Business Purchase and Sale Agreement Document

Common mistakes

-

Not including all parties involved: It's essential to list every person or entity involved in the transaction. Missing a party can lead to confusion and legal issues later on.

-

Failing to specify the purchase price: Clearly stating the purchase price is crucial. Without it, the agreement lacks clarity and enforceability.

-

Ignoring the payment terms: Detail how the payment will be made. Will it be a lump sum, installments, or a combination? Not specifying this can lead to misunderstandings.

-

Omitting contingencies: Contingencies protect both parties. Not including them can result in unexpected problems down the line.

-

Neglecting to describe the assets being sold: Be specific about what is included in the sale. This includes inventory, equipment, and intellectual property. Vague descriptions can lead to disputes.

-

Not addressing liabilities: Clarify who is responsible for any existing debts or obligations. Leaving this out can create future liabilities for the buyer or seller.

-

Forgetting to include closing details: Specify when and where the closing will take place. This ensures that both parties know what to expect.

-

Using vague language: Clear and precise language is important. Ambiguities can lead to different interpretations and potential disputes.

-

Not consulting a professional: It’s wise to have a lawyer or a business advisor review the agreement. They can spot mistakes or omissions that you might miss.

-

Failing to sign and date the agreement: An unsigned agreement is not legally binding. Ensure all parties sign and date the document to make it official.

Learn More on This Form

-

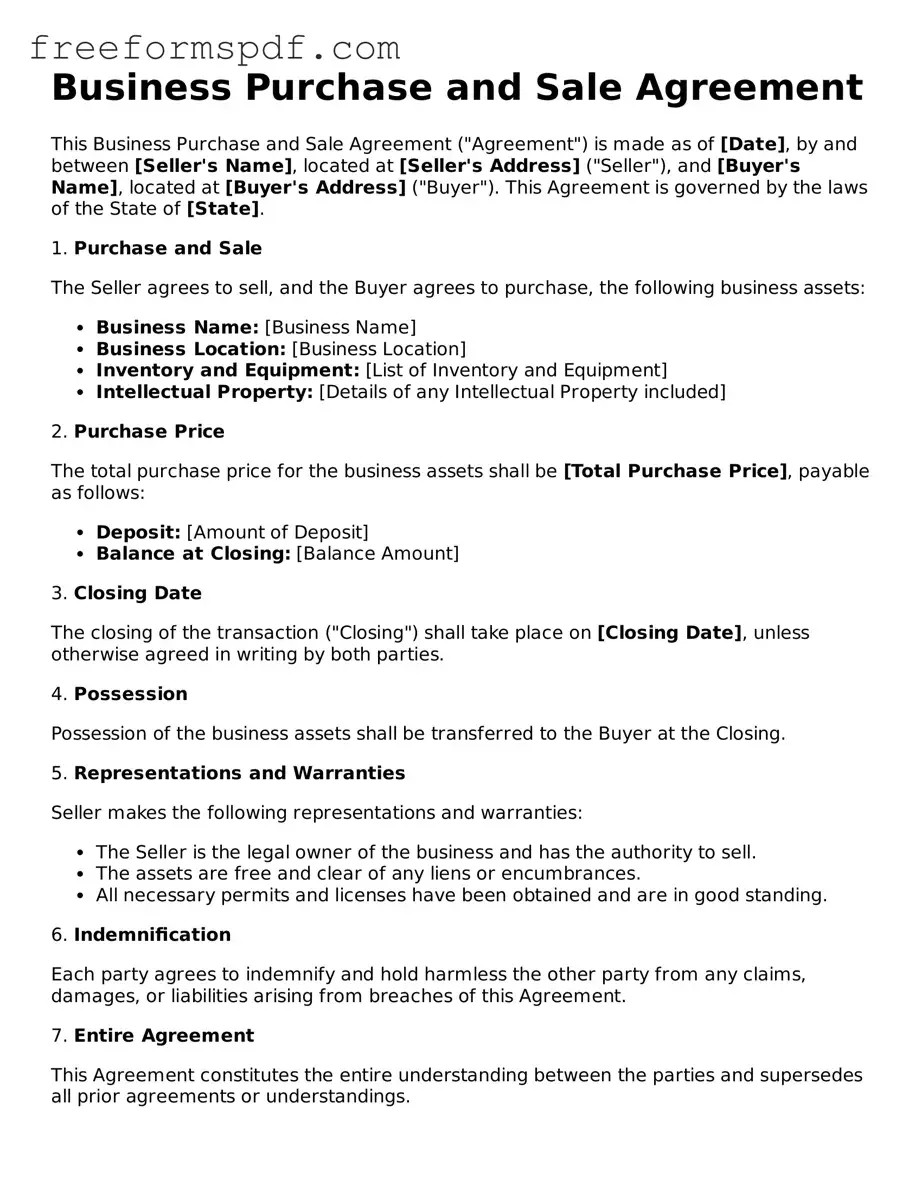

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. This agreement serves as a blueprint for the transaction, detailing the responsibilities of both the buyer and the seller. It includes important information such as the purchase price, payment terms, and any conditions that must be met before the sale can be finalized.

-

Why is this agreement important?

This agreement is crucial because it protects the interests of both parties involved in the transaction. By clearly outlining the terms, it helps prevent misunderstandings and disputes that could arise after the sale. Furthermore, having a written agreement can provide legal protection if issues occur, ensuring that both the buyer and seller have a clear understanding of their rights and obligations.

-

What should be included in the agreement?

Typically, a Business Purchase and Sale Agreement should include:

- The names and contact information of both the buyer and seller.

- A detailed description of the business being sold, including assets and liabilities.

- The purchase price and payment terms.

- Any contingencies that must be satisfied before the sale is completed.

- Representations and warranties made by both parties.

- Any post-sale obligations, such as non-compete clauses.

-

How is the purchase price determined?

The purchase price can be determined through various methods, such as an appraisal, market analysis, or negotiation between the buyer and seller. Factors like the business’s financial performance, assets, and market conditions play a significant role in this process. It’s essential for both parties to agree on a fair price to ensure a smooth transaction.

-

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. It is advisable to document any modifications in writing to avoid confusion later. Verbal agreements may not hold up legally, so it’s best to ensure that all changes are clearly stated in an amended agreement.

Misconceptions

Understanding the Business Purchase and Sale Agreement (BPSA) is crucial for anyone involved in buying or selling a business. However, several misconceptions often arise. Here are six common misunderstandings:

- It is only necessary for large transactions. Many believe that a BPSA is only relevant for high-value deals. In reality, any business transaction, regardless of size, can benefit from a formal agreement.

- It is a one-size-fits-all document. Some think that a standard template will suffice for every transaction. Each business sale is unique, and the agreement should be tailored to reflect the specific terms and conditions of the deal.

- Once signed, it cannot be changed. Many assume that the agreement is set in stone after signing. However, parties can negotiate changes before closing, as long as all involved agree to the modifications.

- It only protects the buyer. Some people believe that the BPSA is solely for the buyer's benefit. In fact, it protects both parties by clearly outlining their rights and obligations, reducing the risk of disputes.

- Legal counsel is unnecessary. There is a misconception that individuals can draft the agreement without professional help. While it is possible, having a lawyer ensures that the document is comprehensive and compliant with relevant laws.

- It covers everything related to the sale. Some think that the BPSA addresses all aspects of the transaction. While it includes many important details, it may not cover every issue, such as post-sale obligations or specific industry regulations.

Being aware of these misconceptions can help ensure a smoother transaction process for both buyers and sellers.

Popular Forms:

Patron List for Church Fundraiser - Every dollar is a vote for a brighter future!

For those navigating the complexities of retirement options, understanding the NYCERS F170 form is essential, especially for EMT members looking to make informed decisions about their future. This form not only facilitates enrollment in the Optional 25-Year Retirement Program for eligible Tier 1 and Tier 4 members but also directs Tier 2 members towards the Optional 25-Year Improved Retirement Program. To ease the process, additional resources are available, such as the comprehensive guide found at NY Templates, which can assist applicants in meeting the necessary eligibility criteria.

Cg2010 0704 - Timely review of this endorsement is advisable for all involved parties.