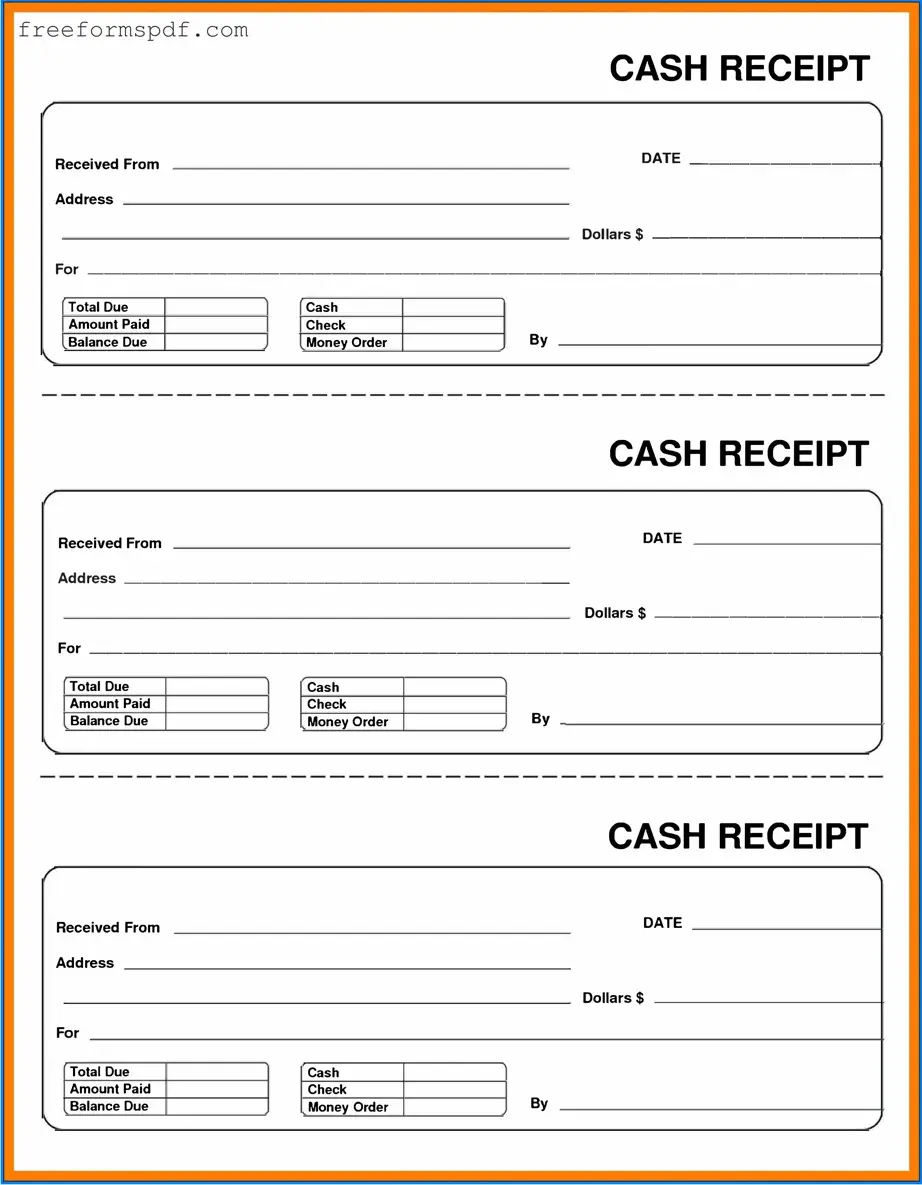

Fill in a Valid Cash Receipt Template

Common mistakes

-

Incomplete Information: Many individuals forget to fill in all required fields. Missing details can lead to delays or errors in processing.

-

Incorrect Amounts: Double-checking the amount received is crucial. Mistakes in numbers can result in financial discrepancies.

-

Improper Date: Using the wrong date can cause confusion. Always ensure the date reflects when the payment was received.

-

Missing Signatures: A signature is often required to validate the receipt. Neglecting to sign can render the document invalid.

-

Failure to Provide a Description: Not including a brief description of the payment can lead to misunderstandings later. Clarity is key.

-

Using Incorrect Payment Method: Indicating the wrong payment method can cause issues in tracking funds. Ensure that the method used matches what is recorded.

Learn More on This Form

-

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of transaction for both the payer and the recipient. This form typically includes details such as the date of the transaction, the amount received, the name of the payer, and a description of the payment purpose. By providing a clear record, it helps in maintaining accurate financial records and can be crucial for accounting and auditing purposes.

-

When should a Cash Receipt form be used?

This form should be utilized whenever cash is received, whether for goods sold, services rendered, or other payments. It is particularly important in situations where cash transactions occur, as it helps to ensure transparency and accountability. For businesses, issuing a Cash Receipt form can also enhance customer trust, as it provides them with documentation of their payment.

-

Who is responsible for completing the Cash Receipt form?

The responsibility for completing the Cash Receipt form typically falls on the individual or department that receives the payment. This could be a cashier, an accounts receivable clerk, or any authorized personnel. It is essential that the person completing the form does so accurately to avoid discrepancies in financial records.

-

What information should be included on a Cash Receipt form?

- Date of the transaction

- Name of the payer

- Amount of cash received

- Purpose of the payment

- Signature of the person receiving the cash

Including all of this information helps ensure that the receipt is complete and can be referenced easily in the future. Each element contributes to creating a comprehensive record of the transaction.

-

How should a Cash Receipt form be stored after completion?

After the Cash Receipt form is completed, it should be stored securely to protect sensitive financial information. Depending on the organization’s policies, this may involve filing the form in a physical location or scanning it for digital storage. Proper storage is crucial for future reference, especially during audits or financial reviews. Keeping these records organized and accessible can save time and effort when needed.

Misconceptions

Misconceptions about the Cash Receipt form can lead to confusion and errors in financial record-keeping. Here are nine common misconceptions and clarifications regarding the Cash Receipt form:

- All cash transactions require a Cash Receipt form. Many people believe that every cash transaction must be documented with a Cash Receipt form. However, this is not always necessary for small, informal transactions.

- Cash Receipt forms are only for businesses. While businesses frequently use Cash Receipt forms, individuals can also benefit from using them to keep track of personal cash transactions.

- Cash Receipt forms must be printed. Some think that Cash Receipt forms can only be valid if printed on paper. Digital versions are also acceptable as long as they include the necessary information.

- Receiving cash means a Cash Receipt form is not needed. This is incorrect. Even if cash is received, documenting the transaction with a Cash Receipt form is important for record-keeping.

- Cash Receipt forms are only for sales transactions. While commonly used for sales, these forms can also document other cash inflows, such as refunds or deposits.

- Once a Cash Receipt form is filled out, it cannot be changed. It is a misconception that these forms are set in stone. Corrections can be made, but they should be documented properly to maintain accuracy.

- Cash Receipt forms do not need to be stored. Some believe that once a transaction is complete, the form can be discarded. In reality, these forms should be retained for record-keeping and tax purposes.

- All Cash Receipt forms look the same. There is a misconception that all Cash Receipt forms are identical. In fact, they can vary by organization and may include different fields based on specific needs.

- Cash Receipt forms are only for cash payments. This is not entirely true. Cash Receipt forms can also be used to document payments made by checks or electronic transfers, as long as cash is involved in some capacity.

Understanding these misconceptions can help ensure proper use and management of Cash Receipt forms, leading to better financial practices.

Browse More Forms

Cadet Command Forms - A key purpose of the form is to verify eligibility for commissioning in the Army.

What Is 1040 Form - The IRS provides guidance on how to fill out the 1040 accurately and efficiently.

For those seeking to navigate the complexities of vehicle transactions, an essential resource is the informative Motor Vehicle Bill of Sale guide. This document not only facilitates the orderly exchange of vehicle ownership but also ensures that both parties fulfill the necessary legal requirements during the sale process.

Renewing a Passport - Ensure your photos are between 35mm and 40mm wide and 45mm to 50mm high.