Fill in a Valid Cash Drawer Count Sheet Template

Common mistakes

-

Inaccurate Counting: One common mistake is miscounting the cash in the drawer. It’s essential to take your time and ensure that every bill and coin is accounted for accurately. Rushing through this process can lead to significant discrepancies.

-

Not Using the Correct Denominations: Failing to categorize cash by denomination can create confusion. When filling out the form, ensure that you separate bills into their respective values, such as $1s, $5s, $10s, and so forth. This organization helps prevent errors.

-

Forgetting to Include Coins: Some individuals overlook the importance of counting coins. Remember to include all coins in the total count. Neglecting this step can lead to an incomplete cash drawer report.

-

Not Double-Checking Entries: After filling out the form, it's crucial to review your entries. A simple mistake in a number can lead to larger issues down the line. Taking a moment to verify your work can save time and effort later.

-

Missing Signatures: A completed Cash Drawer Count Sheet requires signatures for accountability. Failing to sign or have the necessary approvals can render the document invalid and may cause issues during audits.

-

Ignoring Previous Count Sheets: Not referring to previous count sheets can lead to repetitive mistakes. Comparing current counts with past entries can provide insights into trends and help identify any persistent discrepancies.

-

Neglecting to Record Non-Cash Transactions: Remember to document any non-cash transactions that may affect the cash drawer balance. This includes checks, credit card payments, or other forms of payment that should be noted for accuracy.

Learn More on This Form

-

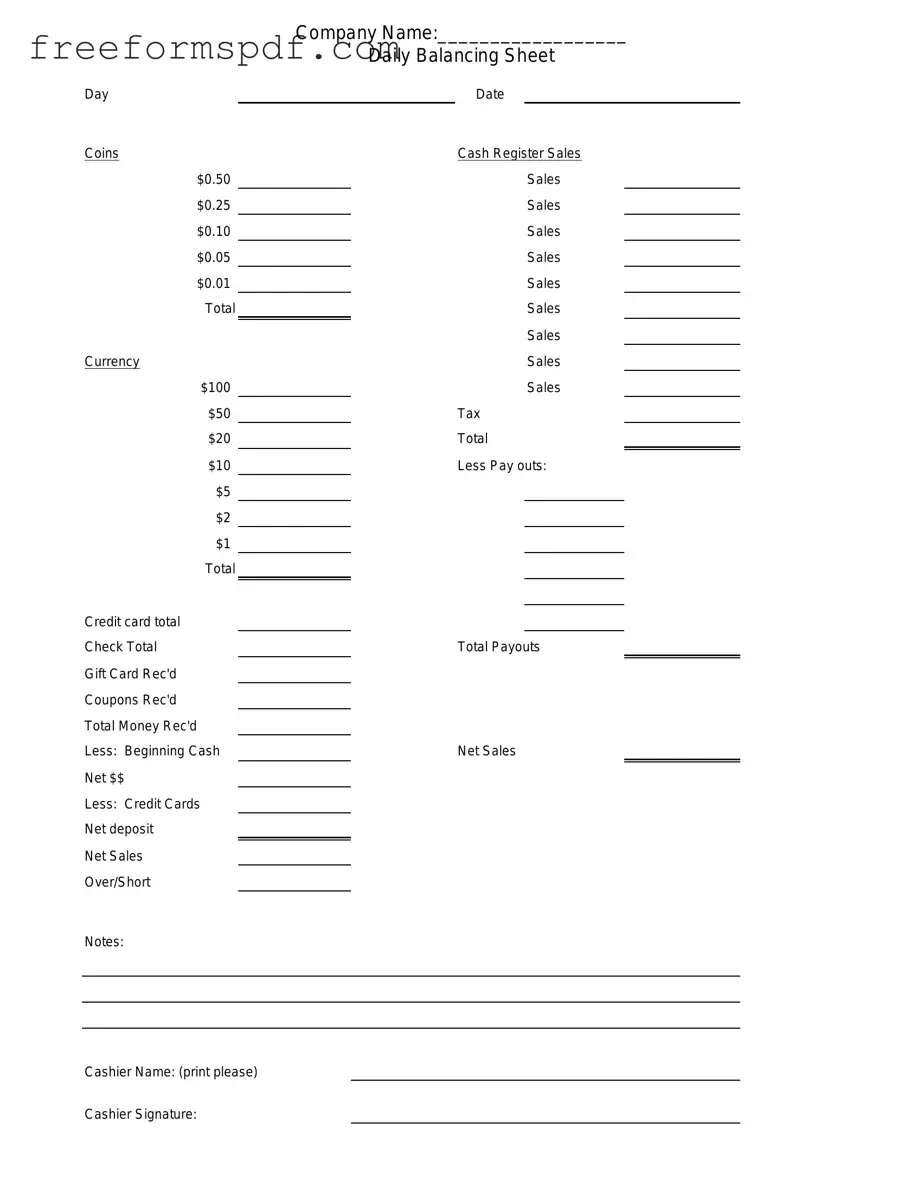

What is the purpose of the Cash Drawer Count Sheet?

The Cash Drawer Count Sheet is a crucial tool used by businesses to track and verify the amount of cash present in the cash drawer at the beginning and end of each shift. It helps ensure that all cash transactions are accounted for and assists in identifying any discrepancies that may arise during the day.

-

How do I fill out the Cash Drawer Count Sheet?

To complete the Cash Drawer Count Sheet, start by entering the date and the name of the employee responsible for the cash drawer. Next, list all denominations of cash present, including bills and coins. Record the quantity of each denomination and calculate the total cash amount. Be sure to double-check your entries for accuracy.

-

Why is it important to perform a cash count at the beginning and end of each shift?

Performing a cash count at the start and end of each shift is essential for maintaining financial integrity. It allows businesses to detect any errors or theft promptly. Regular cash counts foster accountability among employees and help in maintaining trust within the organization.

-

What should I do if I find a discrepancy in the cash count?

If a discrepancy is identified during the cash count, it is important to remain calm and investigate the issue thoroughly. Review the transaction records for the shift, check for any potential errors in counting, and consult with other employees if necessary. Document the discrepancy on the Cash Drawer Count Sheet and report it to a supervisor for further action.

-

Can the Cash Drawer Count Sheet be used for other types of transactions?

While the primary purpose of the Cash Drawer Count Sheet is to track cash transactions, it can also be adapted for other payment methods. For example, businesses may include sections for credit card transactions or checks, allowing for a comprehensive overview of daily financial activity.

-

How long should I keep the completed Cash Drawer Count Sheets?

It is advisable to retain completed Cash Drawer Count Sheets for a minimum of three to five years. This retention period aligns with standard accounting practices and may be necessary for audits or tax purposes. Ensure that these documents are stored securely to protect sensitive financial information.

Misconceptions

Misconceptions about the Cash Drawer Count Sheet form can lead to confusion. Below are some common misunderstandings and clarifications.

- It is only for cash transactions. The Cash Drawer Count Sheet can also include information about credit card transactions, checks, and other forms of payment.

- It is only necessary at the end of the day. While many businesses use it for end-of-day reporting, it can also be used throughout the day to track cash flow.

- Only managers need to complete it. Employees who handle cash should also be familiar with the form and its importance in maintaining accurate records.

- It is a complicated document. The form is designed to be straightforward and user-friendly, making it easy for anyone to fill out.

- It is not important for small businesses. Regardless of size, accurate cash management is crucial for all businesses to prevent losses and discrepancies.

- Once submitted, it cannot be changed. If errors are found after submission, corrections can typically be made and noted on the form.

- It is only used for accounting purposes. The Cash Drawer Count Sheet also serves as a tool for monitoring employee performance and identifying potential theft.

Browse More Forms

Affidavit of Support - The I-864 plays a fundamental role in the U.S. immigration framework, fostering family connections.

For those navigating the complexities of retirement options, the NY Templates provide valuable resources, particularly for members considering the NYCERS F170 form, which is essential for enrolling in the Optional 25-Year Retirement Program tailored for Emergency Medical Technicians.

Da Form 638 Fillable Pdf - It serves as a centralized record for individual nominations of military honors.

Cair2 - Parents should be proactive about immunization schedules.