Corrective Deed Document

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to delays. Ensure that every section of the form is filled out completely.

-

Incorrect Names: Using the wrong names for parties involved can invalidate the deed. Double-check spelling and ensure that the names match official documents.

-

Omitting Signatures: All required signatures must be present. Without them, the deed may not be considered valid.

-

Not Including the Correct Legal Description: The property’s legal description should be accurate and detailed. Errors in this section can create confusion and legal issues.

-

Failure to Notarize: Many jurisdictions require notarization for the deed to be valid. Skipping this step can result in the deed being rejected.

-

Ignoring Local Regulations: Each state may have different requirements for corrective deeds. Familiarize yourself with local laws to ensure compliance.

-

Not Keeping Copies: After submitting the form, it’s essential to keep copies for your records. This can help resolve any future disputes or questions.

Learn More on This Form

-

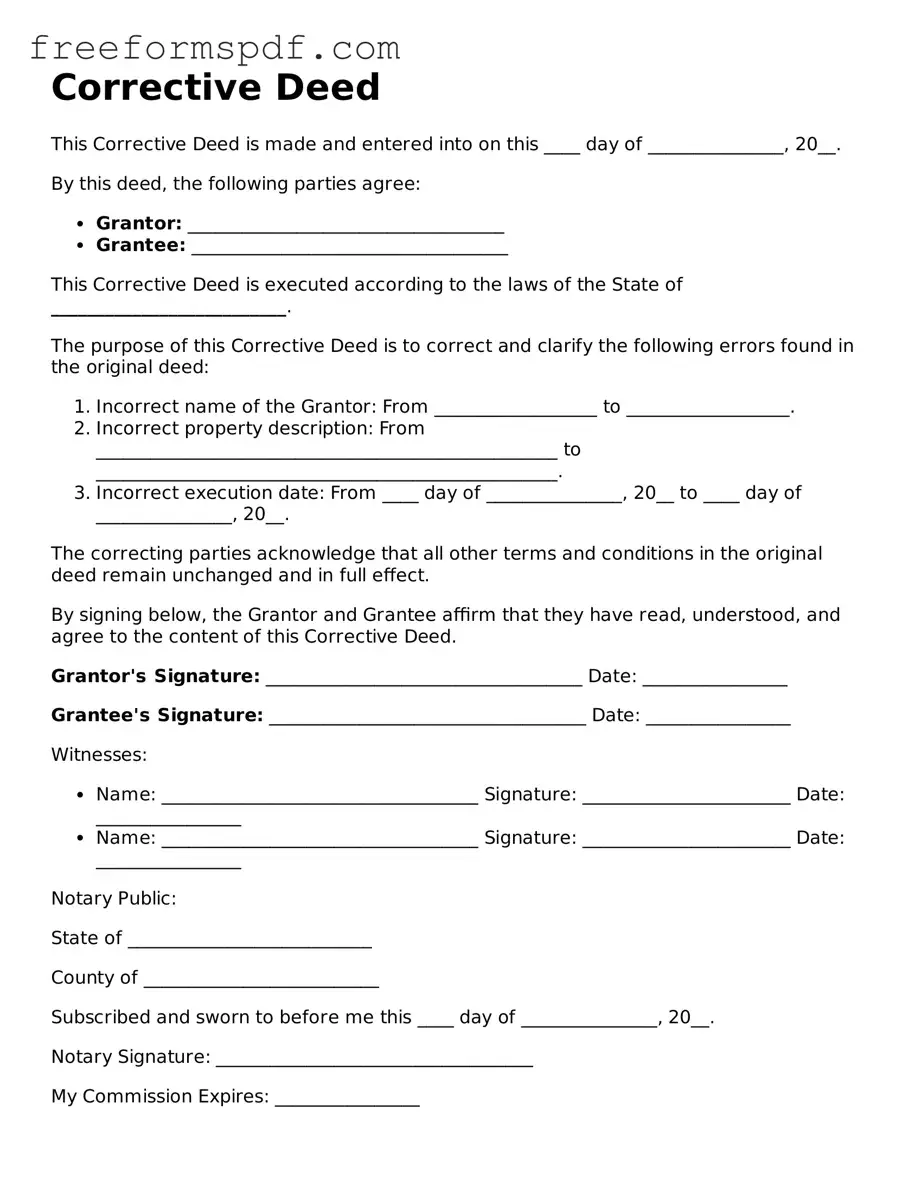

What is a Corrective Deed?

A Corrective Deed is a legal document used to amend or correct errors in a previously executed deed. This could include mistakes such as misspelled names, incorrect property descriptions, or other clerical errors that could affect the validity of the original deed. By filing a Corrective Deed, the parties involved ensure that the public record accurately reflects the intended terms of the original transaction.

-

When should a Corrective Deed be used?

A Corrective Deed should be used when there are identifiable mistakes in an existing deed that need to be rectified. Common situations include:

- Incorrect names of the grantor or grantee.

- Errors in the legal description of the property.

- Omissions of necessary information that were present in the original deed.

It is essential to address these errors promptly to avoid potential legal disputes or complications in future transactions involving the property.

-

How is a Corrective Deed prepared?

Preparing a Corrective Deed involves several steps. First, review the original deed to identify the specific errors that need correction. Next, draft the Corrective Deed, clearly stating the original deed's details and specifying the corrections being made. It is crucial to include a reference to the original deed's recording information, such as the book and page number. After drafting, the Corrective Deed must be signed by the parties involved and notarized. Finally, it should be filed with the appropriate county recorder's office to ensure the corrections are officially recognized.

-

Are there any costs associated with filing a Corrective Deed?

Yes, there are typically costs associated with filing a Corrective Deed. These may include:

- Filing fees charged by the county recorder's office.

- Notary fees for witnessing the signatures.

- Potential attorney fees if legal assistance is required for drafting the document.

It is advisable to check with the local recorder's office for specific fee amounts and any additional requirements that may apply.

Misconceptions

Understanding the Corrective Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Below is a list of ten common misconceptions about the Corrective Deed form, along with explanations to clarify each point.

- Corrective Deeds are only for correcting names. Many believe that these deeds are solely for name corrections. In reality, they can address various errors, including incorrect legal descriptions or omissions.

- All errors require a Corrective Deed. Not every mistake necessitates a Corrective Deed. Minor errors may be rectified through other means, depending on the situation.

- Corrective Deeds are unnecessary if the error is minor. Even minor errors can lead to significant issues in property transactions. Using a Corrective Deed can provide clarity and prevent future disputes.

- A Corrective Deed is the same as a Quitclaim Deed. These two forms serve different purposes. A Quitclaim Deed transfers interest without guaranteeing title, while a Corrective Deed specifically corrects errors in existing deeds.

- Only attorneys can file a Corrective Deed. While it is advisable to seek legal counsel, individuals can file a Corrective Deed themselves if they understand the process and requirements.

- Corrective Deeds can be used to change property ownership. This is incorrect. A Corrective Deed does not transfer ownership; it merely corrects errors in the existing deed.

- There is a specific form for every type of correction. There is no one-size-fits-all form. The Corrective Deed is a flexible document that can be tailored to the specific error being corrected.

- Once a Corrective Deed is filed, the original deed is void. This is not true. The original deed remains valid; the Corrective Deed simply clarifies or corrects specific details within it.

- Filing a Corrective Deed is a lengthy process. The process can be straightforward and quick if the necessary information is prepared correctly. Timeliness often depends on local recording office procedures.

- Corrective Deeds are only necessary for residential properties. This is a misconception. Corrective Deeds can be used for any type of property, including commercial and industrial real estate.

By addressing these misconceptions, individuals can navigate the process of filing a Corrective Deed with greater confidence and understanding.

Other Types of Corrective Deed Forms:

Free Printable Gift Deed Form - Using a Gift Deed may simplify the process of transferring property among family members.

When preparing to transfer property ownership in Georgia, it is essential to utilize a reliable resource such as Georgia PDF, which provides the necessary forms and guidance to ensure a smooth transaction.