Fill in a Valid Childcare Receipt Template

Common mistakes

-

Neglecting to Include the Date: It is essential to fill in the date when the childcare services were provided. Without this information, the receipt may lack clarity and could lead to complications during tax filing or reimbursement requests.

-

Incorrect Amount Entry: Double-check the amount paid for childcare services. Errors in this section can result in financial discrepancies and may affect eligibility for tax credits or deductions.

-

Omitting the Provider’s Signature: The signature of the childcare provider is a crucial component of the receipt. This signature serves as proof that the services were rendered and payment was received.

-

Failing to List All Children: If multiple children are receiving care, it is important to list each child's name clearly. Omitting a child’s name can lead to confusion and may impact any potential benefits or claims.

Learn More on This Form

-

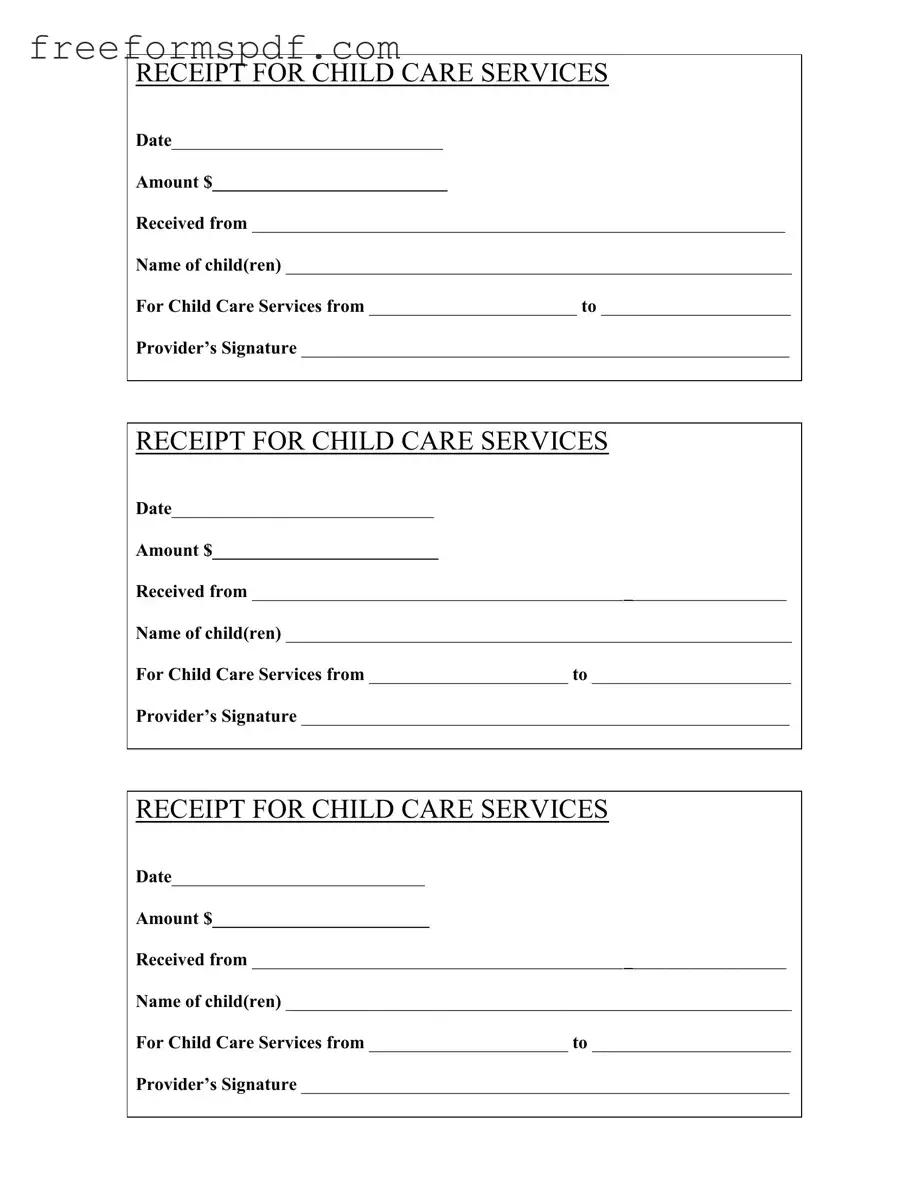

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a written record of payment for childcare services. It provides essential details such as the date of service, amount paid, and the names of the children receiving care. This form is important for both parents and childcare providers for tracking payments and for tax purposes.

-

Who needs to fill out the Childcare Receipt form?

The childcare provider is responsible for filling out the Childcare Receipt form. They should complete it each time a payment is received from a parent or guardian. Parents may also want to keep a copy for their records.

-

What information is required on the form?

The form requires several key pieces of information:

- Date of service

- Amount paid

- Name of the person making the payment

- Name(s) of the child(ren) receiving care

- Dates of the childcare services

- Provider’s signature

-

Can I use a handwritten receipt?

Yes, a handwritten receipt can be used as long as it includes all the necessary information. However, it’s best to use a standardized form to ensure clarity and consistency. This can help avoid any confusion later on.

-

Is the Childcare Receipt form necessary for tax deductions?

Yes, the Childcare Receipt form is often necessary for claiming tax deductions related to childcare expenses. Parents should keep these receipts as proof of payment when filing taxes, as they may be eligible for credits or deductions.

-

How should I store the receipts?

It’s advisable to keep the receipts in a safe and organized manner. Consider using a folder or binder specifically for childcare-related documents. This way, you can easily access them when needed, especially during tax season.

-

What if I lose a receipt?

If a receipt is lost, the childcare provider can issue a duplicate receipt if they have a record of the transaction. It’s important to communicate with the provider promptly to ensure you have the necessary documentation.

-

Are there any specific regulations regarding childcare receipts?

While there may not be strict regulations on the format of the receipt, it is essential that it includes all required information. Each state may have its own guidelines regarding childcare services, so it’s beneficial to be aware of local laws.

-

Can I customize the Childcare Receipt form?

Yes, the Childcare Receipt form can be customized to fit the needs of the childcare provider. However, it’s important to ensure that all required information remains included. Customization can help make the form more user-friendly or align with the provider’s branding.

Misconceptions

Misunderstandings about the Childcare Receipt form can lead to confusion for both parents and childcare providers. Here are ten common misconceptions:

- All childcare providers must use the same receipt format. Many assume that there is a universal template, but providers can create their own receipts as long as they include essential information.

- The receipt is only necessary for tax purposes. While many parents use it for tax deductions, the receipt also serves as proof of payment and can be helpful for personal record-keeping.

- Only licensed providers need to issue receipts. Regardless of licensing status, any childcare provider can issue a receipt to document services rendered.

- Receipt information is not important. Each detail, such as dates and amounts, is crucial. Inaccuracies can complicate tax filings or disputes over services.

- Parents must request a receipt. Providers should automatically issue receipts after payment. However, parents can always ask for one if it is not provided.

- Electronic receipts are not valid. Digital receipts are just as valid as paper ones, provided they contain the necessary information and are properly formatted.

- The receipt does not need to be signed. A provider’s signature adds legitimacy and confirms that the transaction took place, making it an important element.

- Only the amount paid is relevant. The receipt must also detail the services provided and the specific dates to ensure clarity and transparency.

- Receipts can be altered after issuance. Modifying a receipt after it has been issued can lead to legal issues. It is best to issue a new receipt for any corrections needed.

- Childcare receipts are only for full-time care. Receipts can be issued for any childcare services, whether part-time, drop-in, or full-time, as long as they are documented appropriately.

Browse More Forms

Florida Family Law Financial Affidavit Short Form - For families, the affidavit helps in planning for future financial stability.

Properly managing payroll for construction projects in New York is essential, and utilizing resources like the NY Templates can greatly simplify the process for contractors and subcontractors. This aids in adhering to the legal requirements for reporting weekly employee payroll information, as mandated by the Department of Labor's Bureau of Public Work.

Asurion Wireless - The form aids in providing clear instructions for claim submission.

Employer's Quarterly Federal Tax Return - Completing IRS 941 can assist in labor cost management for employers.