Fill in a Valid Business Credit Application Template

Common mistakes

-

Inaccurate Information: Providing incorrect details about the business, such as the legal name, address, or tax identification number, can lead to delays or rejections in the application process.

-

Omitting Key Details: Failing to include essential information, like the owner's name or business structure, can create confusion and hinder the credit evaluation.

-

Not Disclosing Financial Obligations: It's crucial to be transparent about existing debts. Not mentioning loans or credit lines can raise red flags during the review.

-

Ignoring Required Documentation: Some applications require supporting documents, such as financial statements or tax returns. Neglecting to provide these can stall the process.

-

Using Inconsistent Terminology: Different terms can confuse reviewers. For example, referring to the business as both a "company" and "corporation" in the same application can lead to misunderstandings.

-

Overlooking Credit History: Many applicants fail to review their credit history before applying. A poor credit score can impact approval chances, so it's wise to check beforehand.

-

Not Updating Information: Businesses evolve, and so do their details. Ensure that the application reflects the most current information to avoid discrepancies.

-

Failing to Sign the Application: A signature is often required to validate the application. Forgetting to sign can lead to automatic rejection.

-

Neglecting to Review the Application: Before submitting, take the time to review the entire application for errors or omissions. A second look can catch mistakes that might have been overlooked.

-

Rushing the Process: Filling out the application in haste can lead to mistakes. Take the necessary time to ensure accuracy and completeness.

Learn More on This Form

-

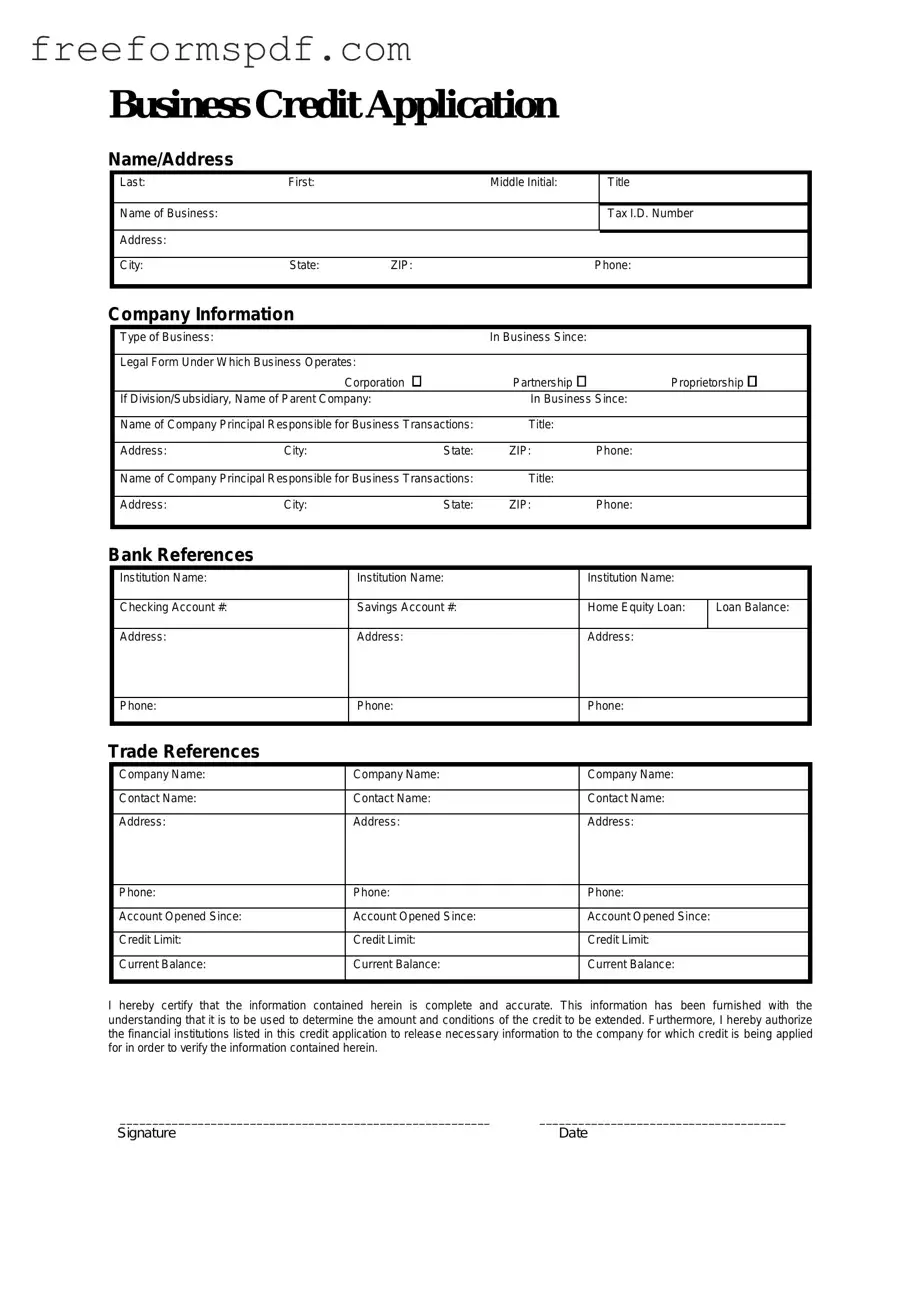

What is a Business Credit Application form?

A Business Credit Application form is a document that businesses fill out to request credit from a supplier or lender. This form collects essential information about the business, including its financial history, ownership details, and credit references. By submitting this form, businesses seek to establish a credit line to purchase goods or services on credit terms.

-

Why do I need to fill out a Business Credit Application?

Filling out a Business Credit Application is crucial for several reasons. It allows suppliers or lenders to assess your business's creditworthiness. This assessment helps them determine whether to extend credit and under what terms. Additionally, a completed application can expedite the credit approval process, enabling you to access the necessary resources for your business operations more quickly.

-

What information is typically required on the form?

The form usually requires basic information about your business, such as:

- Business name and address

- Type of business entity (e.g., LLC, corporation)

- Owner's personal information

- Tax identification number

- Banking details

- Trade references

- Financial statements or other relevant documents

Providing accurate and complete information is essential for a smooth application process.

-

How long does the approval process take?

The time it takes to process a Business Credit Application can vary. Generally, it can take anywhere from a few days to a couple of weeks. Factors influencing this timeframe include the lender's policies, the completeness of your application, and the complexity of your business's financial situation. Following up with the lender can help you get updates on your application status.

-

What happens if my application is denied?

If your application is denied, you will typically receive a notice explaining the reasons for the denial. Common reasons include insufficient credit history, low credit scores, or incomplete information. You can address these issues by improving your credit profile or providing additional documentation. If possible, consider reaching out to the lender to discuss the denial and explore options for reapplying in the future.

-

Can I appeal a denial?

Yes, you can appeal a denial. Many lenders have a process for reconsideration. To do this, gather any supporting documents that address the reasons for the denial. Submit these documents along with a formal request for reconsideration. Keep in mind that the lender is not obligated to approve your appeal, but providing additional information can improve your chances.

Misconceptions

Understanding the Business Credit Application form can be tricky. Many people hold misconceptions that can lead to confusion or mistakes. Here are seven common misunderstandings:

- It’s only for large businesses. Many believe that only big corporations can apply for business credit. In reality, small businesses and startups can also benefit from establishing credit. It’s a crucial step for any business looking to grow.

- Personal credit scores don’t matter. Some think that their personal credit history has no bearing on their business credit application. However, lenders often look at personal credit scores, especially for new businesses, to gauge the owner’s financial responsibility.

- All lenders have the same requirements. It’s a common belief that every lender asks for the same information. In truth, requirements can vary widely. Some may require detailed financial statements, while others might focus more on business plans or cash flow projections.

- Submitting an application guarantees approval. Many assume that simply filling out the application means they will get credit. Unfortunately, approval is not guaranteed. Lenders evaluate many factors, including credit history, revenue, and business viability.

- Once you’re approved, you can borrow as much as you want. It’s easy to think that being approved for credit means you can access unlimited funds. However, lenders typically set limits based on your business’s financial health and creditworthiness.

- The application process is the same for every type of credit. Some believe that applying for a credit card is the same as applying for a loan. Different types of credit can have unique processes, terms, and conditions. Understanding these differences is key to a successful application.

- Once you establish credit, you don’t need to maintain it. There’s a misconception that establishing credit is a one-time effort. In reality, ongoing management is essential. Regularly monitoring your credit and maintaining good financial practices keeps your credit healthy.

By clearing up these misconceptions, you can approach the Business Credit Application process with confidence and clarity. Understanding the facts can lead to better decisions and a stronger financial future for your business.

Browse More Forms

U.S. Corporation Income Tax Return - Form 1120 helps corporations document and justify any tax credits they may claim.

Florida Real Estate Forms - In case of any title defects, the Seller’s obligations to cure them are specified within a designated time frame.

By utilizing the NYCERS F266 form, members can streamline their application process for the Vested Retirement Benefit. For those looking to ensure their retirement benefits are properly vested, it's important to pay attention to the details in the application. For further assistance and templates, refer to NY Templates, which can provide additional resources for completing the form accurately.

Chart in Word - Lessons Learned: A space to document what has been learned through the process.