Fill in a Valid Cg 20 10 07 04 Liability Endorsement Template

Common mistakes

-

Failing to include the correct policy number. Ensure that you enter the exact policy number to avoid processing delays.

-

Not specifying the additional insured parties. Clearly list all individuals or organizations that should be covered under this endorsement.

-

Leaving out the locations of covered operations. It's crucial to provide specific locations where the coverage applies to avoid confusion.

-

Ignoring the requirement for accurate information. Any missing or incorrect details can lead to disputes over coverage later.

-

Not understanding the limitations of coverage. Review the terms to know what is and isn’t covered to avoid surprises.

-

Overlooking contractual obligations. If coverage is required by a contract, ensure that it aligns with what is stated in that contract.

-

Failing to sign and date the form. A signature is essential to validate the endorsement; without it, the form is incomplete.

-

Not keeping a copy of the completed form. Always retain a copy for your records, as it may be needed for future reference.

-

Submitting the form without reviewing it. Double-check all entries for accuracy before sending it in to prevent errors.

-

Assuming all coverage is automatic. Understand that additional insured status may not automatically include all types of coverage; verify what is specifically included.

Learn More on This Form

-

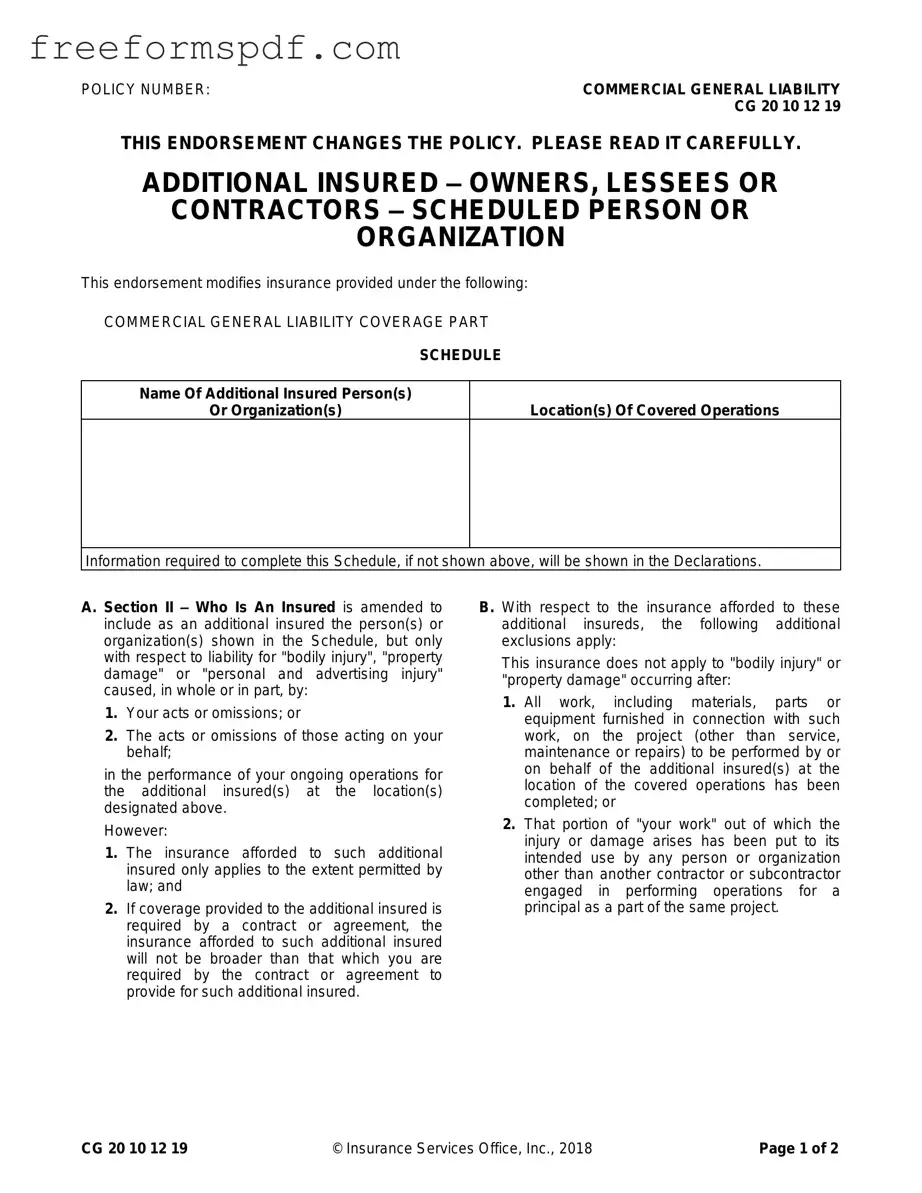

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

This endorsement adds specific additional insureds to your Commercial General Liability policy. It ensures that certain persons or organizations are covered for liabilities arising from your operations, as specified in the endorsement.

-

Who qualifies as an additional insured under this endorsement?

The endorsement includes the persons or organizations listed in the Schedule. They are covered for liabilities related to bodily injury, property damage, or personal and advertising injury caused by your actions or those acting on your behalf during ongoing operations.

-

Are there limitations on the coverage for additional insureds?

Yes, coverage is limited to the extent permitted by law. Additionally, if a contract requires specific coverage, the insurance for the additional insured cannot exceed what is stipulated in that contract.

-

What types of injuries or damages are covered?

The endorsement covers bodily injury, property damage, and personal and advertising injury. However, these must arise from your acts or omissions or those of individuals acting on your behalf.

-

Are there exclusions to the coverage for additional insureds?

Yes, coverage does not apply to bodily injury or property damage that occurs after all work related to the project has been completed. This includes materials, parts, or equipment furnished in connection with the work.

-

What happens if the work has been put to its intended use?

If the portion of your work that caused the injury or damage has been used as intended by someone other than another contractor or subcontractor on the same project, coverage will not apply.

-

How are the limits of insurance affected by this endorsement?

The endorsement does not increase the applicable limits of insurance. The maximum amount payable on behalf of the additional insured is the lesser of what is required by the contract or the limits available under your policy.

-

Is there a need to complete any additional information?

If the Schedule does not include specific names or locations, you must provide this information in the Declarations. It is crucial to ensure all relevant details are accurately documented.

-

What should I do if I have more questions about this endorsement?

If you have further questions, consider reaching out to your insurance agent or legal advisor. They can provide clarification and guidance tailored to your specific situation.

Misconceptions

Misconceptions about the CG 20 10 07 04 Liability Endorsement form can lead to confusion regarding its purpose and application. Here are five common misconceptions:

- It automatically provides full coverage for all claims. Many believe that adding an additional insured automatically grants them full coverage. In reality, coverage is limited to specific liabilities and situations as outlined in the endorsement.

- All additional insureds receive the same level of coverage. Some think that every additional insured receives identical coverage. However, the extent of coverage can vary based on the terms of the contract or agreement that necessitated the endorsement.

- Coverage applies regardless of the circumstances. There is a misconception that the endorsement covers any incident involving the additional insured. In fact, coverage is only applicable if the liability arises from the acts or omissions of the primary insured during their ongoing operations for the additional insured.

- The endorsement increases the policy's limits. Many assume that adding an additional insured increases the overall limits of the insurance policy. This is incorrect; the endorsement does not raise the limits but rather adheres to the existing policy limits or those specified in the contract.

- It covers all types of damages. Some people think that the endorsement covers all forms of liability. However, it specifically addresses "bodily injury," "property damage," and "personal and advertising injury," and excludes certain situations as detailed in the endorsement.

Browse More Forms

Cuddle Application - Form connections that transcend conventional friendship through cuddling.

6 Team Single Elimination Bracket With Consolation - Consistently updating game results can lead to exciting outcomes.

When engaging in a trailer transaction, it is essential to utilize the New York Trailer Bill of Sale form, which not only serves as proof of purchase but also clarifies the seller's rights and the buyer's ownership. For those looking to draft this important legal document, you can find a helpful resource at newyorkform.com/free-trailer-bill-of-sale-template/, ensuring that the registration or transfer of the trailer's title is handled smoothly and legally.

Asurion Wireless - The form simplifies the information-gathering stage for claim handlers.