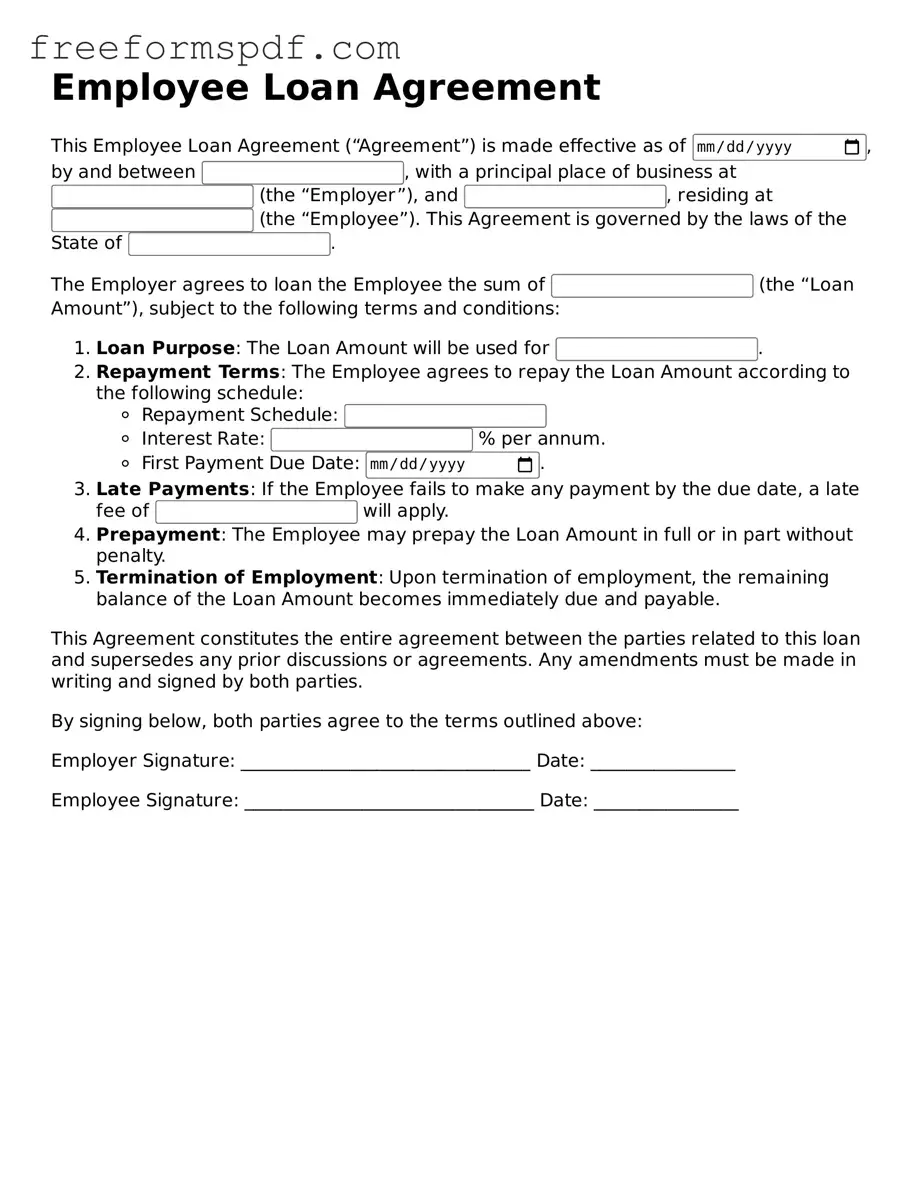

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement specifies the loan amount, repayment schedule, interest rate (if applicable), and any other relevant terms.

-

Who is eligible for an Employee Loan?

Eligibility for an Employee Loan typically depends on the employer's policies. Generally, full-time employees who have completed a certain period of service may qualify. Some employers may also consider the employee's financial situation or credit history.

-

What information is included in the Employee Loan Agreement?

The agreement usually includes:

- The loan amount

- The purpose of the loan

- The repayment terms, including due dates

- The interest rate, if any

- Consequences of default

- Any other specific terms agreed upon by both parties

-

How is the repayment process structured?

Repayment can be structured in various ways. Common methods include:

- Regular deductions from the employee's paycheck

- Monthly payments made directly by the employee

- A lump sum payment at the end of the loan term

Details of the repayment process will be clearly outlined in the agreement.

-

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan, the agreement should specify the consequences. This may include:

- Additional fees or penalties

- Withholding of future wages

- Legal action, if necessary

It is crucial for both parties to understand these terms before signing the agreement.

-

Can the terms of the Employee Loan Agreement be modified?

Yes, the terms can be modified, but any changes must be agreed upon by both the employer and the employee. It is advisable to document any modifications in writing to avoid misunderstandings.

-

Is an Employee Loan Agreement legally binding?

Yes, once signed by both parties, the Employee Loan Agreement is legally binding. This means that both the employer and the employee are obligated to adhere to the terms outlined in the agreement.

-

Where can I obtain an Employee Loan Agreement form?

Employee Loan Agreement forms can typically be obtained from your company's HR department or legal team. Additionally, various online resources provide templates that can be customized to meet specific needs.

Misconceptions

When it comes to Employee Loan Agreements, there are several common misconceptions that can lead to confusion for both employers and employees. Understanding these misconceptions can help ensure that both parties are clear on their rights and responsibilities. Here are four prevalent myths:

-

All employee loans are interest-free.

Many people assume that loans provided by employers to employees do not carry interest. In reality, the terms of the loan, including interest rates, should be clearly outlined in the agreement. Employers may choose to charge interest to cover the cost of lending.

-

Employee Loan Agreements are not legally binding.

Another common belief is that these agreements are informal and not enforceable. However, once both parties sign the agreement, it becomes a legally binding document. This means that both the employer and employee are obligated to adhere to the terms outlined in the agreement.

-

Only large companies offer employee loans.

Some people think that only large corporations provide loans to their employees. In truth, businesses of all sizes can offer employee loans. Small companies may also find it beneficial to provide financial assistance to retain talent and support their workforce.

-

Employee Loan Agreements are only for emergencies.

While many employees may seek loans during financial emergencies, these agreements can also be used for other purposes, such as education expenses or home purchases. The specific purpose of the loan should be discussed and documented in the agreement.