Business Bill of Sale Document

Common mistakes

-

Omitting essential information: Many individuals forget to include crucial details such as the business name, address, and identification numbers. Without this information, the bill of sale may not be valid.

-

Incorrectly listing the purchase price: Some people either miscalculate or fail to specify the purchase price. This can lead to disputes later on, especially if the amount is not documented clearly.

-

Not including a description of the business: A detailed description of the business being sold is vital. This should encompass assets, liabilities, and any other relevant details that define what is being transferred.

-

Failing to sign the document: A common oversight is neglecting to sign the bill of sale. Without signatures from both the seller and the buyer, the document lacks legal enforceability.

-

Using vague language: Ambiguity can create problems. Clear and precise language is necessary to avoid misunderstandings regarding the terms of the sale.

-

Not having witnesses or notarization: Depending on the jurisdiction, having witnesses or notarizing the document may be required. Skipping this step can result in the bill of sale being questioned in the future.

-

Ignoring local laws and regulations: Each state has its own laws governing the sale of businesses. Failing to comply with these can render the bill of sale ineffective.

-

Not keeping copies: After completing the bill of sale, individuals often forget to make copies for their records. Retaining a copy is important for future reference and legal protection.

-

Neglecting to outline payment terms: It's essential to specify how and when payment will be made. Not doing so can lead to confusion and potential disputes between the parties involved.

Learn More on This Form

-

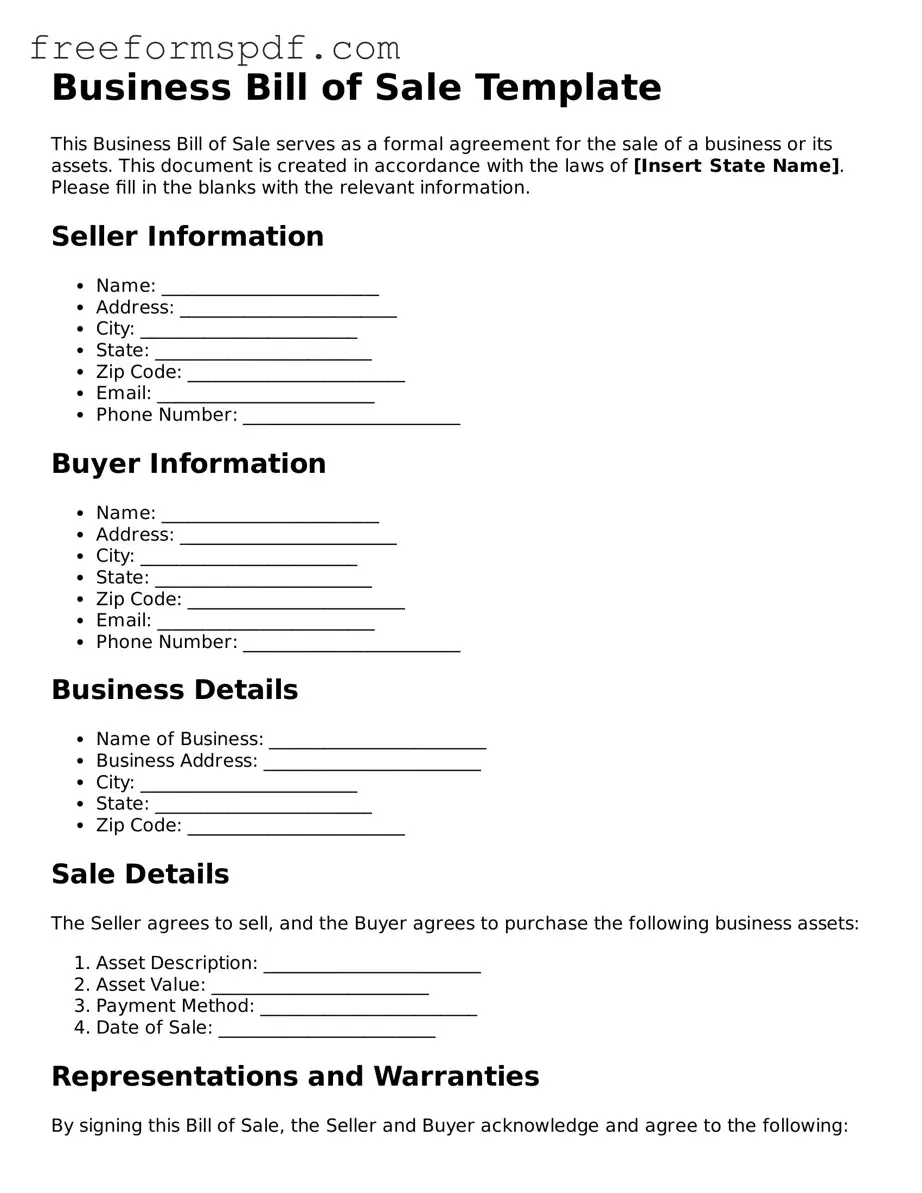

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. This document serves as proof of the sale and includes important details about the transaction.

-

Why do I need a Business Bill of Sale?

This document is essential for both the buyer and the seller. It protects the rights of both parties and provides a clear record of the transaction. It can help prevent disputes and misunderstandings in the future.

-

What information is included in a Business Bill of Sale?

A typical Business Bill of Sale includes:

- The names and addresses of the buyer and seller

- A description of the business or assets being sold

- The sale price

- The date of the sale

- Any warranties or representations made by the seller

-

Is a Business Bill of Sale required by law?

While it may not be legally required in all situations, having a Business Bill of Sale is highly recommended. It provides a formal record of the transaction and can be useful for tax purposes or in case of disputes.

-

Can I create my own Business Bill of Sale?

Yes, you can create your own Business Bill of Sale. However, it is important to ensure that it includes all necessary information and meets legal requirements in your state. You may also consider using a template or consulting a legal professional for guidance.

-

Do I need witnesses or notarization for a Business Bill of Sale?

Witnesses or notarization are not always required, but having a witness or getting the document notarized can add an extra layer of protection. It can help verify the identities of the parties involved and confirm that the sale took place.

-

What happens after I complete the Business Bill of Sale?

Once the Business Bill of Sale is completed and signed by both parties, it should be kept in a safe place. The buyer should also ensure that the business is properly registered in their name, if applicable. This may involve updating licenses, permits, or other registrations.

-

Can I use a Business Bill of Sale for different types of businesses?

Yes, a Business Bill of Sale can be used for various types of businesses, whether it’s a sole proprietorship, partnership, or corporation. Just make sure to tailor the document to reflect the specific details of the business being sold.

-

What if I have more questions about the Business Bill of Sale?

If you have additional questions or need assistance, consider reaching out to a legal professional. They can provide personalized advice and help ensure that your Business Bill of Sale meets all necessary requirements.

Misconceptions

Understanding the Business Bill of Sale form is essential for anyone involved in a business transaction. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It is only necessary for large transactions. Many believe that a Bill of Sale is only required for significant purchases. In reality, this document is beneficial for any business sale, regardless of size, as it provides a clear record of the transaction.

- It is the same as a contract. Some people think a Bill of Sale is just another name for a contract. While both documents outline terms, a Bill of Sale specifically transfers ownership of goods or property, whereas a contract may cover broader agreements.

- It does not need to be notarized. Many assume that notarization is unnecessary. However, having a Bill of Sale notarized can add an extra layer of authenticity, especially in disputes or legal matters.

- It is only for tangible goods. Some believe that a Bill of Sale applies only to physical items. However, it can also be used for intangible assets, such as intellectual property or business goodwill.

- Once signed, it cannot be changed. People often think that a Bill of Sale is final and unchangeable. In fact, amendments can be made if both parties agree, but this should be documented properly.

- It is not legally binding. There is a misconception that a Bill of Sale lacks legal weight. On the contrary, when properly executed, it serves as a legal document that can be enforced in court.

Being aware of these misconceptions can help ensure that business transactions are conducted smoothly and legally. Always consider consulting with a professional if there are uncertainties regarding the use of a Business Bill of Sale form.

Other Types of Business Bill of Sale Forms:

Bill of Sale for Rifle - Includes details that may be important for insurance purposes.

In order to facilitate a smooth transaction and ensure legal validity, both the seller and buyer should complete a General Bill of Sale form, which can be found at https://toptemplates.info/bill-of-sale/general-bill-of-sale/. This document serves not only as a record of the sale but also as a safeguard for the rights of both parties involved.

Snowmobile Bill of Sale Template - Can be printed, filled out, and signed by both parties in minutes.