Fill in a Valid Citibank Direct Deposit Template

Common mistakes

-

Incorrect Account Number: Many individuals mistakenly enter the wrong account number. Double-checking this number is crucial, as an error could lead to funds being deposited into the wrong account.

-

Wrong Routing Number: The routing number is essential for directing the deposit to the correct bank. Ensure that the routing number matches the bank branch associated with your account.

-

Missing Signature: Some people forget to sign the form. A signature is often required to authorize the direct deposit. Without it, the form may be deemed invalid.

-

Inaccurate Personal Information: Providing incorrect personal details, such as your name or address, can lead to confusion. Always verify that your information matches what is on file with your employer and the bank.

-

Not Updating Information: If you change banks or accounts, failing to update your direct deposit information can result in lost or delayed payments. Regularly review your information to ensure it is current.

-

Neglecting to Confirm Submission: After submitting the form, it’s important to confirm that it has been received and processed by your employer. Keep a copy for your records and follow up if you do not see deposits as expected.

Learn More on This Form

-

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows you to set up direct deposit for your paycheck or other recurring payments. By completing this form, you authorize your employer or payment provider to deposit funds directly into your Citibank account.

-

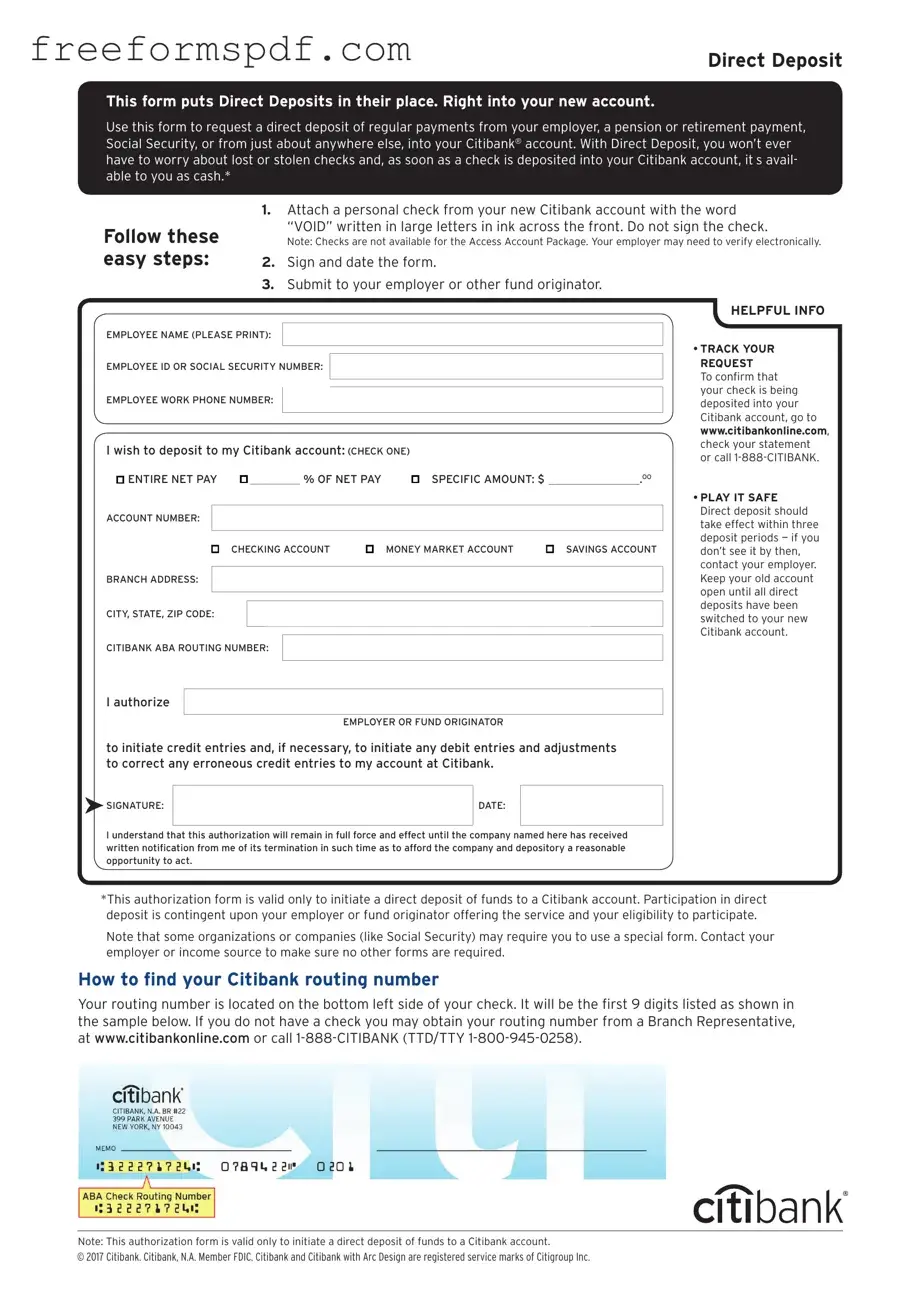

How do I complete the Citibank Direct Deposit form?

To complete the form, you will need to provide your personal information, including your name, address, and account number. Additionally, you must include your bank’s routing number. This information ensures that your funds are deposited correctly into your account. Make sure to double-check all details for accuracy.

-

Where do I submit the completed form?

Once you have filled out the Citibank Direct Deposit form, submit it to your employer or the organization that will be making the deposits. They may have specific instructions on how to send it, such as by email, fax, or physical mail. Always keep a copy for your records.

-

How long does it take for direct deposit to start?

The time it takes for direct deposit to begin can vary. Generally, it may take one to two pay cycles for the direct deposit to be set up and processed. If you have questions or concerns about the timeline, reach out to your employer’s payroll department for more information.

Misconceptions

Understanding the Citibank Direct Deposit form is essential for ensuring smooth financial transactions. However, several misconceptions may lead to confusion. Here is a list of common misconceptions along with clarifications:

- Direct deposit is only for payroll. Many people believe that direct deposit can only be used for salary payments. In reality, it can also be used for government benefits, tax refunds, and other types of payments.

- Direct deposit is complicated to set up. Some individuals think that setting up direct deposit is a complex process. In fact, it typically involves filling out a simple form and providing your bank details.

- Direct deposit is not secure. There is a common belief that direct deposit is less secure than receiving paper checks. However, direct deposit is generally considered safer, as it reduces the risk of checks being lost or stolen.

- You can only have one direct deposit account. Many assume that they can only designate one bank account for direct deposits. In truth, it is often possible to split deposits between multiple accounts, depending on the employer or payment provider.

- Direct deposit means you lose access to your funds. Some people worry that once funds are deposited, they cannot access them immediately. Funds from direct deposits are typically available on the same day they are deposited.

- Changing your direct deposit account is a hassle. There is a misconception that changing your direct deposit account requires extensive paperwork and time. In reality, it usually involves submitting a new form to your employer or payment provider.

- Direct deposit forms are the same across all banks. Many believe that the direct deposit form is standardized across all financial institutions. However, each bank may have its own specific form and requirements for processing direct deposits.

By addressing these misconceptions, individuals can better understand the Citibank Direct Deposit form and utilize it effectively.

Browse More Forms

Health Guarantee for Puppies Template - Once puppies leave the Breeder’s control, further guarantees are not applicable.

For those looking to understand the intricacies of retirement options available to them, the NYCERS F170 form stands out as an essential tool. It serves as a pathway for Tier 1 and Tier 4 members of the New York City Employees Retirement System (NYCERS) wishing to join the Optional 25-Year Retirement Program for Emergency Medical Technicians (EMT). To navigate this process effectively, additional resources such as NY Templates can provide valuable guidance and support, ensuring that applicants are fully informed about the eligibility criteria and the enrollment process.

Navpers 1336 3 - Eligibility criteria are outlined to help applicants understand their standing.