Fill in a Valid California Death of a Joint Tenant Affidavit Template

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the form. This includes not listing the full names of all joint tenants or omitting important dates, such as the date of death. Incomplete forms can lead to delays in processing.

-

Incorrect Signatures: Signatures are crucial. Some people forget to sign the affidavit, while others may not have the required witnesses sign it. Without proper signatures, the affidavit may not be considered valid.

-

Not Including Supporting Documentation: Supporting documents, such as a death certificate, are often overlooked. Failing to attach these documents can result in the affidavit being rejected or delayed.

-

Using Outdated Forms: Laws and forms can change. Some individuals use outdated versions of the affidavit, which may not comply with current requirements. Always check for the latest version before filling it out.

-

Misunderstanding Joint Tenancy: A lack of understanding about joint tenancy can lead to mistakes. Some people may not realize that the surviving joint tenant automatically inherits the deceased's share, which can affect how they fill out the affidavit.

Learn More on This Form

-

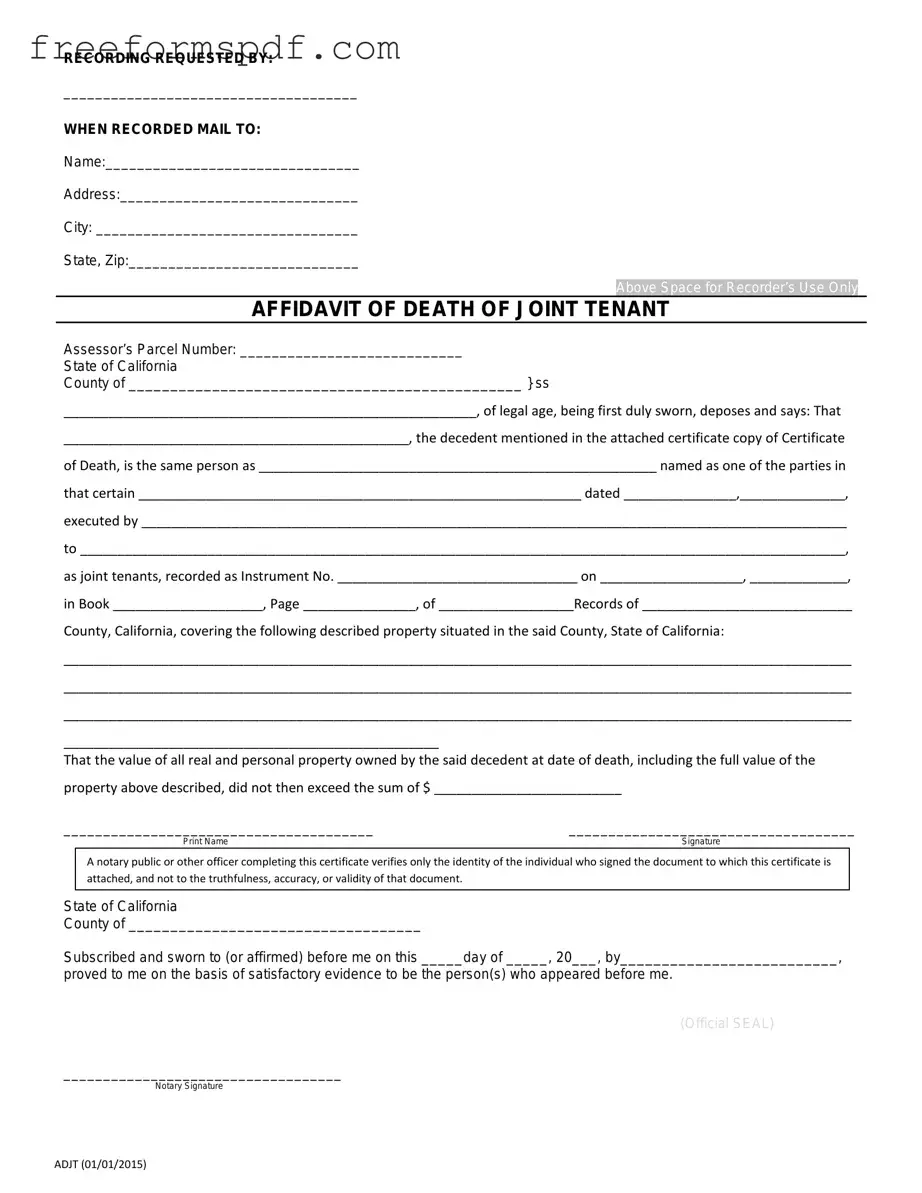

What is the California Death of a Joint Tenant Affidavit?

The California Death of a Joint Tenant Affidavit is a legal document used to transfer ownership of property when one joint tenant passes away. This form helps to clarify the status of the property and ensures that the surviving joint tenant can take full ownership without the need for probate.

-

Who can use this affidavit?

Any surviving joint tenant can use this affidavit. It is specifically designed for situations where property is held in joint tenancy. If you are the surviving tenant, you can file this form to assert your rights to the property.

-

What information is required to complete the affidavit?

The affidavit requires basic information about the property, including its legal description, the names of the joint tenants, and details about the deceased tenant. You will also need to provide a certified copy of the death certificate.

-

How do I file the affidavit?

To file the affidavit, you must submit it to the county recorder’s office where the property is located. Make sure to include any necessary supporting documents, such as the death certificate. It is advisable to keep a copy for your records.

-

Is there a fee to file the affidavit?

Yes, there is typically a fee associated with filing the affidavit. The amount may vary by county, so it is best to check with your local county recorder’s office for specific fee information.

-

What happens if I do not file the affidavit?

If you do not file the affidavit, the property may not automatically transfer to you. This could lead to complications, especially if there are other heirs or if the deceased tenant had a will. Filing the affidavit helps to clarify ownership and avoid potential disputes.

-

Can the affidavit be contested?

Yes, the affidavit can be contested. If there are other heirs or if someone disputes the joint tenancy, they may challenge the affidavit. In such cases, legal advice may be necessary to resolve the issue.

-

How long does it take for the affidavit to be processed?

The processing time can vary by county. Generally, it may take a few days to a few weeks for the affidavit to be recorded. It is a good idea to follow up with the county recorder’s office to check on the status of your filing.

-

Do I need an attorney to file the affidavit?

While it is not required to have an attorney to file the affidavit, it may be beneficial to consult one, especially if there are complexities involved, such as disputes among heirs or unclear ownership issues. An attorney can provide guidance and ensure that the process goes smoothly.

Misconceptions

The California Death of a Joint Tenant Affidavit form is a critical document for individuals dealing with the passing of a joint tenant. However, several misconceptions surround its use and implications. Here’s a breakdown of eight common misunderstandings:

-

The affidavit is only necessary for real estate transactions.

This is not true. While it is often used for real estate, the affidavit can also apply to other types of joint property, such as bank accounts or vehicles.

-

All joint tenants must sign the affidavit.

In reality, only the surviving joint tenant needs to complete and sign the affidavit. This document serves to transfer the deceased tenant's interest to the surviving tenant.

-

The affidavit must be filed with a court.

This is a misconception. The affidavit is typically filed with the county recorder's office where the property is located, not a court.

-

The form is the same for all types of property.

Not necessarily. While the basic structure is similar, specific requirements may vary depending on the type of property involved.

-

The affidavit eliminates the need for probate.

This is partially true. The affidavit allows for the transfer of property without probate, but it does not eliminate the need for probate in all circumstances, especially if other assets are involved.

-

Once filed, the affidavit cannot be changed.

This is misleading. If errors are found, it may be possible to amend the affidavit, but this can require additional steps and documentation.

-

Anyone can complete the affidavit.

While the form may seem straightforward, it is advisable for the surviving tenant to seek guidance to ensure all information is accurate and complete.

-

The affidavit is only needed if the deceased tenant had a will.

This is incorrect. The affidavit is relevant regardless of whether the deceased had a will, as it pertains specifically to joint tenancy rights.

Understanding these misconceptions can help ensure a smoother process when dealing with the passing of a joint tenant and the transfer of property ownership.

Browse More Forms

How Many Cells in 96 Well Plate - Ensures valuable information is not overlooked in research.

The New York DTF-84 form plays a pivotal role for businesses seeking to optimize their tax benefits through the Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification. To navigate the complexities involved, it's vital to refer to resources like NY Templates, which provide essential guidance and templates for submitting the form correctly. Ensuring that all requirements are met will facilitate the processing of the application and grant the access to significant sales tax benefits.

How to Get Acord Insurance Certificate - The Acord 50 WM serves to verify health information with clarity and precision.