Fill in a Valid Employee Advance Template

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Missing sections can delay the processing of the advance.

-

Incorrect Amounts: Some employees miscalculate the amount they request. Double-checking calculations can prevent issues later.

-

Failure to Sign: A common oversight is neglecting to sign the form. Without a signature, the form may be considered invalid.

-

Not Following Company Policy: Each organization may have specific guidelines for advances. Ignoring these can lead to rejection of the request.

-

Submitting Late: Timing is crucial. Late submissions can result in delays or denial of the advance request.

Learn More on This Form

-

What is the Employee Advance form?

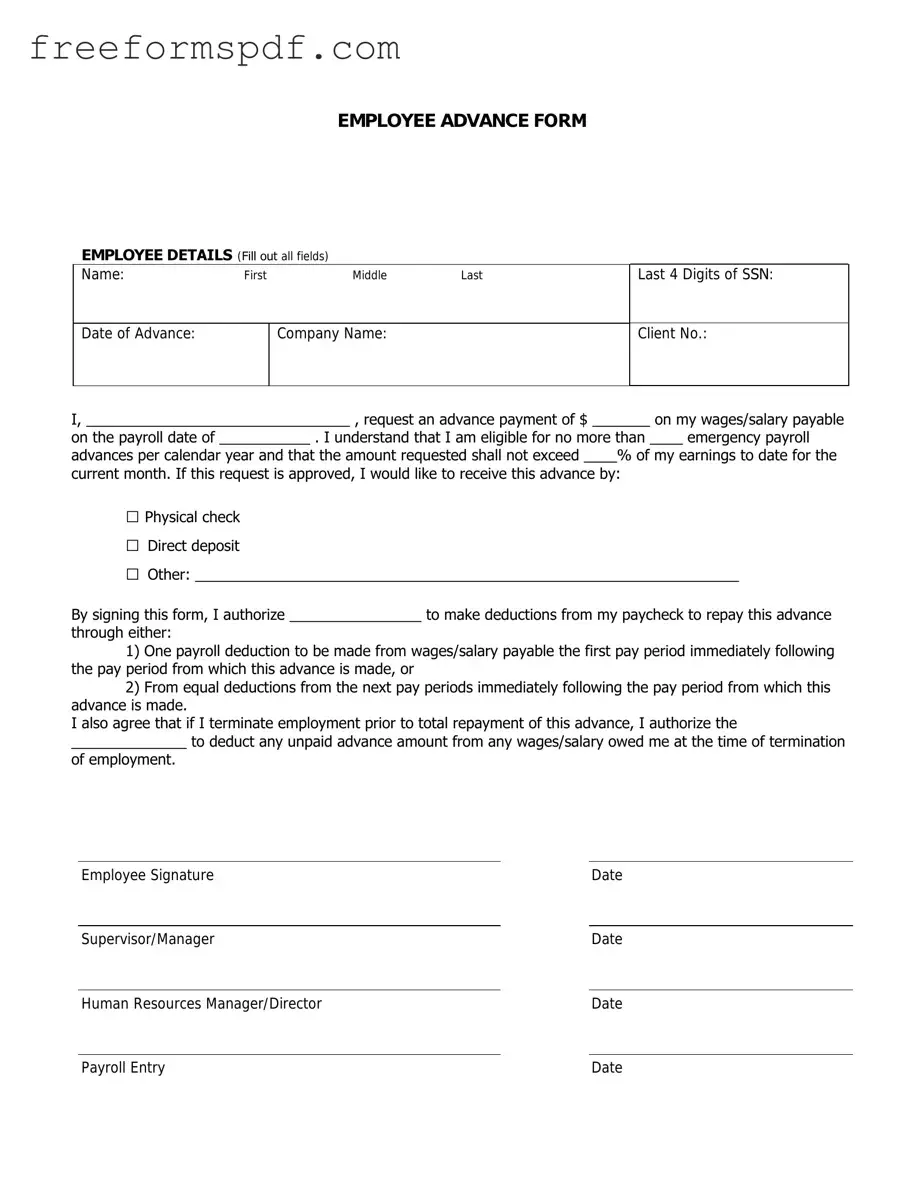

The Employee Advance form is a document that employees use to request an advance on their salary or wages. This advance can help employees manage unexpected expenses or financial emergencies before their regular payday. The form typically requires employees to provide details about the amount requested and the reason for the advance.

-

Who is eligible to submit an Employee Advance form?

Generally, all employees who have been with the company for a specified period are eligible to submit the Employee Advance form. However, eligibility criteria may vary by organization. It is essential to check with your HR department or company policy for specific requirements regarding eligibility.

-

How do I fill out the Employee Advance form?

Filling out the Employee Advance form is straightforward. Start by entering your personal information, including your name, employee ID, and department. Next, indicate the amount you wish to request and provide a brief explanation of why you need the advance. Be sure to sign and date the form before submission. If you have any questions while completing the form, consider reaching out to your HR representative for assistance.

-

What happens after I submit the Employee Advance form?

Once you submit the Employee Advance form, it will typically be reviewed by your supervisor or HR department. They will evaluate your request based on company policy and your employment history. You should receive a response within a few business days. If approved, the advance will be processed and included in your next paycheck or issued separately, depending on company procedures.

-

Do I need to repay the advance?

Yes, most companies require employees to repay the advance through deductions from future paychecks. The repayment terms, including the amount deducted and the repayment schedule, will be outlined in the approval notice you receive after your request is processed. It is crucial to understand these terms to avoid any confusion about your future paychecks.

Misconceptions

Understanding the Employee Advance form can be challenging due to various misconceptions. Below is a list of eight common misunderstandings related to this form.

- All employees are eligible for an advance. Many believe that every employee can request an advance, but eligibility often depends on company policy and the employee's length of service.

- Advances are automatically approved. Some may think that submitting the form guarantees approval. However, each request is subject to review and may be denied based on specific criteria.

- Advances do not need to be repaid. A common misconception is that advances are free money. In reality, they are loans that must be repaid, typically through payroll deductions.

- There is no limit to the amount that can be requested. Employees might assume they can request any amount. However, most companies set a cap on the maximum advance based on various factors.

- The process is quick and easy. While the form may seem straightforward, the approval process can take time, especially if additional documentation is required.

- Advances can be used for any purpose. Employees often think they can use advances for personal expenses. However, many companies restrict the use of advances to work-related costs.

- Submitting the form is the only requirement. Some may believe that filling out the form is sufficient. In many cases, additional steps, such as providing justification or documentation, are necessary.

- Once approved, the funds are immediately available. Employees might expect instant access to funds after approval. However, disbursement timelines can vary based on company procedures.

Being aware of these misconceptions can help employees navigate the Employee Advance process more effectively and avoid potential pitfalls.

Browse More Forms

Navpers 1336 3 - Duplication of requests may be avoided through the careful use of this form.

When engaging in the sale or transfer of vehicles in New York, particularly those that are 1972 or older or any non-titled vehicles, it's crucial to utilize the proper documentation, such as the New York MV51 form. This certification helps ensure the transaction's legitimacy and, to streamline the process, you can refer to resources like NY Templates for assistance with obtaining the necessary forms and understanding the requirements.

Player Evaluation Form Basketball - Examine teamwork and overall work ethic in practice and games.

Dog Vaccination Booster Late - Assists in fellowship between dog owners and health regulation.