Fill in a Valid Broker Price Opinion Template

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to significant delays. Each section of the form is designed to provide critical details about the property and market conditions. Leaving any part blank may result in misunderstandings or inaccuracies.

-

Incorrect Market Conditions: Misrepresenting the current market conditions can skew the property’s valuation. It's essential to accurately assess whether the market is improving, stable, or declining.

-

Neglecting Comparable Sales: Not including enough comparable sales or choosing irrelevant ones can lead to an inaccurate price opinion. Selecting properties that are truly comparable in terms of size, location, and condition is vital for an accurate assessment.

-

Ignoring Property Condition: Underestimating or overestimating the condition of the property can mislead potential buyers. Clearly stating whether repairs are needed and their potential costs is crucial for transparency.

-

Inaccurate Financing Information: Failing to clarify the types of financing available can deter interested buyers. If certain financing options are not available, it’s important to note this clearly.

-

Missing Marketing Strategy: Not providing a clear marketing strategy can leave potential buyers uncertain about how the property will be presented. Outlining whether the property is being sold as-is or with repairs can set appropriate expectations.

-

Omitting Comments: Skipping the comments section can overlook important details that could affect the property's value. Including specific positives or negatives about the property can provide valuable context.

-

Failure to Update: Not updating the form with the latest information can lead to inaccuracies. If the property has been on the market previously, or if market conditions have changed, this information should be reflected in the BPO.

Learn More on This Form

-

What is a Broker Price Opinion (BPO)?

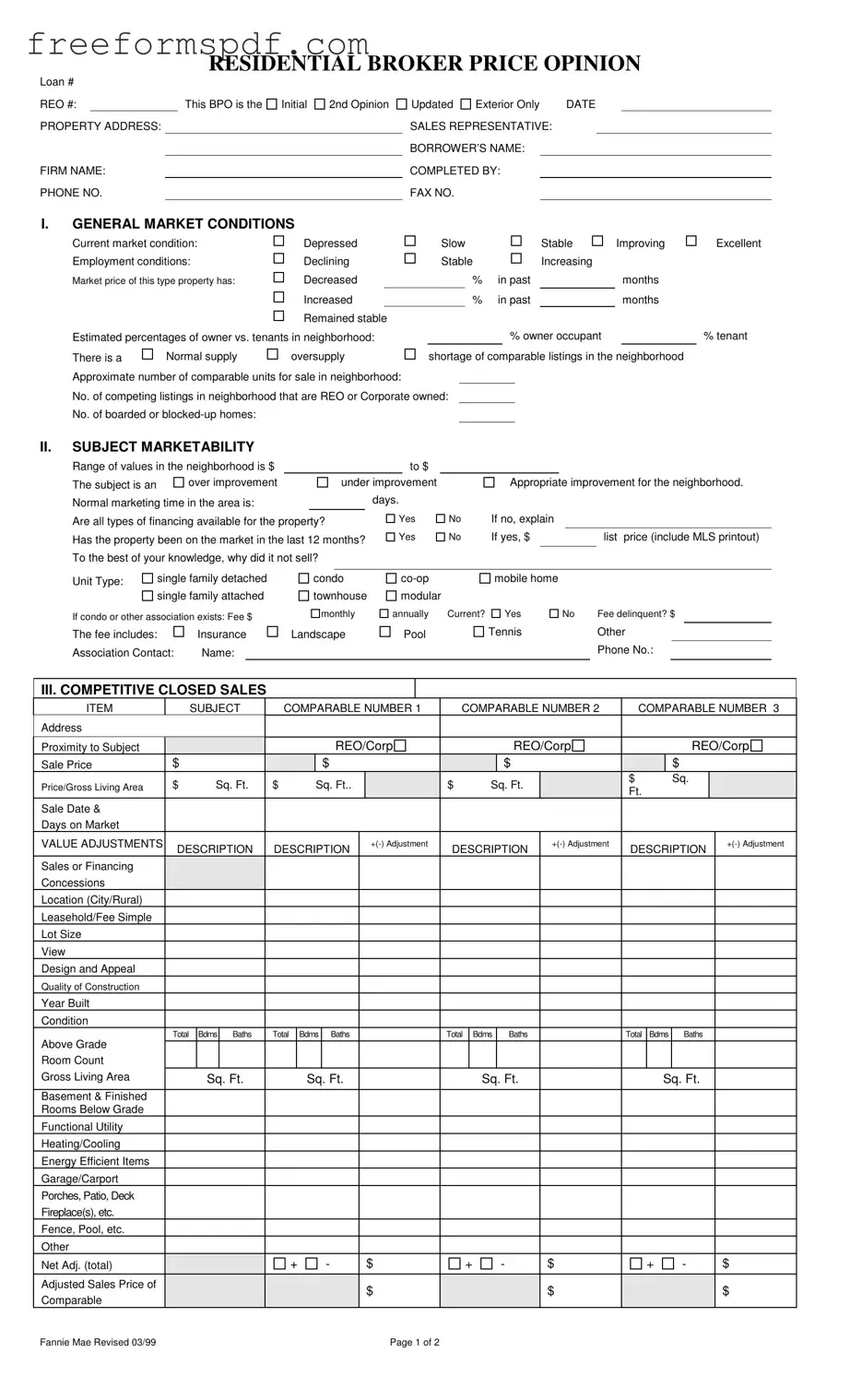

A Broker Price Opinion is an assessment of a property's value conducted by a real estate broker or agent. It provides an estimate of the market value based on various factors, including comparable sales, current market conditions, and property specifics.

-

Why is a BPO important?

A BPO is essential for lenders, investors, and property owners. It helps determine a property's market value, which can influence decisions regarding sales, purchases, or financing. Accurate valuations can lead to better financial outcomes and informed decision-making.

-

What information is included in a BPO form?

The BPO form includes details such as the property address, market conditions, comparable sales data, and suggested pricing strategies. It also outlines necessary repairs and the estimated costs to bring the property to marketable condition.

-

How does the BPO process work?

The process begins with the broker gathering data about the property and the local market. This includes analyzing recent sales of comparable properties, assessing the condition of the subject property, and considering any necessary repairs. The broker then compiles this information into the BPO form, providing a detailed analysis of the property's estimated value.

-

Who typically orders a BPO?

Real estate agents, lenders, banks, and investors often order BPOs. They may seek a BPO to assess a property before foreclosure, determine a listing price, or evaluate potential investments.

-

How long does it take to complete a BPO?

The time required to complete a BPO can vary. Generally, brokers can complete a BPO within a few days, depending on the complexity of the property and the availability of comparable sales data.

-

What factors influence a property's value in a BPO?

Several factors influence a property's value, including its location, condition, size, and the current market conditions. The broker will also consider recent sales of similar properties and any unique features that may affect the property's appeal.

-

Can a BPO be used for loan purposes?

Yes, a BPO can be used for loan purposes, especially in situations where a full appraisal is not necessary. Lenders may rely on BPOs to make informed decisions about loan approvals or modifications.

-

What is the difference between a BPO and an appraisal?

While both a BPO and an appraisal aim to determine a property's value, they differ in scope and methodology. A BPO is typically less formal and may rely on a broker's expertise and local market knowledge, whereas an appraisal is a more comprehensive evaluation conducted by a licensed appraiser.

-

What should I do if I disagree with a BPO value?

If you disagree with the value provided in a BPO, you can gather additional data to support your position. This may include recent sales data, market trends, or specific property features that were not adequately considered. Presenting this information to the broker or lender can help facilitate a reassessment.

Misconceptions

- Misconception 1: A Broker Price Opinion (BPO) is the same as a formal appraisal.

- Misconception 2: BPOs are only used for foreclosures or distressed properties.

- Misconception 3: BPOs are always accurate.

- Misconception 4: A BPO can replace a full appraisal.

- Misconception 5: BPOs are only concerned with the property's physical condition.

- Misconception 6: BPOs are a one-size-fits-all solution.

- Misconception 7: Anyone can complete a BPO.

- Misconception 8: A BPO is a definitive value of a property.

While both a BPO and an appraisal aim to determine property value, they differ significantly. An appraisal is a detailed report prepared by a licensed appraiser, while a BPO is typically less comprehensive and can be completed by a real estate broker or agent.

BPOs can be used in various situations, including determining market value for properties that are not in distress. They are often utilized by lenders, investors, and real estate agents to assess property values in different market conditions.

The accuracy of a BPO can depend on the experience of the broker and the quality of the data used. While brokers strive for accuracy, BPOs are based on estimates and comparable sales, which can vary.

A BPO cannot replace a full appraisal when a more detailed valuation is required, such as for mortgage underwriting or legal purposes. Lenders may still require a formal appraisal in these cases.

While the physical condition of a property is important, BPOs also take into account market trends, neighborhood conditions, and economic factors. These elements can significantly influence property value.

Each BPO is tailored to the specific property and its market. Factors such as location, property type, and market conditions can lead to different approaches and outcomes in each BPO.

While real estate brokers and agents commonly perform BPOs, they must have a good understanding of the local market and property valuation principles. Not everyone is qualified to complete a BPO effectively.

A BPO provides an estimated value based on current market conditions and comparable sales. It should be viewed as a guideline rather than an absolute figure, as market dynamics can change.

Browse More Forms

Acord 130 - The form allows applicants the chance to provide additional coverage needs that might not be standard.

Netspend Dispute Email - Include histories, such as whether you expect a refund or not.

For businesses looking to navigate the complexities of tax certification in New York, understanding the application process for the New York DTF-84 form is vital. This form is not just a bureaucratic requirement; it opens doors to potential sales tax benefits for qualified enterprises. To streamline your application, consider resources like NY Templates that provide valuable guidance and templates to help ensure your submission is complete and meets all specified criteria.

Medication Administration Record Template Excel - Engaging the consumer in their medication records encourages greater compliance.