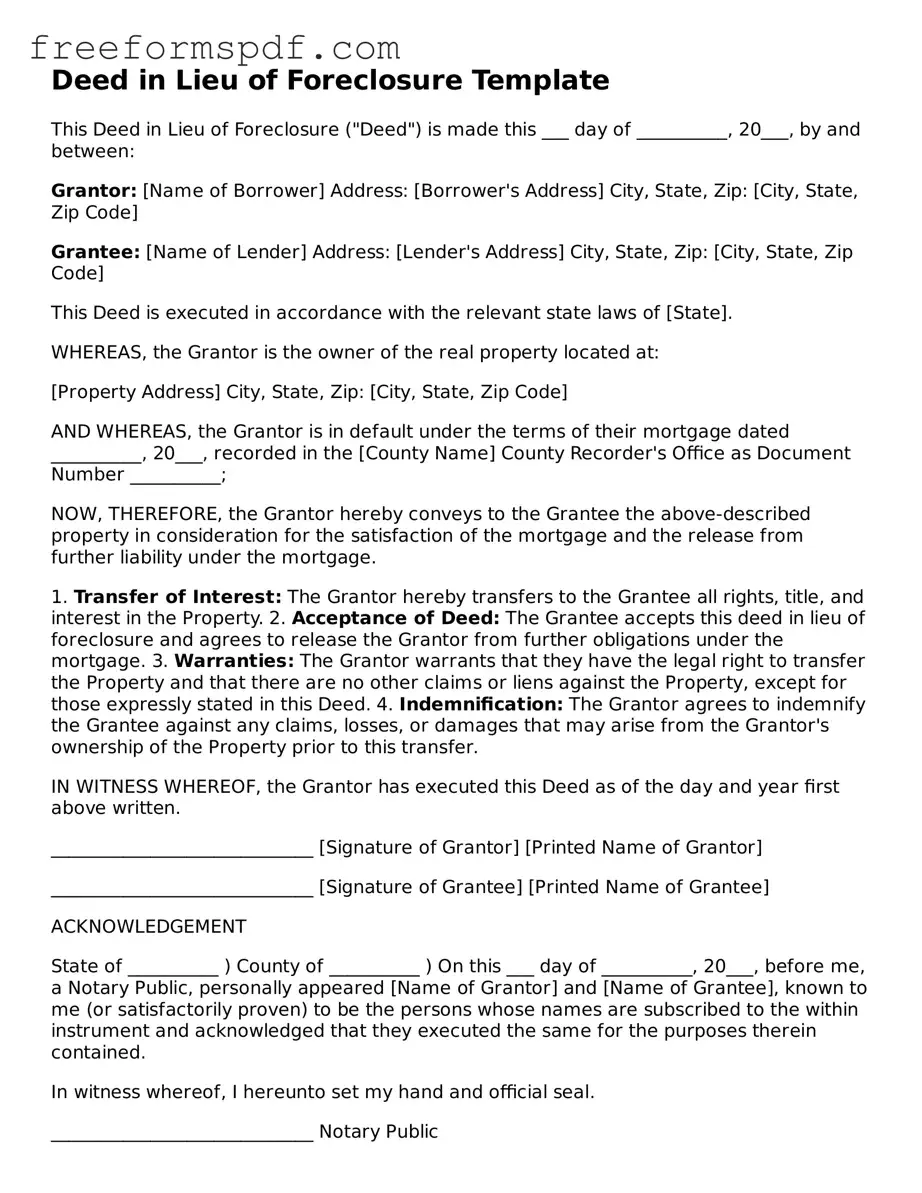

Deed in Lieu of Foreclosure Document

Deed in Lieu of Foreclosure - Customized for Each State

Common mistakes

-

Not Reading the Instructions Carefully: Many people rush through the instructions and miss important details. Take your time to understand each section.

-

Failing to Provide Accurate Information: Inaccurate personal information or property details can lead to delays or rejection. Double-check everything before submission.

-

Not Including Required Signatures: Forgetting to sign the document or missing a co-owner's signature can invalidate the deed. Ensure all necessary parties sign.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for a deed in lieu of foreclosure. Research your state’s laws to ensure compliance.

-

Not Consulting with a Legal Professional: Skipping legal advice can lead to mistakes that are hard to fix later. Consider consulting a lawyer to review the form.

-

Overlooking Tax Implications: Not understanding the tax consequences of a deed in lieu of foreclosure can result in unexpected liabilities. Consult a tax advisor if needed.

-

Failing to Keep Copies: Not retaining copies of the submitted form and related documents can create issues later. Always keep a record for your files.

Learn More on This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and their lender. In this arrangement, the homeowner voluntarily transfers ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This option is often considered when a homeowner is facing financial difficulties and wants to avoid the lengthy and stressful foreclosure process.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It allows homeowners to avoid foreclosure, which can have a lasting negative impact on their credit score.

- The process is typically quicker and less costly than a traditional foreclosure.

- Homeowners may be able to negotiate terms with the lender, such as a move-out date or potential forgiveness of remaining debt.

-

Are there any drawbacks to consider?

Yes, there are some potential downsides. A Deed in Lieu of Foreclosure can still affect your credit score, although not as severely as a foreclosure. Additionally, not all lenders accept this option, and some may have specific requirements that must be met. It's also important to consider that you may not be able to pursue this option if there are multiple liens on the property.

-

How do I initiate a Deed in Lieu of Foreclosure?

To start the process, you should first contact your lender to discuss your situation. They will provide you with the necessary forms and information. It’s advisable to gather all relevant documentation, such as your mortgage agreement and financial statements. Consulting with a legal expert can also help you navigate the process more smoothly and ensure that you understand your rights and obligations.

Misconceptions

Understanding a Deed in Lieu of Foreclosure can be tricky. Here are six common misconceptions that people often have about this process:

- It eliminates all debt. Many believe that signing a Deed in Lieu of Foreclosure wipes out all their mortgage debt. In reality, it only transfers ownership of the property back to the lender. Any remaining debts or obligations may still exist.

- It's a quick solution. Some think that a Deed in Lieu is a fast way to resolve their mortgage issues. However, the process can take time. Lenders often require thorough documentation and may take weeks or even months to process the deed.

- It won't affect your credit score. Many assume that a Deed in Lieu of Foreclosure has no impact on their credit. Unfortunately, it typically does affect your credit score negatively, similar to a foreclosure.

- It is the same as a short sale. Some people confuse a Deed in Lieu with a short sale. While both involve transferring property to the lender, a short sale occurs when the property is sold for less than the mortgage balance, with lender approval.

- It can be done without lender approval. A common misconception is that homeowners can simply sign over their property without any lender involvement. In fact, lenders must agree to the Deed in Lieu for it to be valid.

- It absolves you from future liability. Many think that once they sign a Deed in Lieu, they are free from any future claims by the lender. This is not always the case. Depending on state laws and the terms of the agreement, you may still be liable for certain debts.

Be sure to get informed and seek professional advice before making any decisions related to a Deed in Lieu of Foreclosure.

Other Types of Deed in Lieu of Foreclosure Forms:

Quit Claim Deed Blank Form - May require notarization depending on state laws.

In addition to understanding the importance of the Nyc Apartment Registration Form, landlords can find a useful resource from NY Templates that provides a template to simplify the registration process, ensuring that all necessary information is accurately captured and submitted on time.

United States Tod - This form can simplify estate management, reducing the burden on heirs and minimizing potential disputes.

Free Printable Gift Deed Form - Often used in estate planning, a Gift Deed can help reduce tax liabilities.